Cardano’s ADA traded near $0.90 at last week’s close, though bears pared some of the token’s gains in later trading sessions. Yet, ADA price managed to maintain its trend of setting higher lows, keeping traders focused on the $1 level as a key test.

Broader market conditions also added momentum after fresh U.S. inflation data showed headline CPI rising 0.4% in August, bringing the annual rate to 2.9%. Core CPI advanced 0.3% on the month and 3.1% year-on-year. The softer trend reinforced bets on Federal Reserve rate cuts, boosting risk assets.

Amid the improving macro backdrop, attention turned to Cardano’s internal dynamics. On-chain data showed a marked concentration of ADA supply among top holders and long-term investors. The pattern signaled a tightening pool of liquid coins. With ADA consolidating inside a larger structure, the focus moved toward whale behavior as a critical influence on its near-term path.

Whale Accumulation Shapes ADA’s Supply Picture

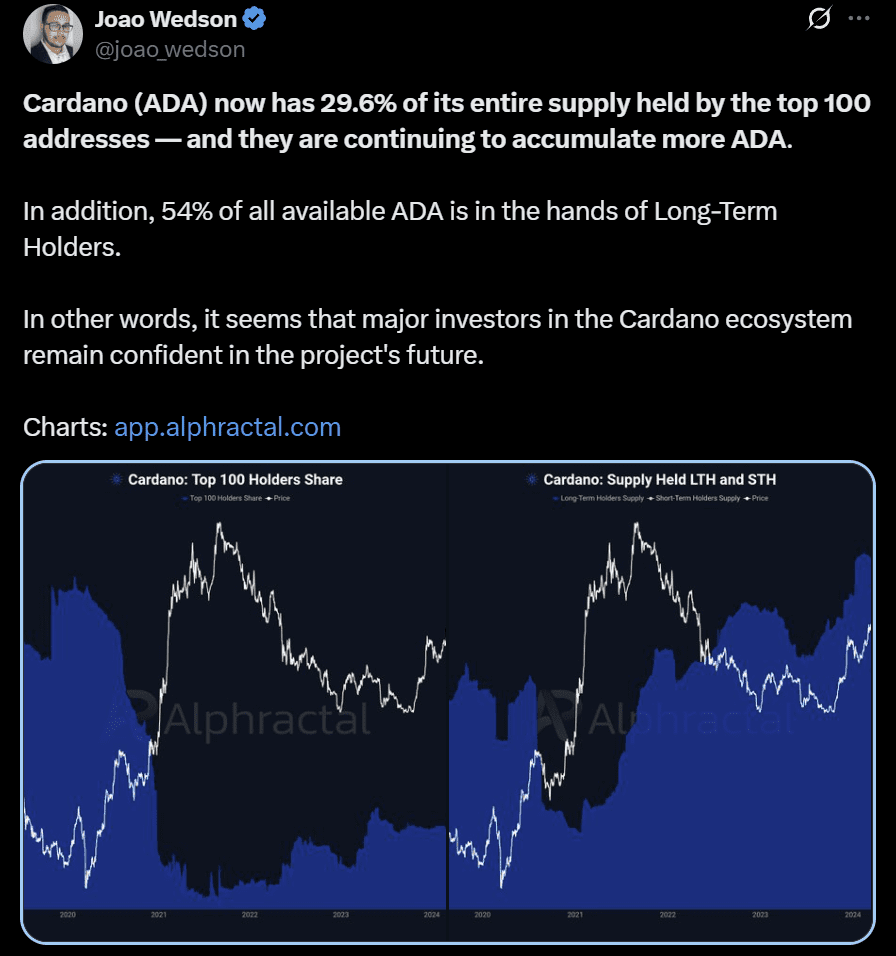

On-chain data underscored how concentrated ADA’s supply had become. Joao Wedson, founder and CEO of Alphractal, reported that the top 100 Cardano wallets held nearly 30% of the circulating tokens.

The analyst also noted that over half of the ADA supply belonged to long-term holders. This shift reflected a pattern of accumulation that reduced the liquid pool available for trading.

Such movements carried implications for ADA’s price structure. Periods of heavy concentration in earlier cycles had coincided with rallies as tighter supply met stronger demand. Traders pointed to similar dynamics unfolding in the current consolidation phase. At the same time, history showed that distribution from large wallets often capped rallies, slowing momentum when ADA attempted breakouts.

Recent activity captured this tension. Specifically, analysts noted that the stalling reflected the push and pull between steady accumulation and intermittent selling from large holders.

