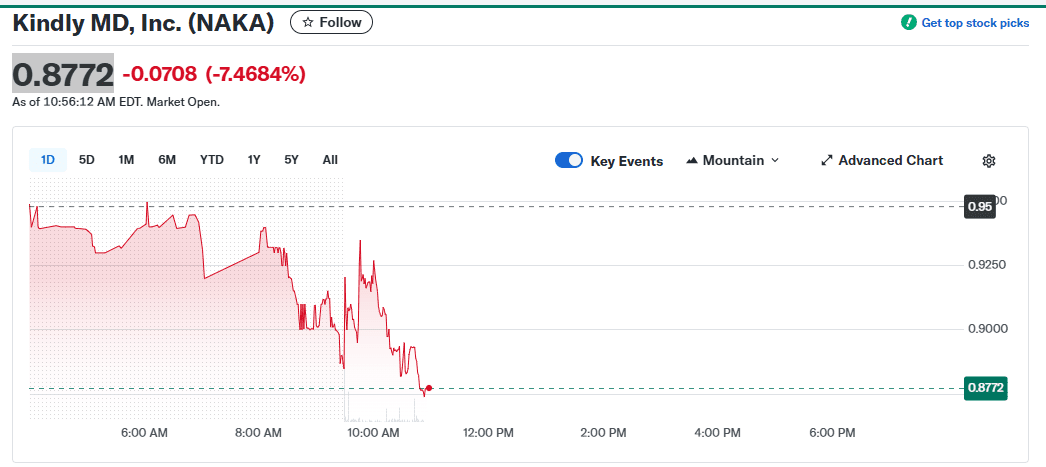

Nakamoto Holdings, the Bitcoin holding company run by David Bailey, saw its NAKA shares on Nasdaq sink from about $25 in May to around $0.9480 after $563 million in private investment in public equity (PIPE) deals became sellable in September. The company raised discounted capital to buy Bitcoin BTC, but once PIPE investors could sell, a large block of shares hit the market. Bailey told Forbes the sell wave “erased billions in market value.” The structure, not Bitcoin, drove the fall.

The company earlier merged with Utah-based KindlyMD and then operated as a public Bitcoin holding company. That made its share price sensitive to equity dilution. When discounted PIPE shares entered open trading, there was not enough demand to absorb them, so the stock dropped more than 98 percent from the May high.

Bailey said short-term investors hurt the firm.

“People that are just looking for a trade are actually very expensive capital for us,”

he told Forbes, adding he wants “long-term aligned partners.”

The financing model allowed fast exits, and the September unlock exposed that.

To support cash flow, Bailey said he plans to put Bitcoin Magazine, the Bitcoin conference, and 210k Capital under Nakamoto Holdings. That would move media, events and fund income into the listed company and keep the group Bitcoin-focused.

