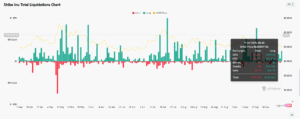

Shiba Inu (SHIB) faced a sharp sell-off on Oct. 9, erasing about $450,000 in long positions as traders betting on a price rise were forced out. The forced liquidations triggered additional selling pressure, deepening the decline and pushing SHIB closer to its lower support band. Now, the token is on a make-or-break point. Let’s analyse what might happen next.

SHIB Trades Near Six-Month Support Floor

The token now trades close to the $0.0000110–$0.0000115 range, a level that has repeatedly acted as a strong support since early 2024. Historically, each time SHIB has approached this zone, it has either stabilized or bounced within days.

A daily close below $0.0000110 would invalidate this support, increasing the risk of a drop toward $0.0000105 or even $0.0000098 — both of which align with the lower trendline of its six-month price channel.

If buyers manage to defend the current zone, a relief bounce could target the descending trendline resistance near $0.0000127, followed by the 200-day exponential moving average (EMA) at $0.0000135. This range remains the upper limit of SHIB’s medium-term downtrend — a breakout above it would be the first bullish signal in over two months.

The Relative Strength Index (RSI) sits around 42, showing weak but stable momentum. RSI readings between 40–45 suggest bearish control without oversold exhaustion. In previous SHIB cycles, bounces often occurred when RSI dipped below 38, meaning the current setup is near but not yet in that recovery zone.

Trading volume has also declined over the past week, confirming that the sell-off was not driven by heavy distribution but more by leveraged liquidations. That’s why a clean bounce would need new spot buying pressure — not just a short-covering rally.

Traders Cut Exposure After Volatile Week

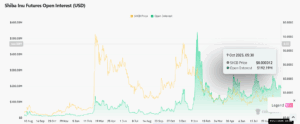

Shiba Inu’s futures open interest has dropped to about $192 million, well below its July highs. This signals that many traders have reduced exposure, preferring to wait for clarity. Meanwhile, the funding rate remains slightly positive, meaning long traders are still paying shorts — a minor bullish bias, but with weak conviction.

If open interest rises alongside price in the coming sessions, it would signal renewed confidence. However, if open interest continues falling while price slips below $0.0000110, it would confirm that traders are exiting the market — a bearish continuation sign.

On-chain activity offers little support to the SHIB price trend. Shibarium’s total value locked (TVL) has fallen below $1 million, and DEX trading volumes are down to around $200, based on DeFiLlama data. The ShibaSwap TVL also dropped nearly 47% over the past month, showing that users are withdrawing liquidity from the ecosystem. Without renewed participation, it will be difficult for Shiba Inu to sustain any major price recovery.

If SHIB price closes below $0.0000110, the next downside targets are $0.0000105 and $0.0000098. These both represent prior consolidation levels and psychological zones where buyers previously stepped in. A drop toward those levels would represent a 6–10% correction from current prices.

In a bullish case, holding above $0.0000110 could trigger a short-term rebound toward $0.0000127, followed by $0.0000135 if momentum improves. A confirmed breakout above the 200-day EMA would shift bias toward a retest of $0.0000150, last seen in late August.

Stay with us for continued coverage as Shiba Inu tests critical support, with liquidity trends and derivatives positioning set to determine whether the token stabilizes or extends its decline.