Today, participants can create new tokens in nearly every proof-of-stake (PoS) network through protocol staking; however, none have yet to offer a killer feature: long-term staking.

Term structures (see note below) allow investors to strategically lock up capital for distinct periods of time in exchange for generally greater returns on investment. In finance, term rates make up a yield curve, which is an essential ingredient into well-functioning financial markets. Yet in crypto, these primitives don’t exist at all at the protocol level.

In this blog post, we’ll explore ways in which PoS networks can better align stakers with the long-term growth and success of their networks and suggest a specific financial construction to elegantly achieve it.

Staking already works, right?

Staking is more than just a way to lock existing tokens in order to create new ones. It plays a crucial role in the security and vitality of PoS networks, which is why stakers benefit from seigniorage in the first place.

However, in the current model of staking, all ecosystem stakers create tokens on the same terms without taking into account their specific orientation toward the network, whether that be short term, long term or even our diamond hands friends. Staking fails to adequately benefit stakers who hold through risk and volatility for the betterment of the network.

Additionally, the option to unstake on a relatively short notice (i.e., a short cool down period) poses a potential risk to networks’ stability, particularly in extreme circumstances where a significant amount of stake is unstaked within a brief timeframe. Such scenarios could lead to network instability, undermining the overall system, or, worse, a full-blown economic attack.

Ethereum uses a queueing system to mitigate this risk, but this essay explores potentially more robust alternatives.

Staking works, but it could be better.

Long-Term Staking

Long-Term Staking incentivizes network stability and staying power by permitting stakers to create a higher percentage of tokens in exchange for longer staking lock-ups.

Long-Term Staking introduces a time-lock variable (e.g., a staker can choose to lock their stake for 1 year, 2 years, etc.) during the staking process. Protocols can view this as time-weighted stake, wherein stakers who take on more duration risk are able to create proportionately more tokens.

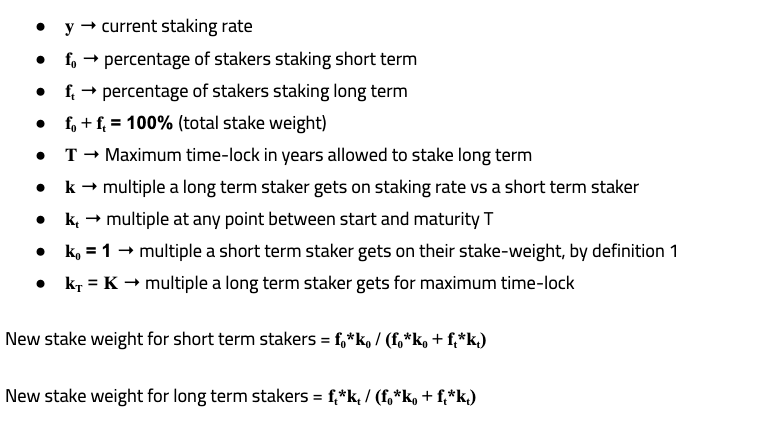

Let’s define a few variables:

We have intentionally defined k as a separate multiplier instead of purely time-weighting the stake to preserve flexibility. By avoiding a strict multiplication by time, particularly in cases of long time-locks, the design prevents overly detrimental effects on short-term staking rates. This in turn eliminates any potential barriers for stakers who may not possess a long-term appetite, ultimately safeguarding against a decrease in staking participation rate (which is important for consensus safety in the near term). Furthermore, it also preserves optionality for networks to be aggressive by increasing k, if needed, to boost long-term staking rates.

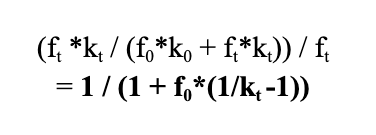

Assuming uniform performance by validators, long term stakers enhance staking rates by,

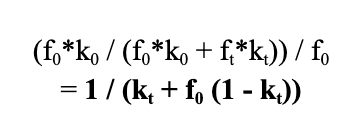

Short term stakers would see a reduction in their staking rates by,

Exploring Financial Constructions and Facilitating Risk Transfer

There are two immediate ways networks could implement long-term staking: perpetual time-lock arrangements and fixed-maturity arrangements.

