SEI price traded near $0.31 early on Sept. 16 after retreating from its recent local peak above $0.357, which it had previously reached on Sept. 13. The token had still held higher lows since early July, signaling that buyers had stayed active despite short-term pullbacks. Momentum has cooled but remains intact, keeping focus on broader structural drivers.

Meanwhile, Messari’s Q2 report showed SEI price up 63.5% quarter-on-quarter, market cap climbing 86%, and staking yields turning positive. DeFi TVL hit record highs, stablecoin supply expanded, and daily active addresses surged.

Fundamentals Strengthen as On-Chain Growth and Liquidity Align

Messari’s report highlighted that SEI’s on-chain activity matched its market rebound, providing depth to the recent price structure.

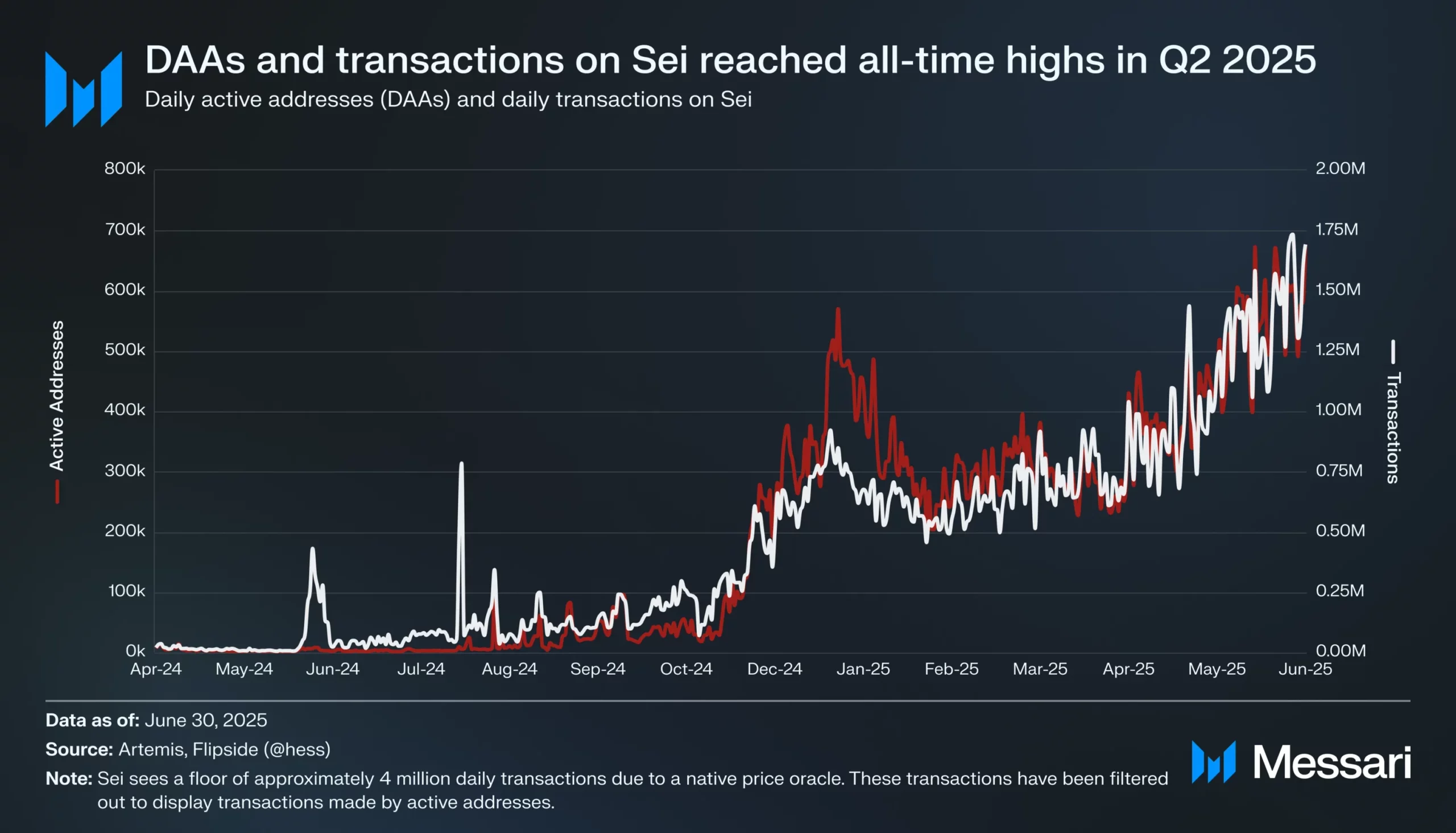

Daily active addresses climbed 36.6% in Q2 to 426,000, while transactions rose 12.6% to 720,300. That growth suggested that user demand strengthened alongside speculative interest, creating a firmer base for the rally. The pattern helped explain why SEI held higher lows even when price momentum cooled on the daily chart.

