XRP open interest on Binance has again reset to yearly lows, giving the XRP market more room to breathe.

This is largely due to the Oct. 10 market crash, which triggered massive liquidations across the market and gave long-term holders a clean slate. According to CryptoQuant analyst Pelin Ay, the market might be setting up for a rally similar to the one that pushed XRP to above the $3.55 peak in July.

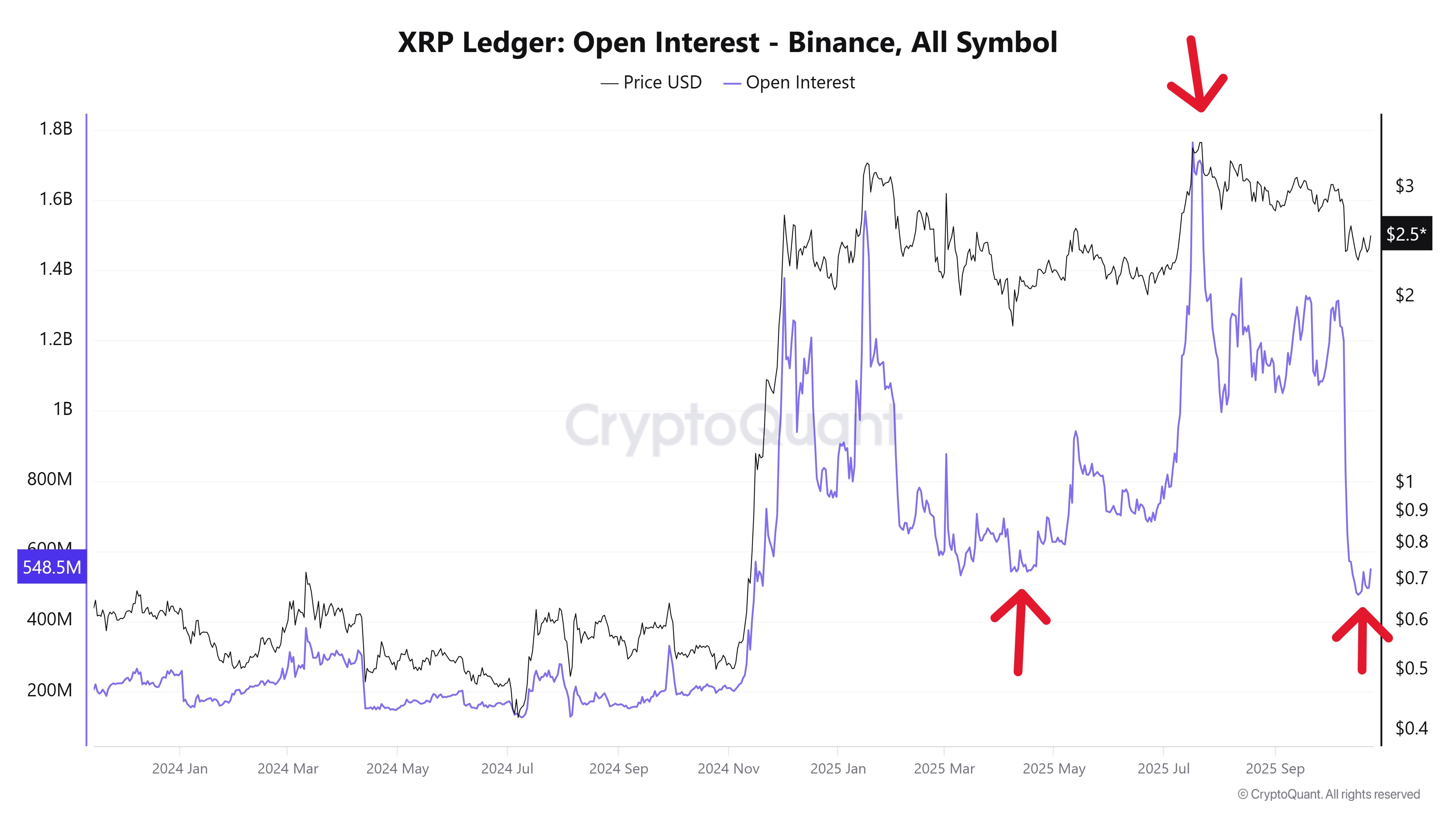

XRP Open Interest Drops to April Lows

In her latest analysis, Ay explained that XRP Open Interest (OI), which tracks active futures contracts, has fallen back to the same level it reached in April/May 2025. When this happened in April, XRP traded at much lower prices, yet OI is now just as low while the token holds steady around $2.5.

Ay believes this shows that strong holders are in control while speculative trading activity has thinned out. In simple terms, more buyers are choosing to hold actual XRP rather than play the futures market.

She pointed out that when OI hit its bottom in April, XRP quickly climbed to $3.5 as trading volume picked up. For context, XRP open interest on Binance dropped to a low of $541.5 million on April 16. At this point, XRP traded for a range of $1.8 to $2. However, as OI recovered, prices soared to a peak of $3.55 by July.

Recently, XRP open interest has dropped to $494 million, down from the $1.3 billion peak recorded on Oct. 6, four days before the market crash. Notably, on this day, total figures stood at $3 billion. With OI now back at similar lows, Ay thinks the setup looks very similar to the April/May one.

Support and Resistance Areas to Watch

She said that such deep OI drops usually mean one of two things: either leverage has been flushed from the system, giving the market room to rise again, or traders have shifted their focus from futures to spot trading. Since XRP still trades near $2.5, she leans toward the first explanation and sees it as the early stage of a new uptrend.

Meanwhile, Ay highlighted the $2.20 to $2.40 area as a short-term buying zone. According to her, as long as XRP stays above that range, the broader bullish trend remains intact.

Further, the analyst identified $1.85 as the major structural support that formed during the last consolidation phase. At the same time, the $0.60 to $0.70 area stands as the deeper psychological floor tied to previous OI lows.

On the upside, Ay sees the $2.80 to $3.00 band as the first resistance to watch. If XRP breaks through that range, she expects momentum to build quickly. The next test sits between $3.30 and $3.50, which marks the peak from the last rally and serves as a critical zone.

A Possible XRP Run to $4.5

Clearing this level alongside a rise in XRP open interest could lead to a full breakout phase. Based on earlier patterns, she sees $4.20 to $4.50 as a realistic price ceiling if this move repeats.

Ay also noted that XRP’s strong price despite weak OI suggests that many short sellers might be trapped. If OI starts to climb again, those short positions could add fuel to the next leg up.

She estimates that even a 25% rise in OI sustained over several days could spark a rapid surge toward $3.5, possibly extending the rally to $4.5 once that barrier breaks. However, analysts like Blockchain Backer believe XRP’s short-term price action may be leaning bearish.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.