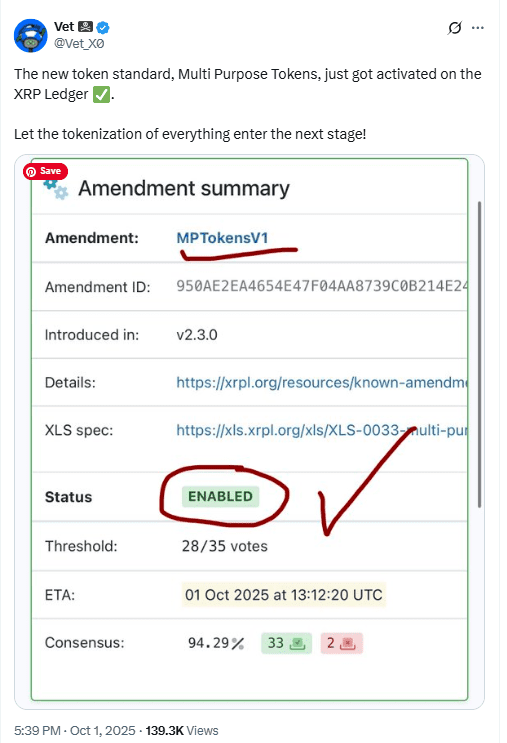

XRPL’s MPTokensV1 (XLS-33) amendment is now live on mainnet after its activation window concluded this week. The standard adds a native, fungible-token format with built-in metadata and issuer controls, reducing the need for bespoke code.

Developers can issue assets with a few lines while the protocol enforces supply, transfer rules, and compliance flags. Documentation describes MPTs as a direct evolution from trust-line tokens, designed for efficiency and easier integration.

Validator data shows the amendment’s long runway from proposal to enablement, reflecting broad network coordination before activation. Community and industry reports tracked the 14-day countdown that ended around October 1.

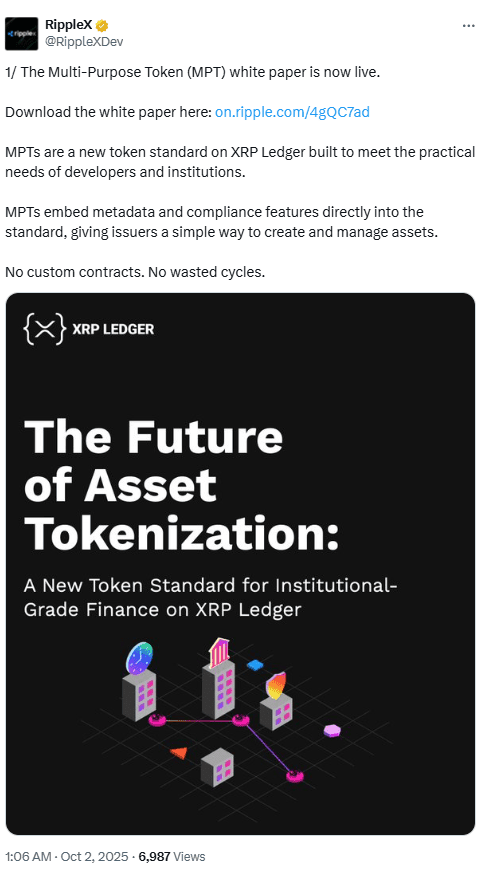

Ripple publishes MPT white paper; messaging stresses “no contracts, no wasted cycles”

Ripple released the MPT technical white paper, outlining how issuers create and manage assets without custom smart contracts. Coverage highlights embedded compliance features and standardized metadata as core design choices.

RippleX’s developer channel promoted the release and linked the paper, positioning it as the canonical reference for builders adopting the standard. The post packages the announcement for engineers who follow XRPL changes.

The paper arrives in the same week as mainnet activation, aligning technical guidance with production availability. This timing closes the gap between specification, documentation, and live deployment.