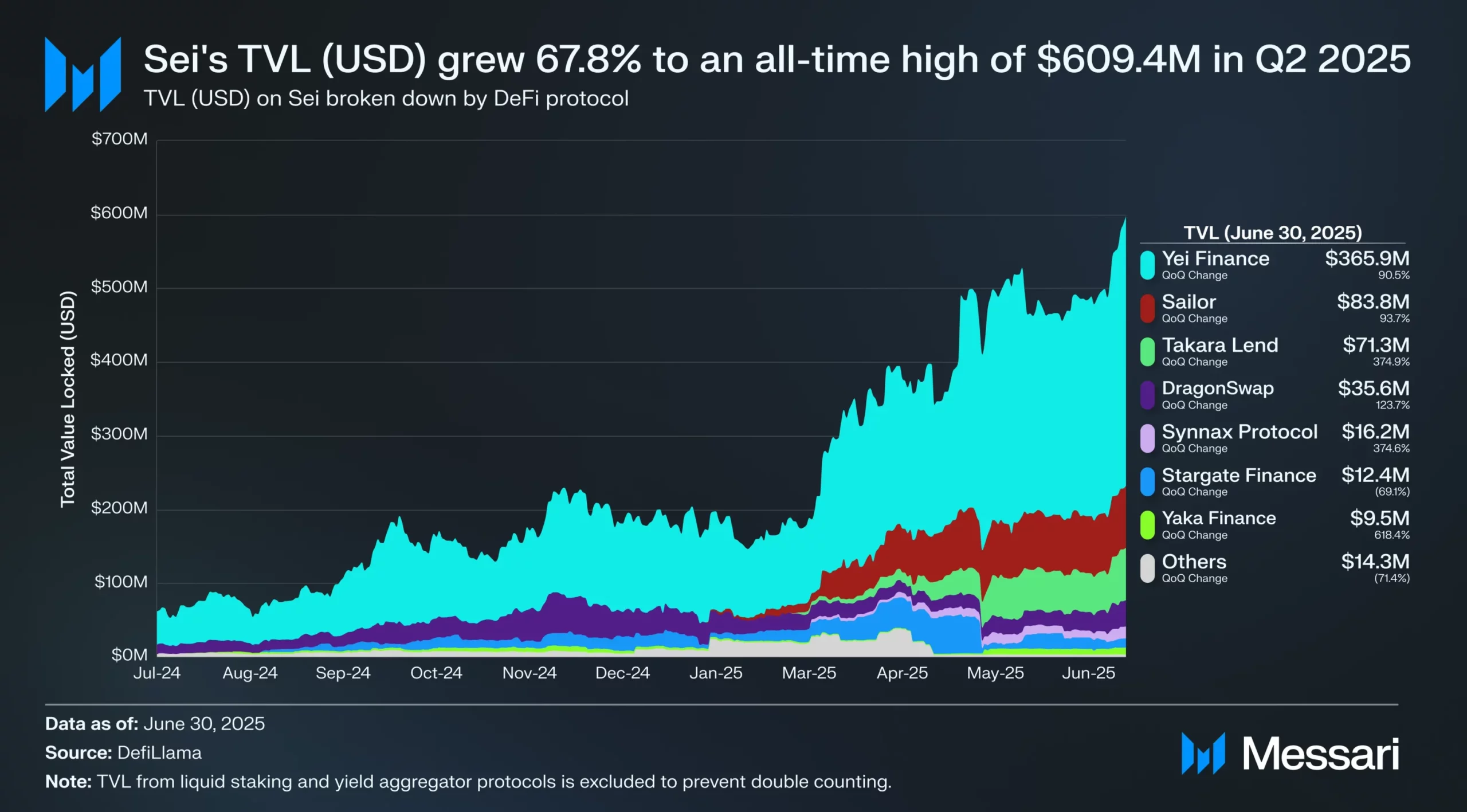

Liquidity also improved across DeFi. Total value locked surged nearly 68% to $609.4 million, setting a new high for the network. Stablecoin’s supply reached $276.8 million, which was led by Circle’s USDC expansion. The rise in stablecoin liquidity added credibility to SEI’s lending and trading markets, giving users more reliable instruments to move capital.

