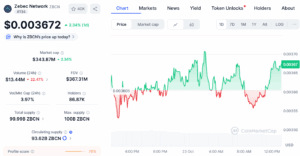

Zebec Network (ZBCN) is trading at $0.0035, up 2 % in the past 24 hours as the project expands its footprint across real-time payroll, Decentralized Physical Infrastructure (DePIN), and Real-World Asset (RWA) payment networks. The token now sits at a critical inflection point, testing long-term support near its 200-day exponential moving average. Let’s analyze whether ZBCN is gearing up for a breakout or facing a potential breakdown.

ZBCN Price Holds Near 200-Day EMA

At press time, ZBCN price trades slightly above the 200-day EMA at $0.00358, an area that has repeatedly acted as dynamic support since mid-year. The daily chart shows that the token has been consolidating between $0.0035 and $0.0055 for the past two months, forming a sideways range after several failed breakout attempts.

Shorter-term EMAs (20, 50, 100) are clustered between $0.0040 and $0.0041, suggesting low directional momentum. The Relative Strength Index (RSI) stands near 42, reflecting neutral-to-bearish conditions but leaving room for recovery if bulls defend the current zone.

A decisive rebound above $0.0041 could pave the way for a retest of $0.0046–$0.0055, while a daily close below $0.0035 may confirm a breakdown toward $0.0030–$0.0028.

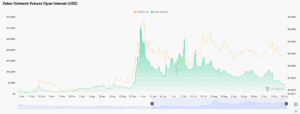

Derivatives Data Shows Cooling Speculation

Data from Coinglass indicates a significant reduction in leveraged trading activity.

Open Interest (OI) in Zebec futures has dropped from above $35 million in June 2025 to roughly $9 million in late October. The steep decline signals waning speculative appetite and a transition toward spot-driven trading.

The funding rate, which turned negative through much of August and September, has normalized near +0.01 %. This is a sign that short-selling pressure has eased. This equilibrium between longs and shorts often precedes a stabilization phase.

Liquidation data also supports the shift. On Oct. 22, total liquidations were under $300, compared with multi-million-dollar spikes during May–June’s volatility. The absence of forced position closures suggests lower leverage exposure and reduced market stress.

Fundamentals Strengthen Amid Technical Uncertainty

Zebec Network continues to expand its real-world integrations even as ZBCN price action softens. Moreover, in October 2025, the U.S. Securities and Exchange Commission (SEC) issued a “no-action” letter clarifying that certain DePIN tokens — such as Double Zero’s 2Z — are not classified as securities. The decision boosted sentiment across decentralized infrastructure projects, including Zebec, which employs a similar model of incentivized node participation.

Additionally, the same month, Kraken listed ZBCN, giving the token broader institutional visibility and deeper liquidity. Earlier this year, Zebec also executed two notable partnerships:

-

Quai Network (September 2025): Enabled $QUAI holders to make real-world payments through Zebec’s Mastercard-linked crypto cards (Silver, Carbon, and Black).

-

OctaSpace (July 2025): Integrated OCTA as the 15th supported blockchain on Zebec’s card network, extending the project’s DePIN and AI-compute reach.

These alliances strengthen Zebec’s positioning within the RWA × DePIN × payments triad — one of the most active segments in Web3 development. According to market trackers, the RWA market exceeded $27.6 billion in tokenized assets by September 2025, while analysts forecast the combined DePIN and RWA industries could surpass $1 trillion by 2030.