Zebec Network moved forward with new ecosystem developments this month, focusing on product deployment and distribution rather than market activity. The team pushed the ZebecNET beta into its first phase, expanded U.S. market access through Kraken, and continued its buyback program tied to card spending. Together, the updates signal a broader push to connect real-time payments with telecom infrastructure and regulated exchange rails.

The project continues to center its roadmap on utility and live products. Zebec is positioning its network as an always-on financial layer with streaming payments, payroll automation, and debit-style spending. The latest milestones show the team executing on timelines that were first outlined earlier in the year.

At the same time, Zebec maintains its focus on adoption metrics rather than token-driven announcements. The shift keeps attention on product usage, partner execution, and infrastructure growth across regions, platforms, and real-world integrations.

ZebecNET beta begins as phased telecom-payments rollout

Zebec started the phased ZebecNET beta in October, working with World Mobile to launch a combined telecom and payments stack. The network aims to pair decentralized eSIM connectivity with real-time financial tools, including payroll and card spending. The model targets regions where both communication access and financial access must scale together.

The partners are rolling out the beta market by market instead of a single global switch-on. This approach lets teams stress-test connectivity, identity, and spending features before expanding to wider regions. It also gives partners room to refine user flows on the telecom layer and the financial layer simultaneously.

ZebecNET remains the core infrastructure push for this quarter. With the beta active, the ongoing phases are expected to introduce additional countries, supported devices, and card-linked features. The roadmap points toward a full release after regional testing meets performance and compliance benchmarks.

Kraken listing expands U.S. access and onboarding channels

Kraken added ZBCN trading on October 15, opening a major U.S. exchange route for Zebec users. The listing gives institutions and retail users a regulated venue with standard order-book tools, fiat on-ramps, and established custody workflows. As a result, Zebec gains a clearer access point for users who rely on traditional platforms instead of cross-chain swaps.

The launch strengthens Zebec’s distribution plan in North America. By placing ZBCN on a regulated exchange, the team removes friction for users who want direct access to the ecosystem without technical hurdles. It also simplifies onboarding for payroll users, debit card users, and businesses that route spending through U.S. platforms.

The Kraken addition follows a year of infrastructure releases centered on cards, payments, and streaming transfers. With a regulated exchange now live, Zebec can align its telecom rollout with clearer entry channels in the U.S. market during the same period.

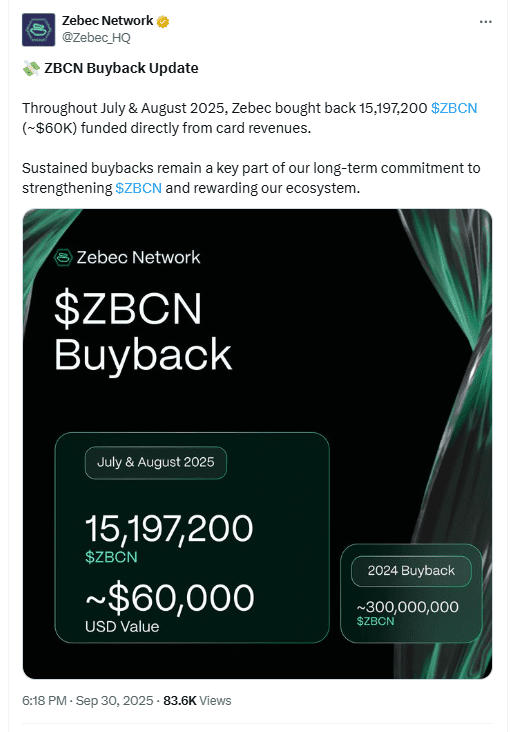

Card-linked buybacks continue through revenue-based model

Zebec continued its buyback program tied to Zebec card transaction volumes. The model allocates a portion of monthly card revenue toward open-market repurchases, linking network activity directly to circulation management. The team uses card performance as the trigger rather than discretionary announcements.

The buyback structure reflects Zebec’s direction toward product-driven treasury actions. As more regions and card partners go live, the mechanism scales with usage instead of speculation. It also gives the project a defined rule set that repeats month to month without relying on external factors.

The program has been active since the summer, and October continues the cadence. With ZebecNET expanding and payments infrastructure growing, the card-linked structure remains a visible treasury lever inside the ecosystem.