With Yei Finance and Takara Lend both gaining traction, borrowing activity is concentrated in protocols that already showed strong retention.

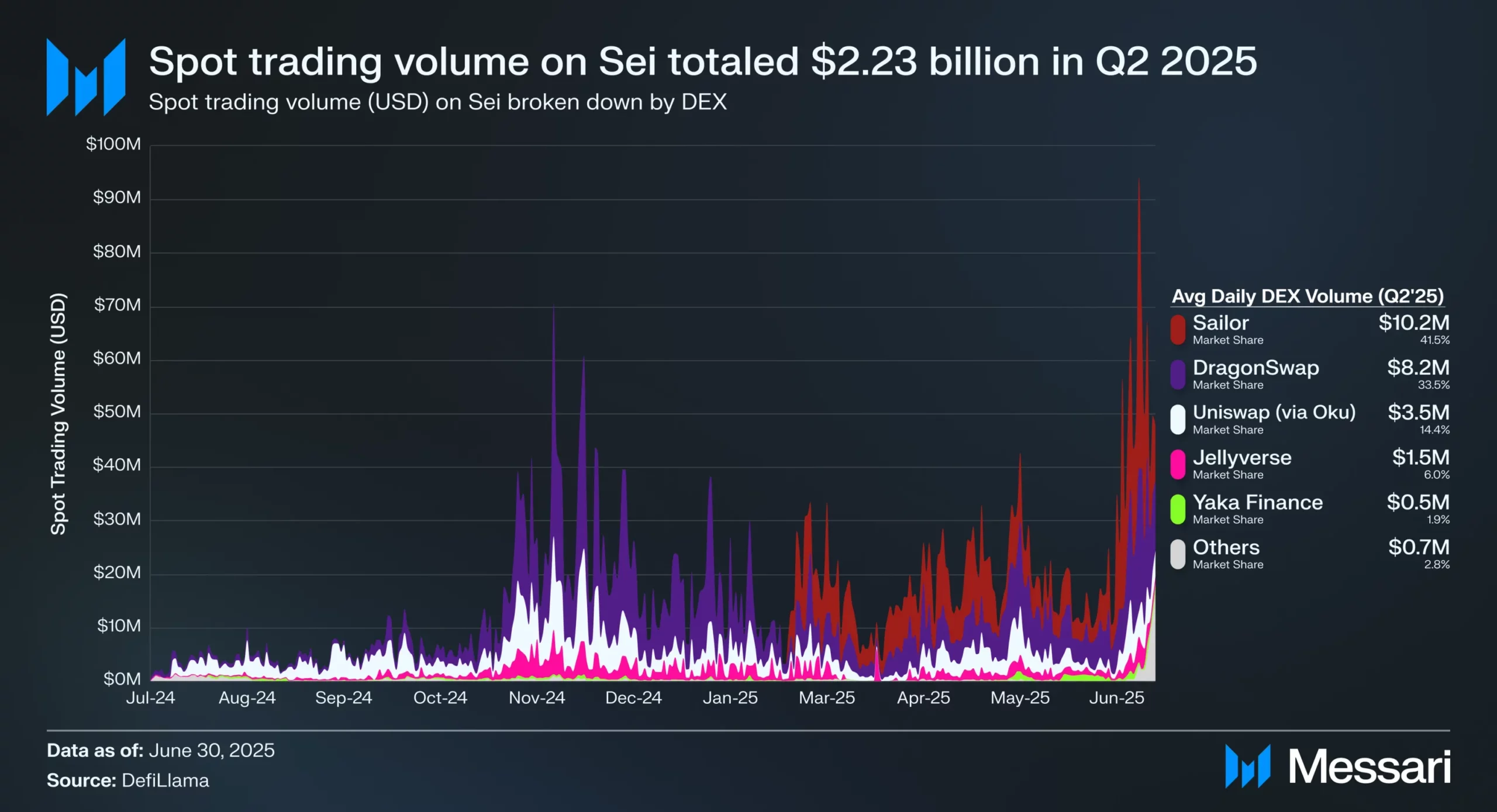

DEX activity provided another layer of validation. Average daily volumes reached $24.6 million, a 52.6% increase from the previous quarter. Sailor and DragonSwap led the surge, introducing their DRG token in July. Those developments are tied neatly to the broader liquidity story, reinforcing how token incentives and stablecoin growth worked together to support higher turnover.