Perpetual Time-Lock Contracts

To start, protocols could allow a perpetual, 1-year staking arrangement for stakers interested in long-term staking. This is, in spirit, analogous to a puttable bond.

Every epoch/block, stakers can submit a redemption notice. Upon submitting a redemption, (i.e., unstake) they can claim the underlying asset after the 1-year time lock expires.

If a staker wants to continue staking, the time-lock would automatically reset to 1 year every epoch/block (i.e., it is auto-rolled). From a staker’s perspective, they would never have to take any uncertainty of return of the amount staked beyond the 1-year time-lock.

Other terms could be rolled out gradually: 3-month, 6-month, 2-year, 3-year, 5-year, 10-year, etc.

Fixed-Maturity Contracts

Fixed-maturity arrangements would be another way to implement term-staking. This would look more similar to a traditional bond wherein the amount staked is returned at a fixed date in the future, and time to maturity continues to decrease with passing time.

Generally, we think perpetuals are a better construct than the fixed-maturity alternative because:

- the perpetual, 1-year time-lock construction allows networks to operate at the maximum possible time-lock every epoch/block, which best incentivizes long-term staking; and,

- by the virtue of having a 1-year time-lock every epoch/block, multiple k can stay constant throughout the lifetime of staking = K. This is particularly important because as time left to maturity date reduces, the staking rate multiplier to parties interested in long-term staking reduces, thereby narrowing the spread between the rates of long-term and short-term stakers, and consequently making it less attractive for long-term stakers.

DeFi: Facilitating Risk Transfer

Even the most basic implementation should be able to accommodate the preferences of long-term stakers who need an exit into the native asset prior to the conclusion of the unstaking period via liquid staking. We expect to see term-based, liquid-staking token pools emerge organically to facilitate such risk transfer.

Furthermore, due to the mean-reverting nature of yields and harnessing the power of composability, automated market-making primitives can facilitate seamless risk transfer among market participants across terms via liquid staking pools. In fact, yield curve trading is a big thing in traditional finance already. For example, we expect to see stToken-12month trading independently from stToken-6month and these tokens to drive more on chain trading and liquidity.

Imagining Long-Term Staking In A Hypothetical PoS Network

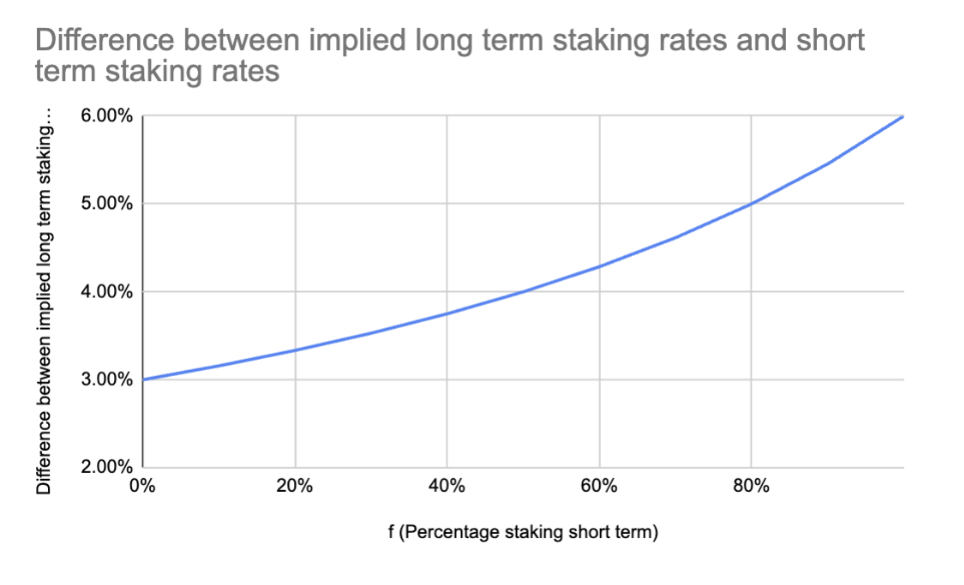

Let’s consider a hypothetical PoS network with a staking rate of y = 6%. Let’s use K = 2 in order to balance short-term and boost long-term staking rates. We’ll assume that T = 1 year for this calculation.