“Privacy first” roadmap surfaces; engineers flag confidential MPTs and ZK work

Senior engineering commentary frames privacy as a precondition for institutional adoption. Ripple’s J. Ayo Akinyele details a program to bring privacy, scale, and institutional infrastructure to XRPL, including zero-knowledge techniques and confidential token flows.

Industry write-ups the past 24 hours echo that focus, saying XRPL’s next iterations emphasize privacy-preserving rails for lending and tokenized assets. These reports connect the privacy push to MPT’s institutional goals.

Together, the standard and the privacy roadmap indicate an integrated approach: native tokens with compliance knobs coupled with confidentiality features to meet regulated-market requirements. That framing targets banks, fintechs, and RWA issuers.

Devnet reset executed around amendment support; PermissionDelegation paused

XRPL’s devnet reset scheduled for October 3 aimed to prevent validators from becoming amendment-blocked in upcoming rippled releases. The maintainers flagged that the PermissionDelegation amendment would be set to unsupported pending further work.

The reset aligns test infrastructure with the live code path, ensuring developers target a consistent feature set. It also reduces friction for node operators who upgrade in step with core releases.

A separate vulnerability disclosure published this week documents the PermissionDelegation issue reported in mid-September, adding technical context for the reset and the temporary pullback.

Legal and corporate backdrop: SEC case closed; stablecoin build-out continues

The SEC’s lawsuit against Ripple formally concluded in August with a $125 million civil penalty and an injunction tied to institutional sales, while exchange sales remained lawful under earlier rulings. With appeals dismissed, those outcomes stand.

Ripple continues to expand stablecoin infrastructure. In August, the company agreed to acquire Rail, a stablecoin payments platform, to bolster RLUSD issuance and distribution pending regulatory approvals. Coverage from major outlets and industry media confirms the deal value and strategic fit

Earlier this year, Ripple also announced a $1.25 billion purchase of prime broker Hidden Road, positioning RLUSD within collateral workflows for institutional clients. The transaction underscores the broader push into regulated settlement rails.