The token economy also showed signs of structural strength. SEI’s monthly vesting rate was set to decline in Aug. 2025, halving potential supply pressure. At the same time, stakers recorded a positive real yield of 0.6% for the first time. That combination of slower unlocks and better staking rewards provided a bullish counterweight to the short-term volatility visible on charts.

Together, these elements showed that SEI’s latest rebound was rooted in more than just speculative swings and instead reflected improving fundamentals across the network.

Analysts See SEI Primed for Breakout After Messari’s Strong Q2 Highlights

The upbeat signals from Messari’s Q2 report carried into market sentiment, where analysts framed SEI’s structure as primed for another move.

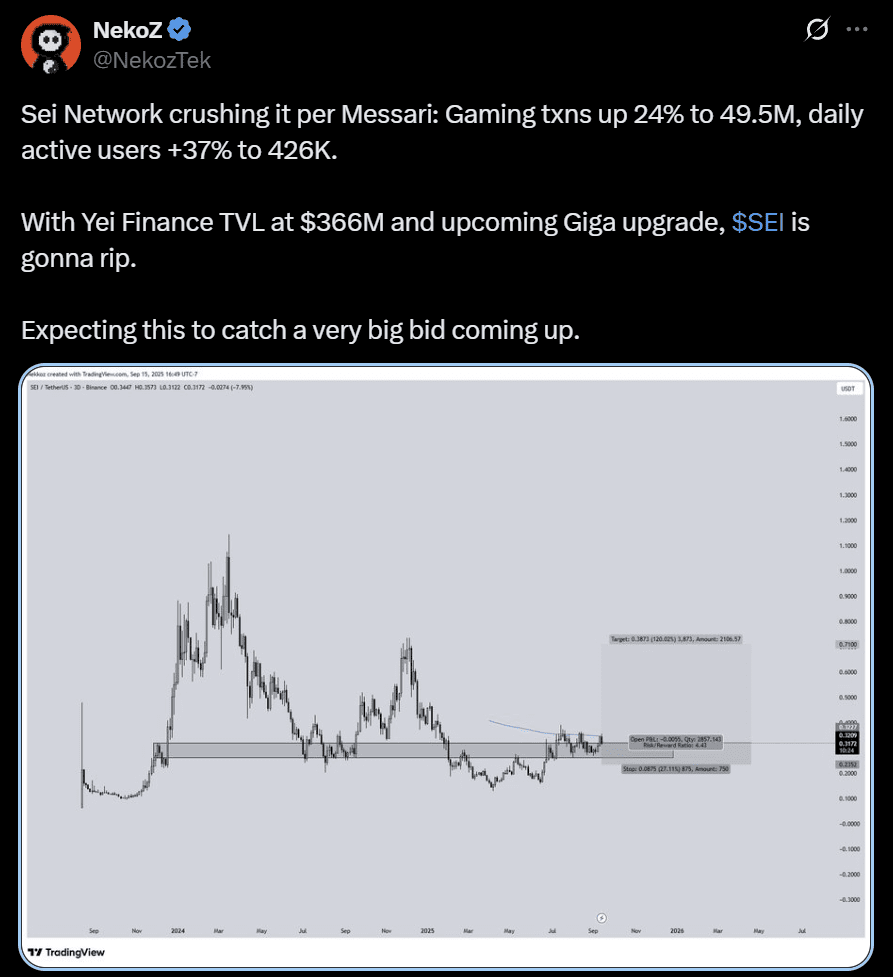

NekoZ tied his outlook directly to the report, pointing out gaming transactions up 24% to 49.5 million and daily active users rising 37% to 426,000. He highlighted Yei Finance’s $366 million TVL and the incoming Giga upgrade as reasons buyers should step in. The analyst’s chart placed the SEI USD pair’s near-term target around the $0.38 zone, reflecting a continuation of the higher-lows structure already visible on daily charts.

