As the market continues to reel in red, Bitcoin wallets that had been inactive for the past three years are coming back to life.

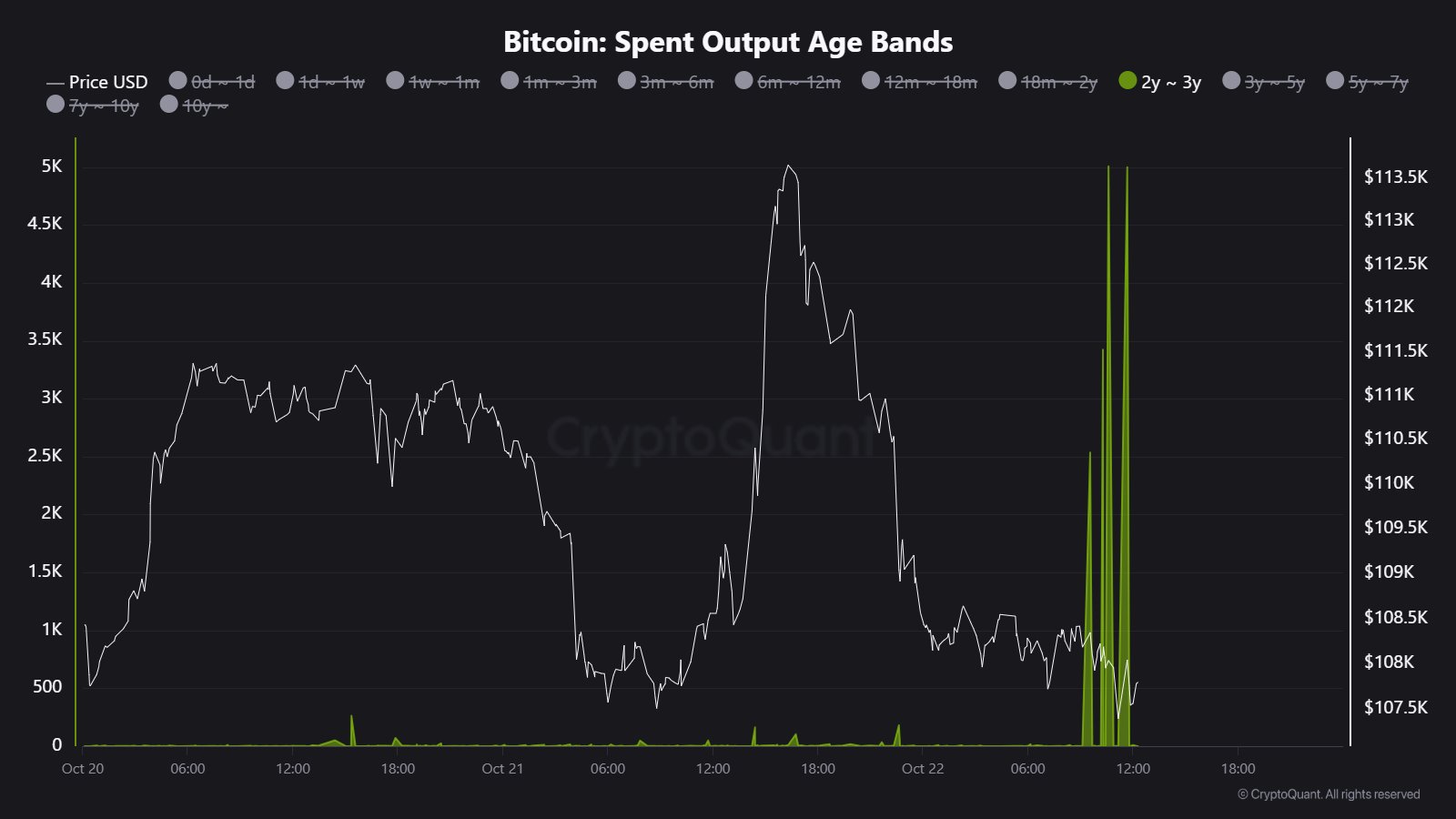

Today, Bitcoin’s on-chain activity recorded a major event: exactly 15,965 BTC, dormant for around three years, suddenly re-entered circulation.

According to CryptoQuant analyst JA Maartun, this is the first significant movement from these wallets since late 2022 to early 2023.

Dormant Bitcoin Waking Up

Indeed, Data from CryptoQuant confirms that these long-dormant Bitcoin wallets had been inactive for roughly two to three years. They transferred a large volume of BTC earlier today to undisclosed destinations.

The coins moved while Bitcoin’s price hovered below $110,000, following a sharp correction earlier this month from its all-time high of $126,000. With Bitcoin currently around $108,000, the coins are worth approximately $1.724 billion.

This development has many wondering whether another major Bitcoin dump is looming. Commenting on JA Maartun’s post, one market watcher noted that old coins entering circulation during a correction is a concerning signal, as it suggests a “transfer of conviction.”

New Whales Underwater

This surge in the movement of old coins coincides with increasing pressure on newer Bitcoin whales. As previously reported, new whale wallets that accumulated BTC near recent highs are now facing nearly $7 billion in unrealized losses—the largest since October 2023.

CryptoQuant data shows these whales hold Bitcoin at an average cost of $113,000. In other words, most are currently underwater with prices still below that level.

Despite this, many large investors are continuing to accumulate BTC, viewing the ongoing dip as a long-term buying opportunity.

BTC Accumulation Continues Despite Losses

Analyst Crypto Patel recently highlighted that over 26,500 BTC tokens have moved into whale accumulation wallets, suggesting quiet accumulation amid fear. He noted that such activity typically occurs during the early stages of accumulation before major uptrends.

🐳 Whales are loading up.

Over 26,500 #BTC just flowed into whale accumulation wallets, that’s not traders, that’s big money moving off exchanges.

Historically, every spike like this has happened when fear is high… and whales are quietly buying. pic.twitter.com/JiXWlBfJrZ

— Crypto Patel (@CryptoPatel) October 19, 2025

Meanwhile, Glassnode data confirms a significant drop in leveraged positions. Open interest has fallen 30%, contributing to a healthier and more stable market structure.

What Comes Next

Notably, market analyst Ted Pillows has identified the $107,000–$108,000 range as a key support zone. A strong defense of this level could trigger a relief rally, while a breakdown might push Bitcoin toward $100,000.

Amid fears of Bitcoin revisiting sub-$100K levels, Standard Chartered’s Head of Digital Assets Research, Geoff Kendrick, has maintained that BTC is still on track to hit $200,000 by year-end.

In a recent interview, Kendrick described the October 10 crash and the ongoing lull as a major buying opportunity. He remains bullish, even in a “bear case,” forecasting prices “well north of $150,000,” assuming continued Fed rate cuts.

Looking ahead, Kendrick reiterated his long-term prediction that Bitcoin could hit $500,000 by the end of Trump’s current second term in 2028.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.