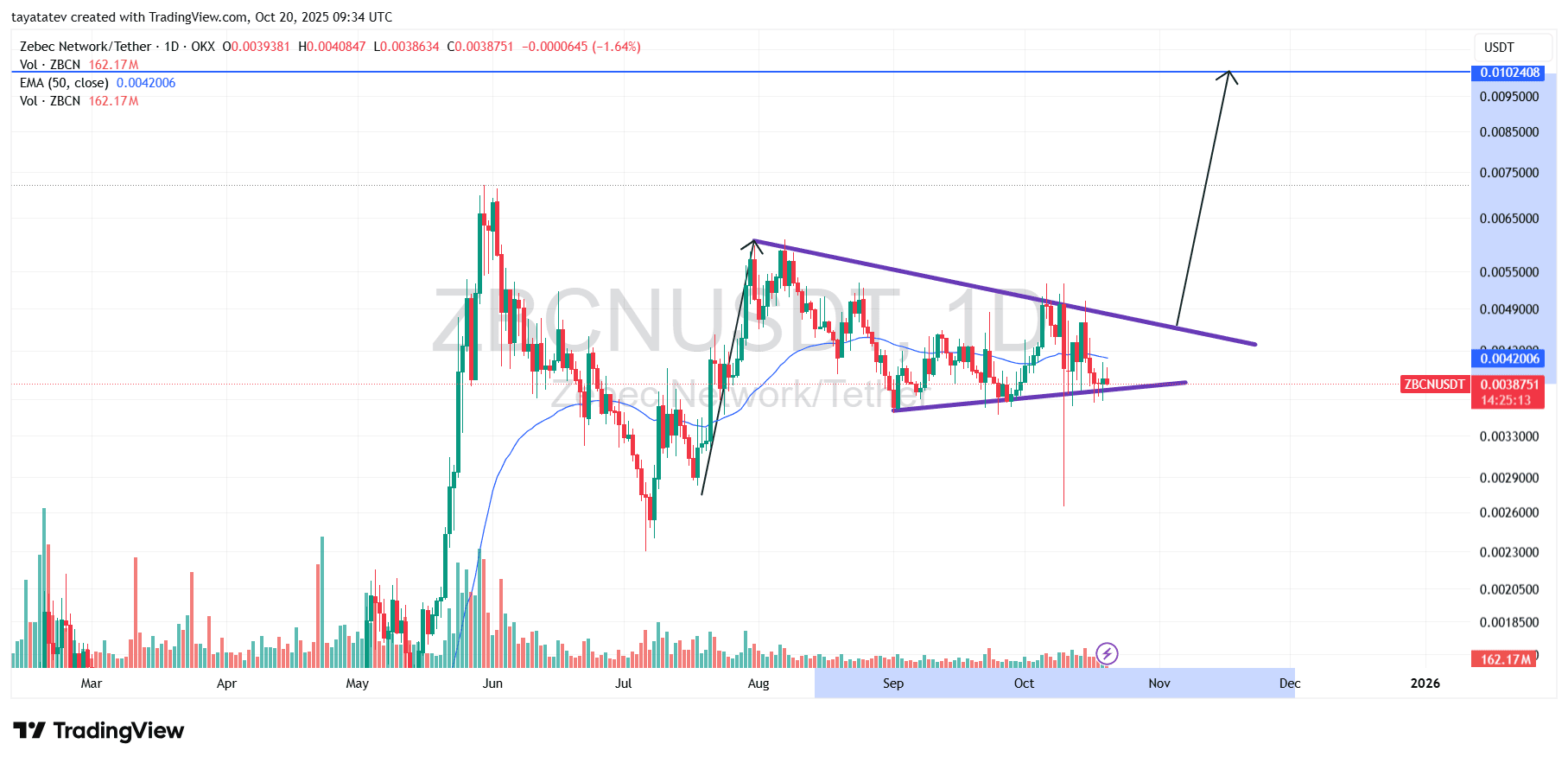

ZBCN forms bullish pennant; a confirmed breakout would project ~163% toward $0.01019 — Oct. 20, 2025

Zebec Network’s ZBCN chart on Oct. 20 shows price compressing inside converging trendlines, shaping a bullish pennant just above the 50-day EMA. Buyers continue to defend rising short-term support while sellers meet them along a descending upper boundary. As a result, the setup now hinges on a clean move through the pennant top with rising volume.

A bullish pennant is a short consolidation with converging trendlines that follows a sharp advance; once price breaks out upward, traders often use the prior “flagpole” to estimate the next leg. Here, the pattern formed after ZBCN’s summer impulse, and momentum has narrowed into a tight range across September–October. Moreover, repeated higher lows along the lower rail keep pressure on the ceiling.

If ZBCN confirms the breakout with a daily close above the pennant’s upper trendline and expanding volume, the measured move implies about 163% upside from the current level, pointing to roughly $0.01019. Until then, the pattern remains unconfirmed; a decisive drop below the lower rail would invalidate the structure and defer the target. Still, the technical bias stays constructive while price holds rising support and the 50-day EMA acts as a pivot.

