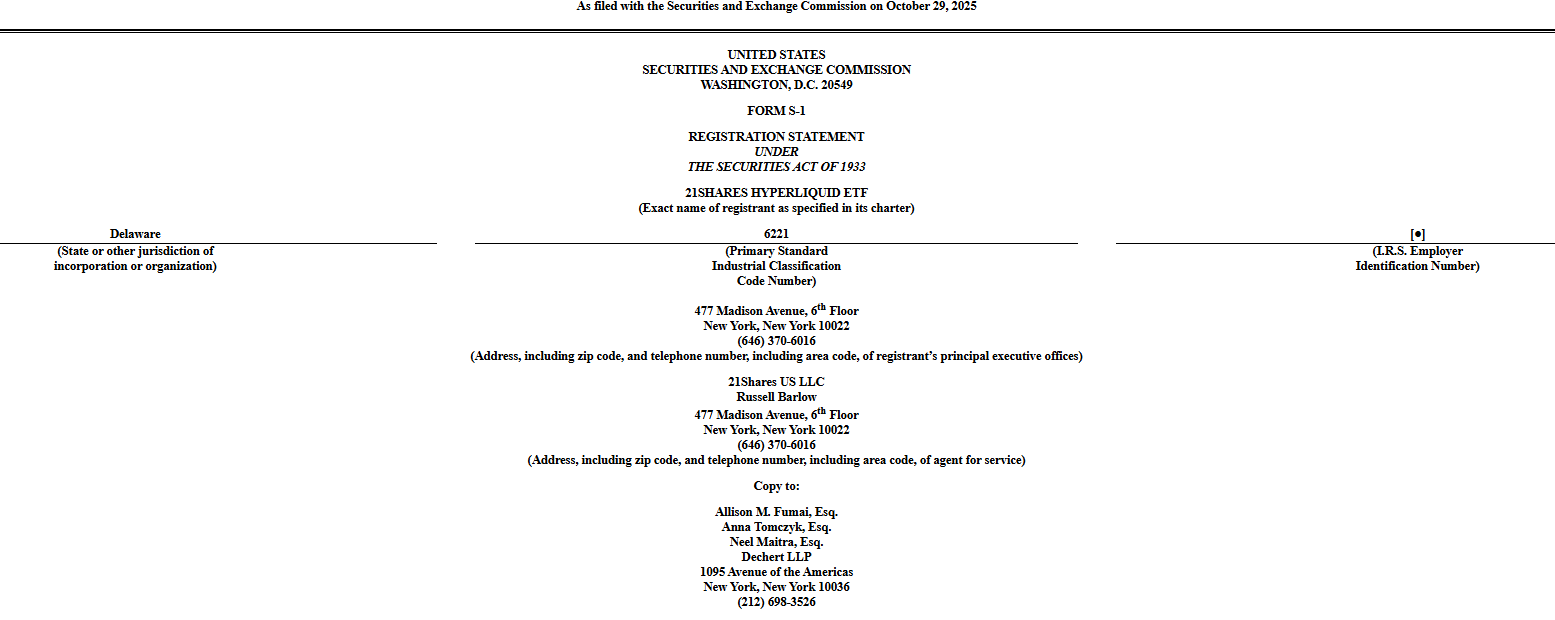

Asset manager 21Shares filed with the U.S. Securities and Exchange Commission on Wednesday for a Hyperliquid ETF. The fund would track the HYPE token, which powers the Hyperliquid perpetual futures protocol and blockchain. The filing did not list a ticker or fee. Coinbase Custody and BitGo Trust were named as custodians. The filing came after Bitwise submitted a similar Hyperliquid ETF application last month, showing two issuers now target the same asset.

21Shares Hyperliquid ETF Filing

The 21Shares Hyperliquid ETF aims to give U.S. investors exposure to HYPE, the token used on the Hyperliquid network to pay fees and receive trading discounts. The token follows the growth of the protocol, which runs a decentralized exchange for perpetual futures.