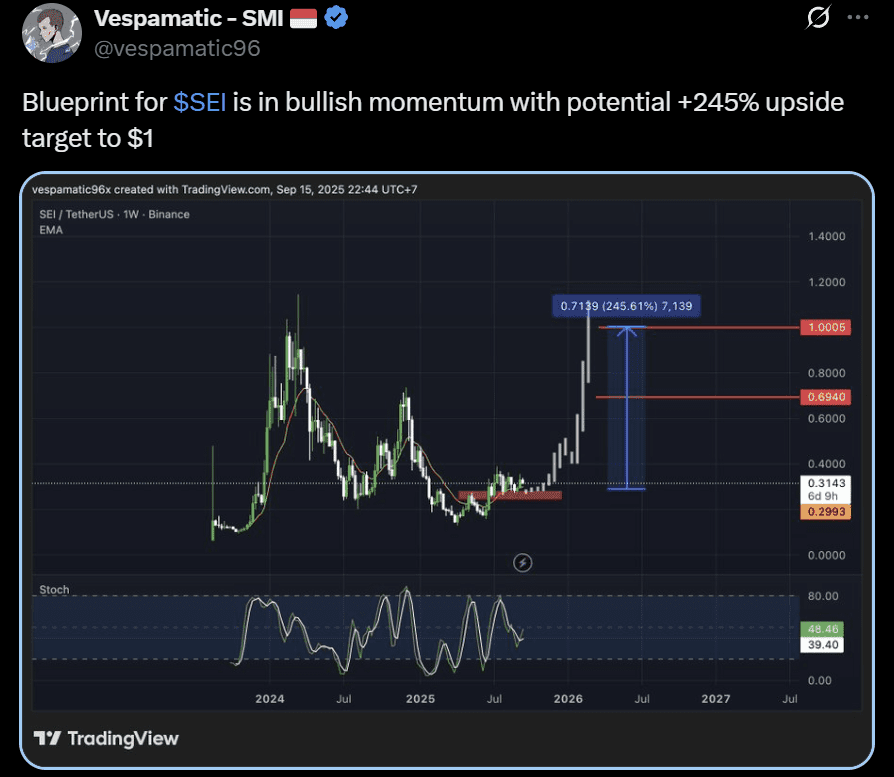

Other analysts echoed the optimism with more ambitious targets. Vespamatic’s weekly chart framed SEI in bullish momentum and projected a path toward $1, representing a “potential 245% upside”. He based his case on consolidation at current levels, the rebound in activity, and a favorable stochastic setup.

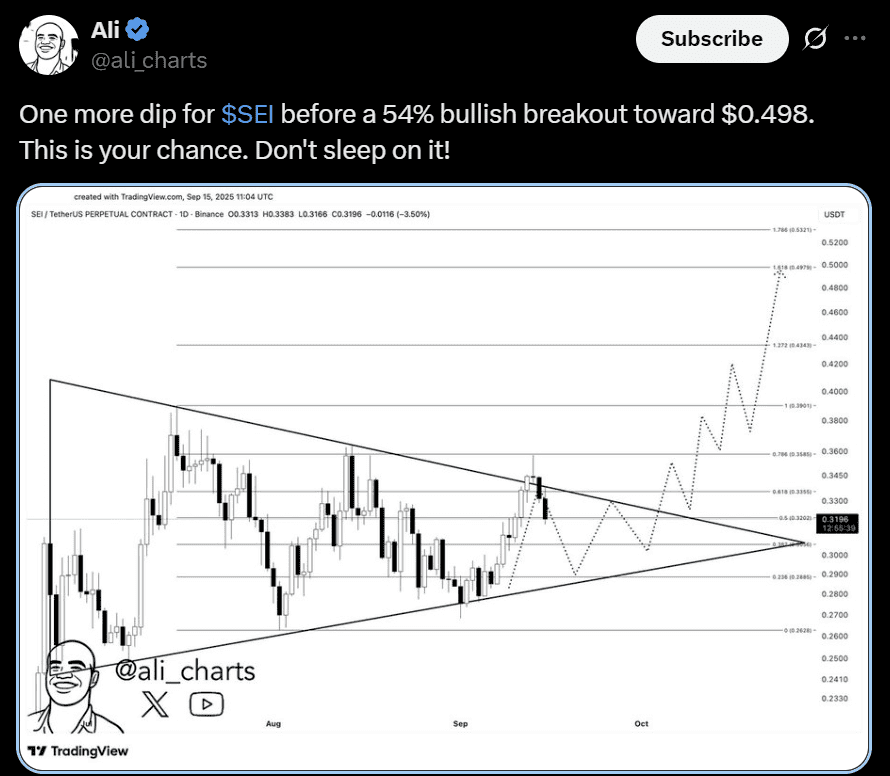

Analyst Ali also stressed the same bullish undertone, but identified a shorter horizon. He mapped a symmetrical triangle that he said could resolve higher, suggesting a move toward $0.50 after one more dip. His Fibonacci extensions aligned with incremental targets at $0.42 and $0.44 before a push toward the upper range.

Together, these calls tied technical structures to the same on-chain growth that Messari underscored. The overlap between stronger fundamentals and aligned technical setups created a coherent bullish picture. While SEI token price still faced resistance overhead, the convergence of improving network health and confident market sentiment suggested that the token had room to extend its recovery if momentum were to hold steady.