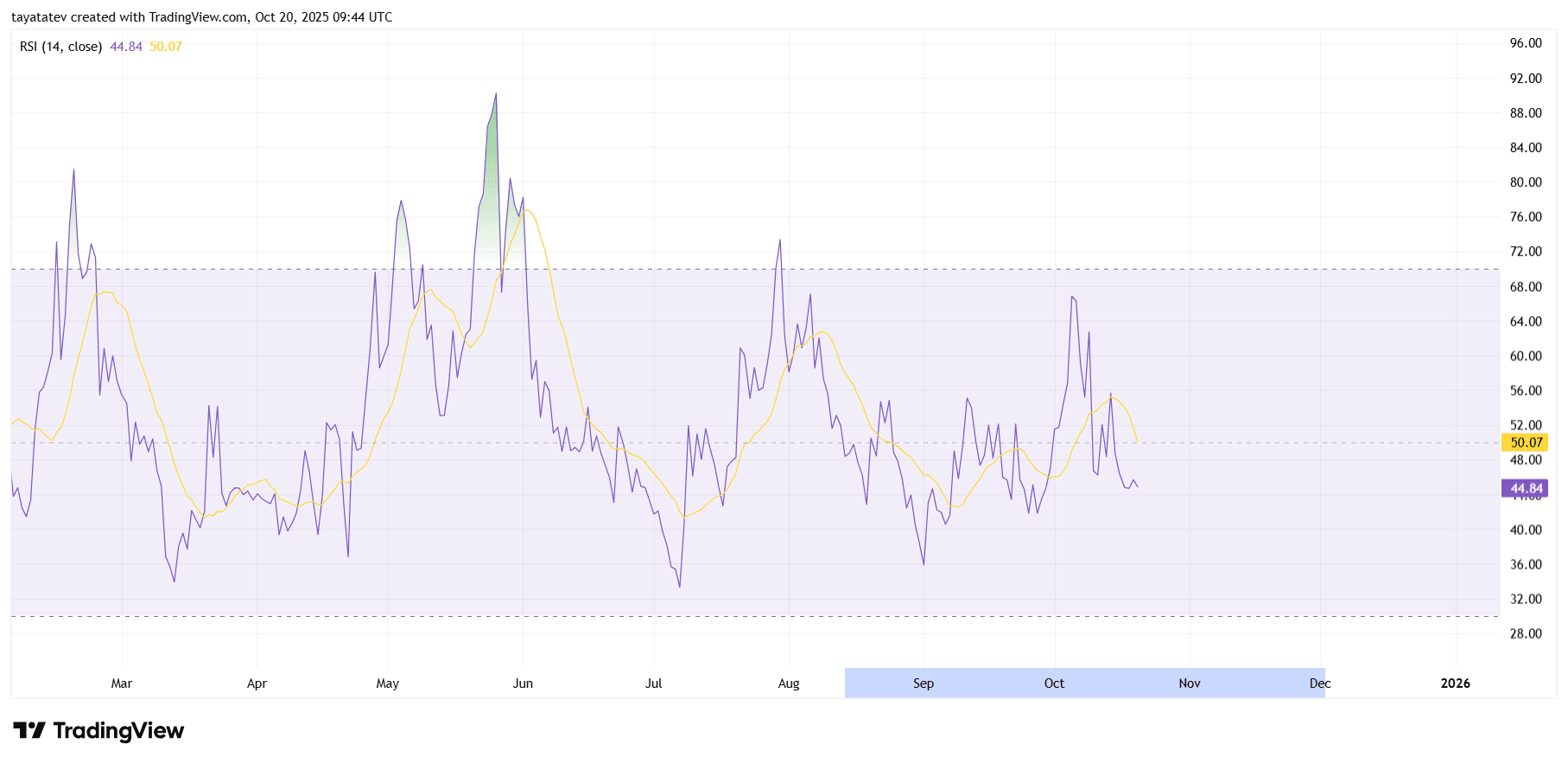

ZBCN daily RSI sits below midline; momentum needs a 50–55 reclaim — Oct. 20, 2025

ZBCN’s 14-day RSI hovers near 44.8 while the RSI signal line trends around 50.1. The oscillator stays under the neutral 50 mark, which signals soft momentum after September–October chop. Moreover, recent swings show lower RSI highs since early October, reinforcing a mild bearish bias until buyers reverse it.

However, conditions remain balanced rather than extended. The RSI trades in the 40–60 zone, far from oversold or overbought extremes, so volatility can expand quickly on new catalysts. A sustained push back above 50–55 with the RSI crossing up through its signal line would indicate improving trend strength and support any upside break visible on price.

Conversely, a decisive RSI drop below 40 would warn of momentum loss and raise the risk of a deeper fade toward the 30 band. Until either trigger prints, the indicator suggests range behavior and a wait-for-confirmation stance that aligns with the pennant view on price.