Analysts Frame Token’s Path with Breakout Targets

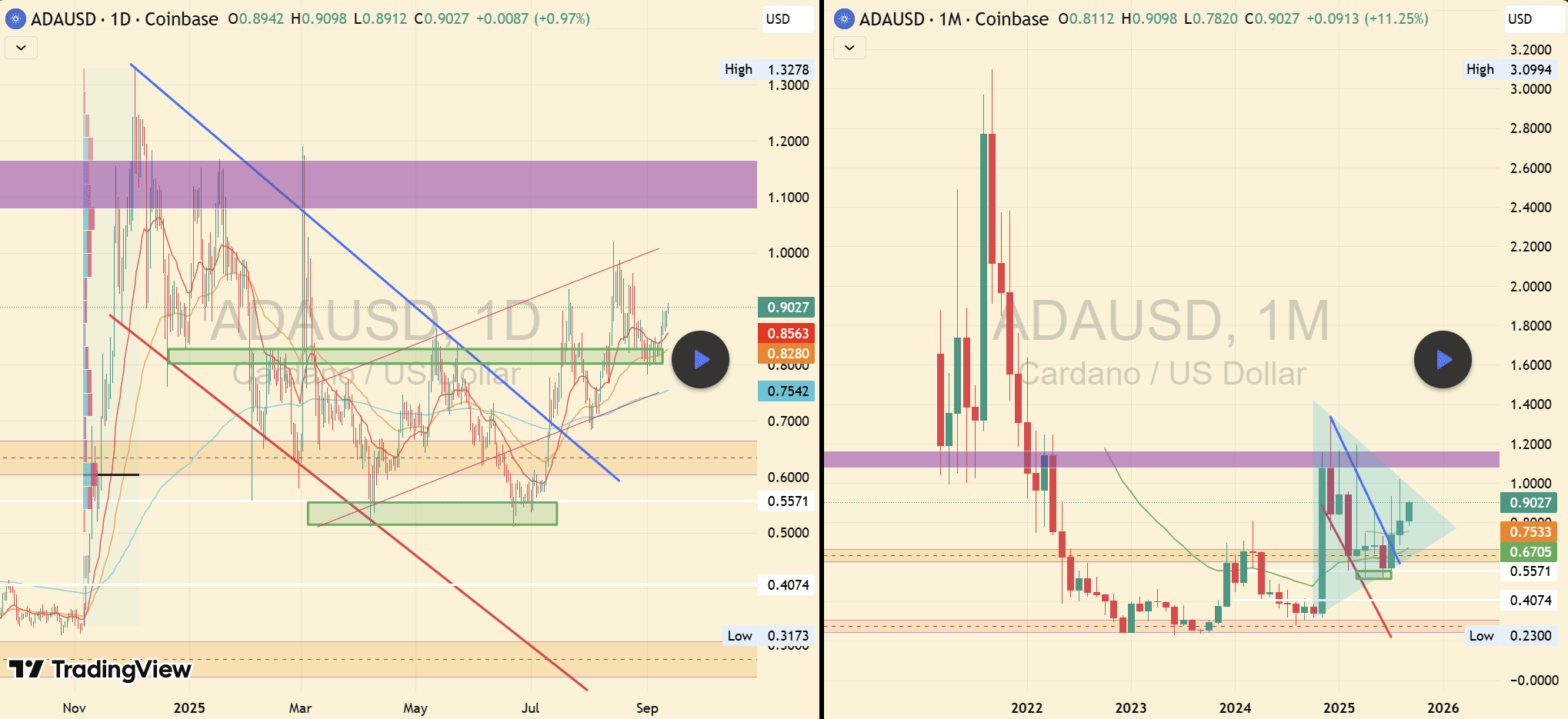

Meanwhile, independent trader Yash Jain stressed that whales limited ADA’s upside during Sept. 2025, capping momentum each time the token approached resistance.

Jain argued that the delayed breakout reflected heavy supply from large holders, even as the ADA USD pair consolidated within a bullish triangle. The analyst’s view tied whale behavior directly to the stalling around the $1 mark.

Another analyst on X, Sheldon the Sniper, mapped higher targets if ADA managed to escape this range.

Sheldon the Sniper highlighted a large symmetrical triangle on the weekly chart and called for a parabolic move. Sniper’s projection placed ADA’s following objectives near $2.08 and $3.13, both aligning with major resistance zones from the previous cycle. That scenario would require ADA to sustain a clean break above the $1–$1.20 corridor, a zone that had repeatedly acted as a ceiling.

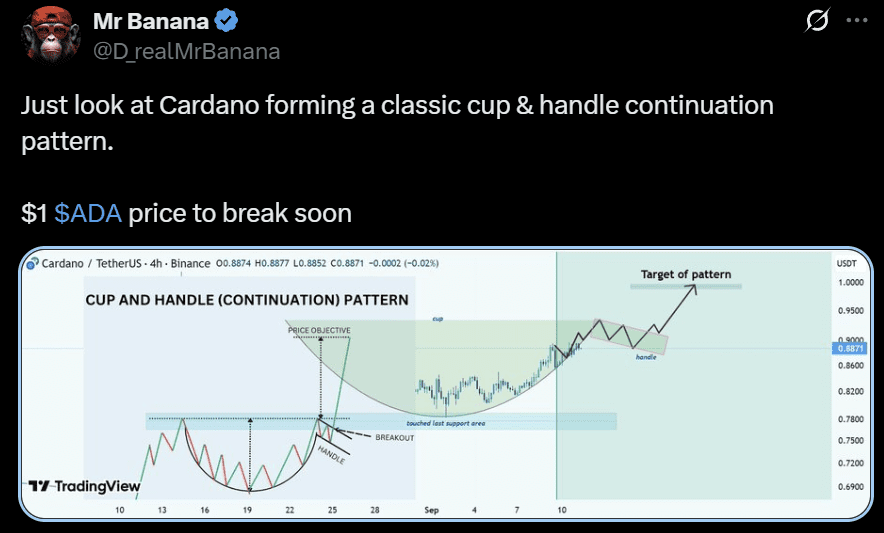

Additionally, short-term patterns added weight to the bullish case. Mr Banana flagged a classic cup-and-handle structure forming on the four-hour chart, with a measured target near $1. The pattern suggested that ADA could retest the symbolic $1 level before attempting a larger breakout. Market watchers noted that a close above this area would confirm the pattern and potentially set momentum toward higher levels.

Taken together, the analyses showed a layered structure. ADA price faced immediate resistance at $1, with further hurdles near $1.20 and $1.40. A decisive move beyond those levels could validate the broader triangle and cup formations, bringing long-term targets into focus. Overall, the concentration of supply in whale and long-term holder wallets added context, showing how accumulation and resistance converged to define Cardano ADA’s next phase.