Polkadot’s DAO approved a hard cap of 2.1 billion DOT. The vote ends the network’s open-ended issuance for the first time. The cap applies to total supply, not only circulating coins.

Under the prior DOT tokenomics, the network minted about 120 million DOT each year. There was no limit on total supply. That policy is now retired by the Polkadot token cap decision.

Polkadot reported a total supply near 1.5 billion DOT at announcement time.

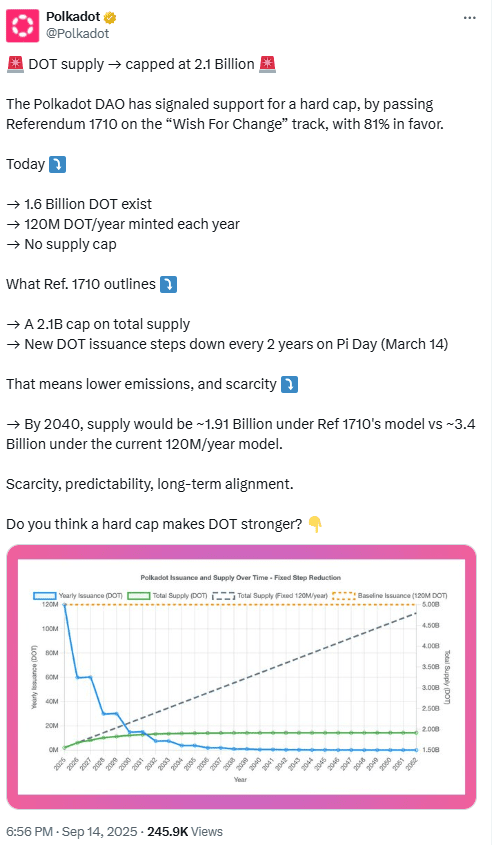

DOT Tokenomics Shift: Issuance Reduction Every Two Years on Pi Day

The new DOT tokenomics introduces a gradual issuance reduction on a fixed schedule. The step-down occurs every two years. The cadence aims to slow inflation over time.

Polkadot set each reduction for March 14, widely known as Pi Day. The team also shared a chart that contrasts old and new supply paths. The schedule turns the policy into a predictable calendar event.

Under the old path, total DOT supply could have exceeded 3.4 billion tokens by 2040. With the cap, projections now sit far lower. External coverage notes a ~1.91 billion circulating figure by 2040, under the revised model.

Polkadot Capital Group: Institutional Investors Focus and Use Cases

The Polkadot Capital Group launched on Aug. 19, 2025. The division targets institutional investors across asset managers, banks, exchanges, OTC desks, and venture firms. It connects them to Polkadot’s infrastructure.

Coverage states the unit will provide data, resources, and engagement routes. The focus includes DeFi, staking, and real world asset tokenization. It also aims to bridge Wall Street and Web3 through structured outreach.

This institutional track launches alongside the DOT supply cap. Both threads shape how capital views the network’s policy and tooling. The sequence adds context to the timing around the tokenomics shift.

DOT Price Reaction: DOT Slips ~5% After Tokenomics Update

After the cap announcement, DOT moved from about $4.35 to near $4.15. That marks a decline of roughly 5% over the cited window. Public price pages recorded the move in the same period.

Intraday snapshots show DOT around the $4.17–$4.20 area today. The 24-hour change sat in negative territory. These values reflect market data feeds at press time.

Price context sits against the new DOT tokenomics and the fixed issuance reduction plan. The DOT supply cap does not imply an immediate effect on price. It defines the supply curve and its dates.

Polkadot Model Details: DOT Supply Cap Mechanics and 2040 Path

Polkadot’s materials emphasize a step-down design rather than a one-off cut. The issuance reduction repeats on Pi Day every two years. That sets a clear calendar for supply changes.

Reporting shows multiple reduction schedules were outlined during discussions. External summaries describe options that front-load cuts or smooth them across decades. All sit under the 2.1 billion ceiling.

By comparison with the old curve, the new path avoids the 3.4 billion scenario. It preserves programmatic rewards while enforcing a DOT supply cap. That cap sets an upper bound for lifetime issuance.