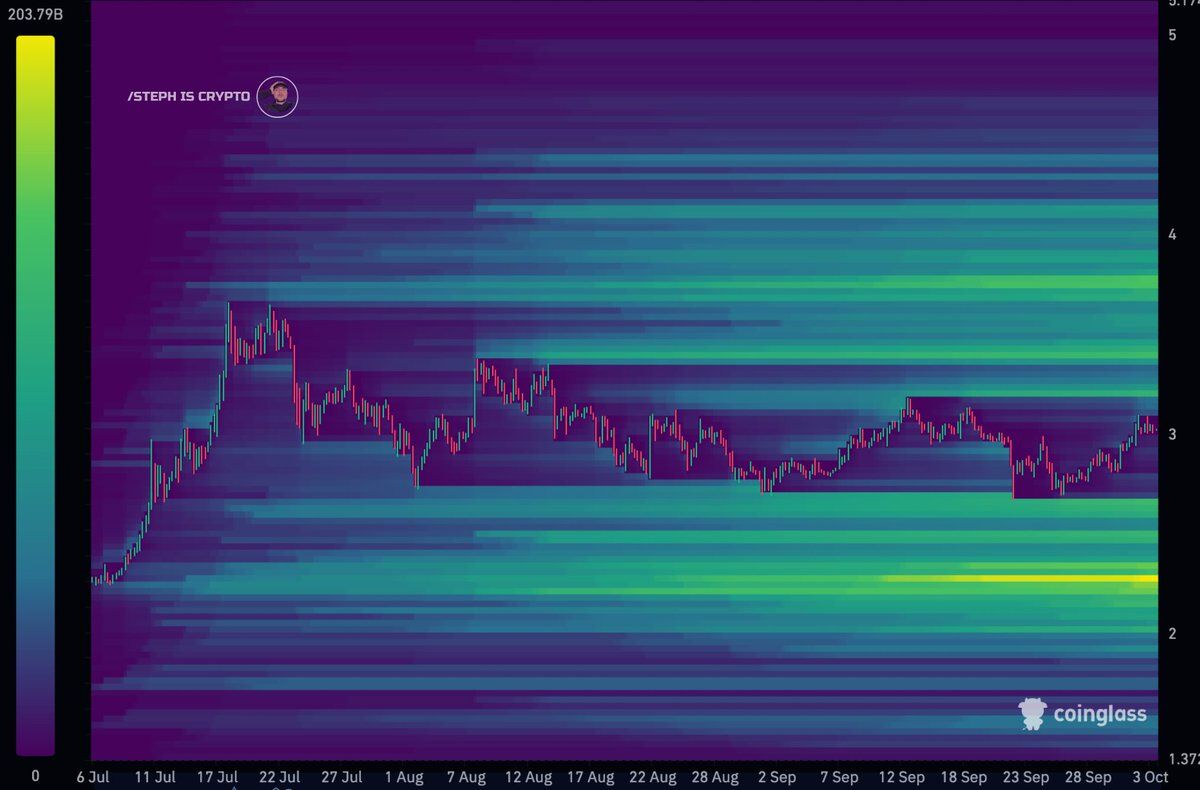

Large XRP liquidity band appears near 2.25 on heatmap

Analyst Steph is Crypto flagged a dense XRP liquidity cluster around 2.25 using a Coinglass heatmap. The graphic shows brighter bands where resting orders or liquidation interest concentrate. The band near 2.25 stands out across recent sessions, signaling a level where significant orders may sit.

Traders watch such clusters because price often travels toward liquidity. Market makers and aggressive flows can drive moves that “clear” crowded levels before reversing or continuing. However, these bands change as participants add or cancel orders, so the map offers a snapshot rather than a fixed target.

Context matters. If liquidity above or below current price thickens, order flow can pivot toward the larger pool. Conversely, if the highlighted band thins, the draw weakens. Therefore, desks typically track updates across multiple venues and time frames, confirm with volume, and compare with funding and open interest before forming a view.