What we discover is that at one extreme, when everyone stakes for the short term, everyone receives the same staking rate of y = 6%. However, the first person to stake long term can achieve twice that rate, or K * y = 12%. On the other extreme, when everyone stakes long term, the staking rate remains at y = 6%, but anyone choosing to stake short term would only achieve y / K = 3%. In reality, the equilibrium might fall somewhere in between these extremes. Consequently, the network could potentially achieve increased security over a longer duration using the same aggregate staking rate.

Note: Above chart demonstrates that as more people stake short term, that makes the staking rates curve steeper and incentivizes more people to stake long term

It’s essential to acknowledge that the thought experiment here was focused on a single term: 1-year. This constraint allows for a streamlined implementation while maintaining the flexibility to easily incorporate additional time-locks in the future. The process of expanding into multiple time-locks should be a collaborative effort, where communities can delve into the specific idiosyncrasies of each subsequent time-lock and the respective PoS network.

This design is 1) simple and intuitive, 2) easy to reconfigure based on market feedback, 3) incorporates free-market demand, and 4) ensures that long-term staking rates are greater than short-term staking rates.

Managing Design Risks

Long-term staking is not a cure all. It comes with some edge cases and other constraints to consider.

One of the most important risks in this design is that whales can time-lock for maximum term and

- Dictate K, multiple on long term staking rates, that can be punitive to short term stakers, thereby increasing the risk of short term stakers leaving the network, and potentially leading to centralization of the network.

- It could have a detrimental effect on validators with short term stakers. It could make these validators less competitive, thereby increasing the probability of these validators leaving the network

The solution is to design a community-driven methodology for deciding the value of K. This multiple should be big enough to matter, but small enough to not discourage short-term stakers. Multiple stakeholders need to be consulted with – short-term stakers, long-term stakers, validators with different mix of stakers, and potentially many more.

Stronger Blockchains

In our view, in order to ensure network resilience and grow into financial infrastructure that supports billions of users and trillions of dollars, PoS networks need to start thinking seriously about how to incentivize long-term, values-aligned stakers. Yield curves are the backbone of well-functioning financial markets. Long-Term Staking is a crypto-native way to bring that vision to life and we can leverage the power of composability to create seamless risk transfer mechanisms between various market participants.

By implementing Long-Term Staking, PoS networks can create a robust ecosystem that rewards those who prioritize long-term engagement and align with the network’s values. Furthermore, by voluntarily locking their stake for extended periods, long-term stakers significantly enhance the implied network security. Their long-term “skin in the game” instills confidence in the blockchain’s security, attracting more stakers and fostering a virtuous cycle of growth. By implementing these measures, we can significantly improve the dynamics of PoS blockchains, fortifying their stability, security, and long-term viability.

Thanks to Kyle Samani, John Robert Reed, and Nihar Shah for their feedback on this essay.

Important note: It is essential to note that while we employ the term “term structure” or “yield curve,” it differs from how traditional fixed income markets operate. In the United States, for instance, the Federal Reserve governs monetary policy and controls the printing of money into circulation. On the other hand, it is the US Treasury that issues fixed income products to raise funds that have already been printed into circulation. In this proposal, we are suggesting a redistribution of the programmatically issued new token creation in a hypothetical PoS blockchain. When we use the term “staking rate,” we are referring to the rate at which stakers are able to create new tokens as part of the protocol’s consensus and new money supply mechanisms.