- The Bitcoin price prolongs its narrow consolidation around $68,000 to recoup its exhausted bearish momentum.

- In the daily time frame chart, the falling channel pattern drives a steady mid-term trend in BTC.

- Recent LTH-NUPL readings between 0.39 and 0.41 show long-term holders are still sitting on profits overall.

The Bitcoin price plunged 1.14% during Monday’s U.S. to trade at $67,981. The possible reason for this downtick can be investors’ reactions to regulation delays on the CLARITY Act, and intact overhead supply at $70,000. While BTC has remained sideways for the past two weeks, the below mentioned latest on-chain data shows the coin price is far from its bottom formation. Will pioneer cryptocurrency lose $60,000 floor?

LTH-NUPL May Define the Next Market Bottom

Over the past four months, the Bitcoin price has tumbled from all-time high of $126,272 to the current trading of $68,424. The coin price faces an intact supply pressure at $70,000 mark, the market observers expected a continued correction ahead.

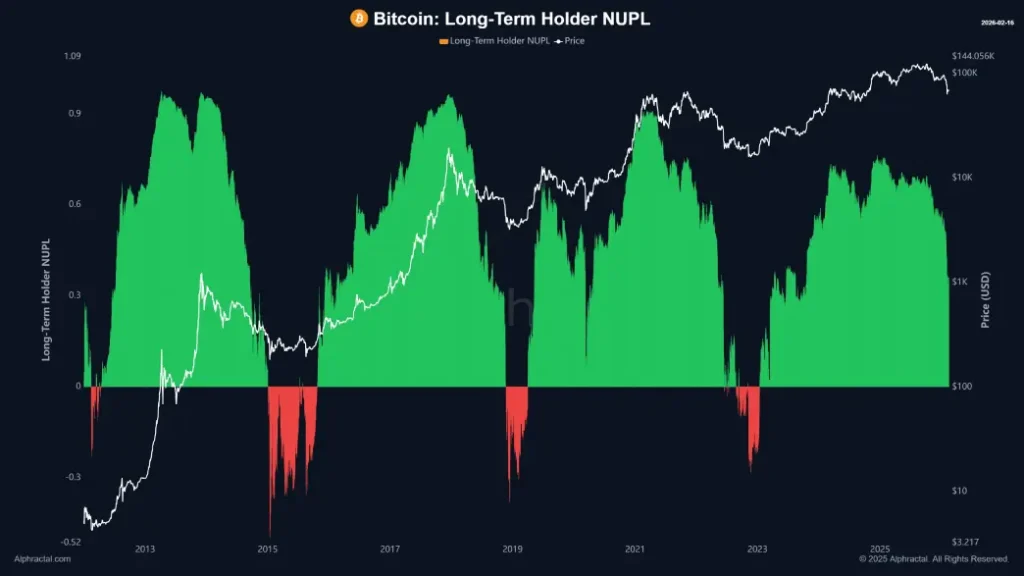

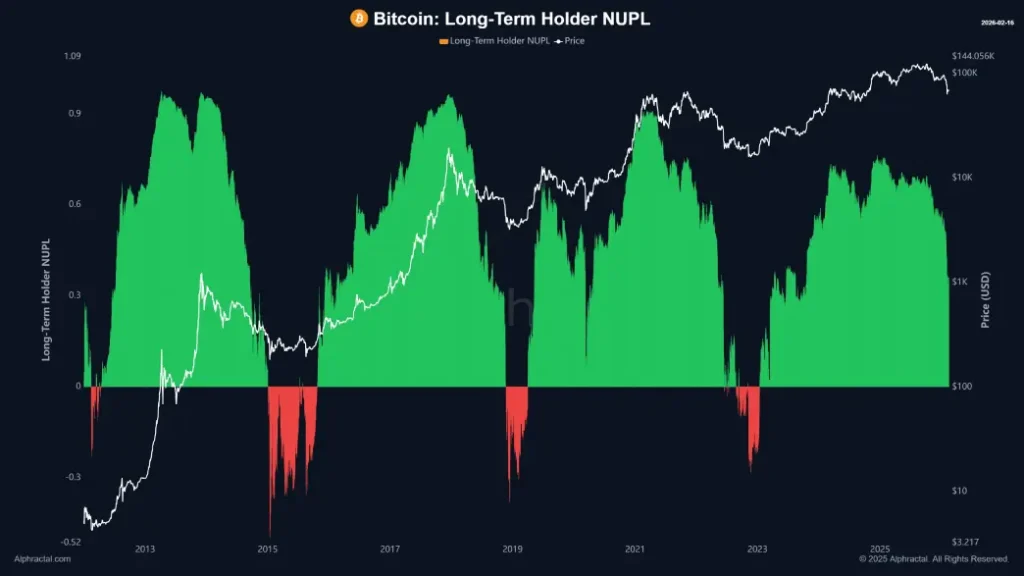

As the key questions arise among Bitcoiners of potential bottom, analysts point to the Long-Term Holder Net Unrealized Profit/Loss (LTH-NUPL) metric as a key indicator of cycle shifts. This indicator measures the average unrealized gain or loss of the coins held for more than 155 days, which reflects the position of committed investors.

As mentioned above, recent numbers put the LTH-NUPL somewhere in the region of 0.39 to 0.41, which means that these holders are still in positive territory overall. The metric helps to understand the distance between current prices and the mean acquisition cost for this group.

Historical patterns have indicated that shifts into negative values, which see unrealized losses figure prominently for long-term participants, have preceded big reversals. In previous cycles, such dips coincided with periods of general capitulation, weaker selling pressure and eventual accumulation that fueled subsequent uptrends.

Analyzing the below chart shows that the LTH-NUPL metric could witness a dive to the negative region once BTC drops below $41,000 . This level would be a major pull-up from recent trading areas, and so a possible exhaustion level for weaker hands.

Bitcoin Price Wavers In a Narrow Range If Next Breakdown

For the past two weeks, the Bitcoin price has been wavering around the $68,000 mark. This consolidation, created with short-body candle and notable wicks on either side indicate lack of initiation from buyers or sellers to drive a sustained price movement.

Interestingly, the entire lateral trend is developed within the range of the February 5th candle, with its high and low at $73,430 and $62,200 respectively. Currently, this sideways trend offers a temporary halt for sellers to recoup their bearish momentum.

If the sellers’ pressure persists, the Bitcoin price could breach the bottom support of $62,200. The potential breakdown. The post-breakdown fall could push the price another 11% to retest a long coming support trendline at $55,130.

Since December 2022, this trendline has acted as a major accumulation point for buyers to renew the recovery trendline. A bullish reversal or downside breakdown could significantly influence the upcoming trajectory of BTC.

Also Read: Harvard Management Co Trims BlackRock Bitcoin ETF Holdings, Bets on Ethereum