The SEC filing named Coinbase Custody Trust Company and BitGo Trust Company as custodians, which means assets will be held with two U.S.-registered providers. That structure matches other crypto ETF filings in 2025 that rely on recognized custodians.

This filing followed the Bitwise Hyperliquid ETF proposal. As a result, regulators now have two applications for a Hyperliquid ETF tied to the same underlying token. Both filings show that issuers are expanding from Bitcoin and Ether to tokens linked to active on-chain platforms.

U.S. Demand for Altcoin ETFs

U.S. investors have already shown interest in ETFs tracking altcoins when the structure is clear and the token has on-chain use. HYPE is the token for the Hyperliquid blockchain and the Hyperliquid DEX, so its function is easy to explain in a fund document.

Altcoin ETF products in 2025 include features such as staking or protocol-linked rewards. These products try to mirror what users already do on-chain but in a regulated wrapper. That is the market where the 21Shares Hyperliquid ETF wants a place.

Because there is already a Bitwise HYPE ETF filing, any later product will compete on liquidity, custody setup, and secondary-market activity once listed.

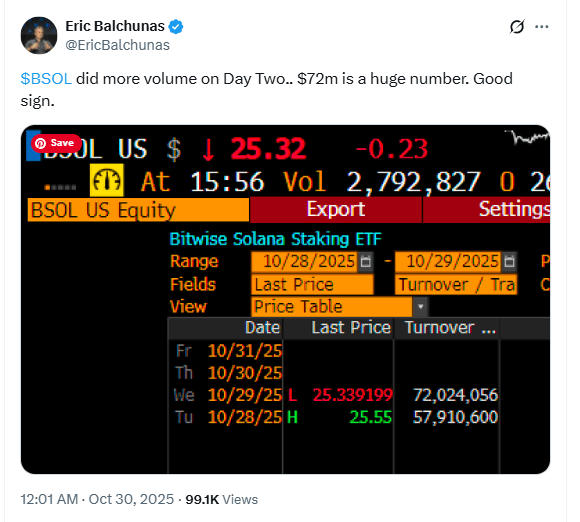

Bitwise Solana Staking ETF Reports 72 Million Trading Volume

While 21Shares filed for the Hyperliquid ETF, Bitwise reported strong activity in its Solana Staking ETF (BSOL). On Wednesday, the second trading day, BSOL trading volume exceeded 72 million dollars.

Eric Balchunas, ETF analyst at Bloomberg, called the number “a huge number” and said it stood out because ETF volume often falls after the first day. The quote stayed in the public post that tracked the fund.

BSOL debuted on Tuesday with about 55.4 million dollars in trading volume. That opening session was already the largest among crypto ETFs launched in 2025, according to the same source. The second-day volume shows that the Bitwise Solana Staking ETF remained active on screens.

Solana ETFs Launched Together but Traded Differently

The Bitwise Solana Staking ETF listed on the same day as Canary Capital’s Litecoin ETF and a Hedera (HBAR) ETF, but BSOL captured most of the volume. The key difference was that BSOL added a staking component on top of Solana exposure, while still trading through traditional brokers.

Because BSOL had strong day-one and day-two numbers, it now sets the early Solana ETF liquidity level on U.S. exchanges. Market makers and institutional desks often look at that number when deciding spreads.

The high volume also shows that U.S. investors are currently ready to trade altcoin ETFs when the asset is established, the custodian is named, and the instrument tracks a live network such as Solana.

Grayscale Investments launched its staking-enabled Grayscale Solana Trust ETF (GSOL) on Wednesday, one day after BSOL went live.

GSOL recorded about 4 million dollars in trading volume on its first day. Balchunas described the print as “healthy” but noted it was below the Bitwise Solana Staking ETF level.

He also said that being “just one day behind” makes it harder for a second Solana ETF to match a fund that already showed more than 50 million dollars on its first session.