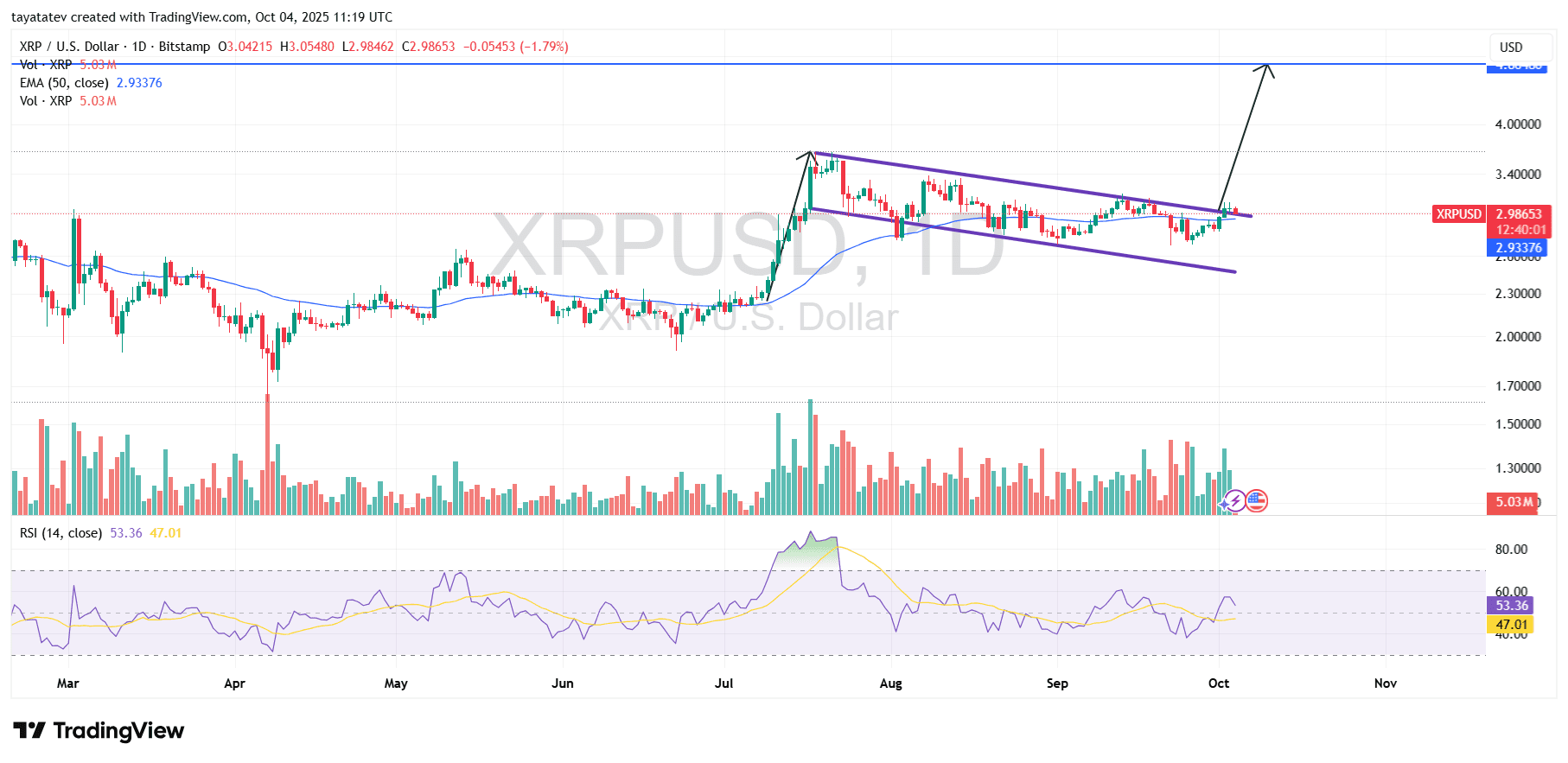

XRP bullish flag confirmed; EMA, volume, and RSI align

The XRP/USD chart shows a completed bullish flag with price closing above the upper rail. That breakout followed a sharp September impulse and a tight, downward drift. Therefore, the pattern signals continuation rather than reversal.

Exponential moving averages back the move. The 8-EMA has crossed above the 21-EMA and now tilts higher. Meanwhile, price trades above both EMAs, turning them into dynamic support on dips.

The 50-EMA sits below the 21-EMA but is curling upward. If price holds above the flag top, the 21-over-50 bullish cross typically follows. That sequence often marks trend resumption on this timeframe.

Volume expanded on the breakout candle. Participation increased as price cleared the flag line, confirming real interest. Subsequent bars kept volume above the recent pullback average, which supports follow-through.

However, volume usually cools during post-breakout retests. If a dip returns to the breach zone on lighter activity, bulls still control. A heavy-volume drop back inside the flag would weaken the signal.

RSI turned higher through the 50 midline and now tracks in the 55–65 zone. That regime suggests bullish momentum without immediate overbought risk. A sustained push above 70 would indicate acceleration but also raise pullback odds.

Momentum structure looks constructive across multiple windows. The breakout candle printed a wider spread than prior sessions, which shows intent. Moreover, smaller pullbacks get absorbed near the 8-EMA, keeping trend pressure upward.

The measured move remains unchanged. Using the flagpole method, we project a 61 percent extension from the current price. In other words, target equals current price times 1.61 while the breakout holds.

Risk levels are clear on the chart. The former flag top now acts as first support; the 21-EMA sits just beneath it. A daily close back inside the flag would invalidate the immediate continuation view.

In summary, EMAs slope up, volume confirmed, and RSI sits in a healthy bull zone. Price already trades above the flag, so the path favors the 61 percent extension. The setup remains valid as long as candles close above reclaimed resistance.