Key Points

-

The cryptocurrency landscape is experiencing harsh selling pressure.

-

Major players in the crypto realm such as Bitcoin, as well as more speculative altcoins like XRP, are losing their premium.

-

Despite their utility, investors are rotating capital away from XRP and crypto assets and seeking more durable opportunities.

- 10 stocks we like better than XRP ›

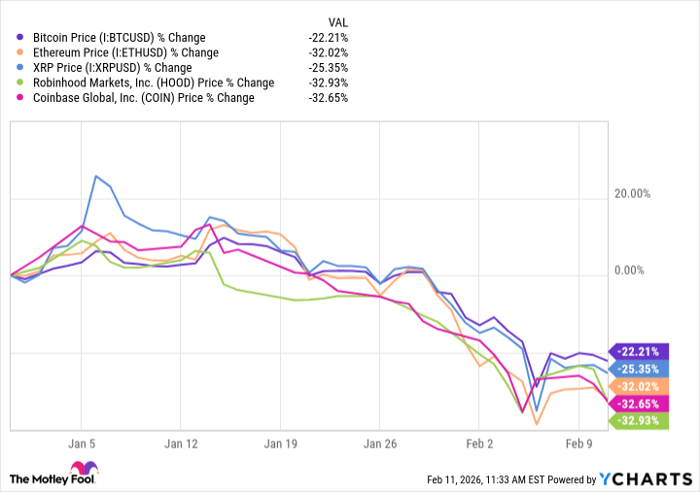

Less than two months into 2026, growth investors have been hard-pressed on where to make money. Certain pockets of the artificial intelligence (AI) realm, such as software stocks, are getting clobbered while speculative opportunities in cryptocurrency are plummeting.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Bitcoin Price data by YCharts

So far this year, XRP (CRYPTO: XRP) has cratered by 25%. Could XRP’s sell-off be an opportunity to buy the dip, or is the token headed even further south?

Why is crypto crashing?

One of the interesting aspects about the current crypto winter is that it’s taking a toll on both major assets like Bitcoin and Ethereum as well as smaller, less-established altcoins like XRP.

A major contributor to the crypto sell-off is liquidity rotation. The AI opportunity has become a bellwether for the technology, energy, and infrastructure industries. As such, many investors are opting for the upside potential of the multi-trillion dollar, multi-year AI infrastructure supercycle over more volatile opportunities in the crypto arena.

From a macro perspective, another headwind for cryptocurrency investors is rising geopolitical tensions and uncertainties around the Federal Reserve’s monetary policy decisions. Instead of holding onto digital assets, investors are beginning to flock to other alternative assets — particularly safe havens such as gold.

Image source: Getty Images.

After cratering 25%, will XRP go back up?

As of this writing (Feb. 11), XRP trades at a price of $1.35 — equating to a market capitalization of $82 billion.

XRP’s issuer, Ripple, has done a respectable job of integrating the token into its payments network. Indeed, XRP has proven it can challenge incumbent solutions such as the Society for Worldwide Interbank Financial Telecommunication (SWIFT) in the cross-border transactions market.

Here’s the problem: During periods of macroeconomic uncertainty, the idea of real-world utility — which XRP has achieved — can be overshadowed by broader liquidity flows. From an investment perspective, this means that the opportunity cost of holding onto a volatile, unpredictable asset can reach a breaking point — ultimately fueling outsize selling pressure as capital rotates into more durable, resilient vehicles.

Should XRP’s price continue to slide, it would suggest that the hype around the token’s product-market fit is insufficient to sustain a premium valuation. Instead, it looks as if investors are beginning to value XRP more like an actual fintech company — demanding consistent, measurable growth around market share progress and real-world adoption.

Given these dynamics, I think XRP’s chances of commanding a premium are rapidly diminishing. This isn’t to say that XRP will never experience robust price appreciation again. Rather, I think the most likely outcome is that XRP’s price will continue to normalize in the near term. Another way of saying it is that XRP’s price could very well continue to drop throughout the year.

By the end of 2026, I think XRP could be trading for $1 or even lower. At that point, it could make sense to buy the dip so long as you treat a position in XRP like a utility or infrastructure play, rather than a speculative token you’re hoping to turn into a multibagger.

Should you buy stock in XRP right now?

Before you buy stock in XRP, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and XRP wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $414,554!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,120,663!*

Now, it’s worth noting Stock Advisor’s total average return is 884% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 15, 2026.

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin, Ethereum, and XRP. The Motley Fool recommends Coinbase Global. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.