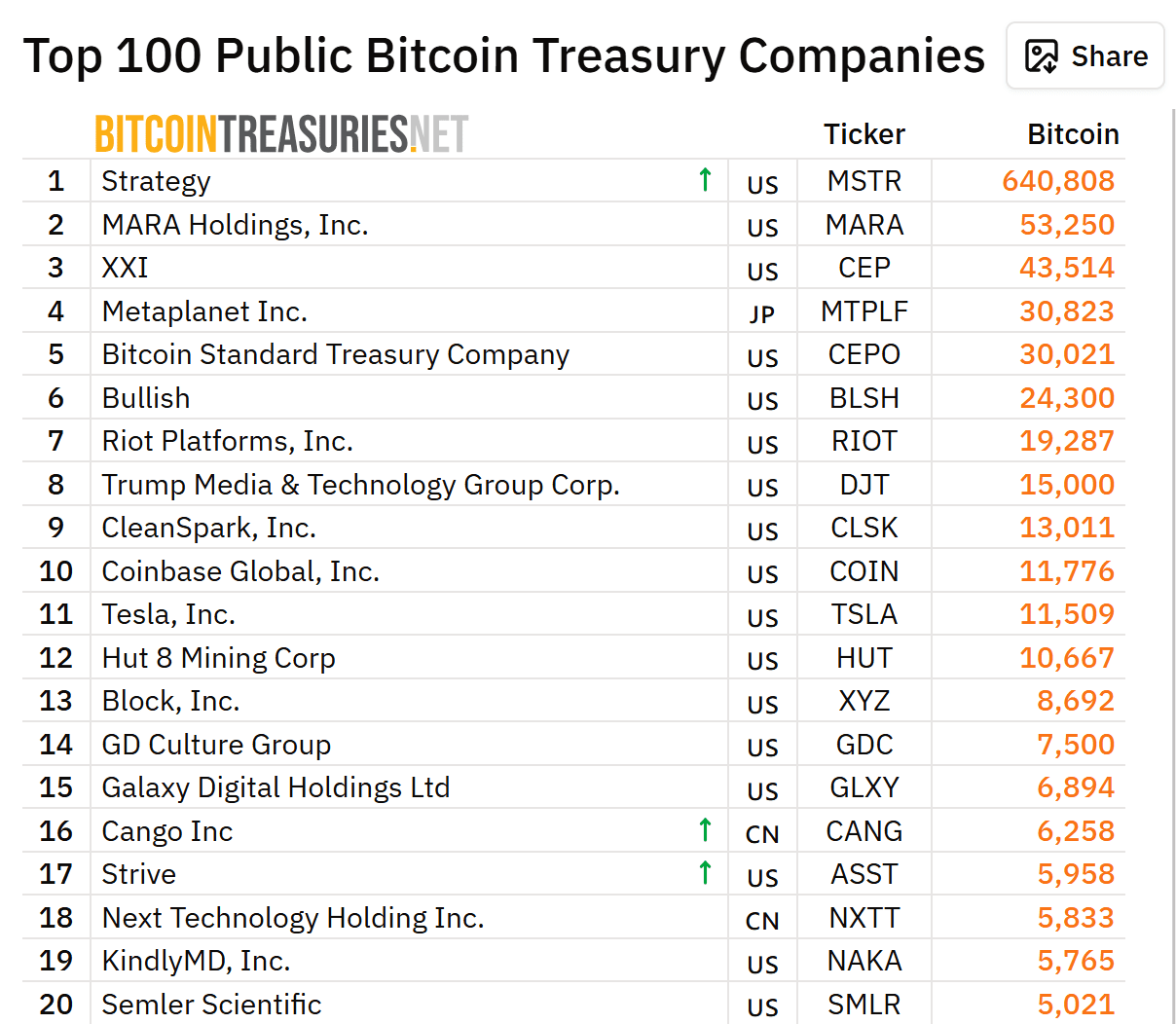

Nakamoto still holds 5,765 BTC worth about $653 million, data from BitcoinTreasuries.NET shows. That makes it the 19th largest public Bitcoin holder. Yet the market now values NAKA well below the company’s Bitcoin. The gap comes from the PIPE overhang and the September selling, not from a cut in BTC reserves.

Bailey is known in the U.S. Bitcoin space and linked to Donald Trump’s pro-crypto push, but the market reaction followed the mechanics of the PIPE unlock, not his profile.

PIPE model created one-time supply shock

In this case, Nakamoto Holdings sold discounted PIPE shares to private buyers to fund Bitcoin purchases. The model assumed the stock would keep trading at higher levels. When the lockup ended, holders sold. Because the unlocked shares were large compared with the public float, the price fell quickly.

As of now, NAKA trades near $0.8772 on Nasdaq, according to Yahoo Finance, while the company still reports hundreds of millions of dollars in Bitcoin on its balance sheet.

In Tokyo, Metaplanet took a different path. On Tuesday, the Bitcoin treasury firm approved a 75 billion yen (about $500 million) share repurchase program after its Bitcoin-backed net asset value (mNAV) fell to 0.88 before recovering to 1.03. The board allowed the company to buy back up to 150 million shares (13.13 percent) on the Tokyo Stock Exchange through October 2026.

Metaplanet paused new Bitcoin purchases to keep the stock closer to its asset value. The firm holds 30,823 BTC worth about $3.5 billion. Unlike Nakamoto Holdings, which faced dilution from a PIPE unlock, Metaplanet used a buyback to pull its share price toward its Bitcoin.