U.S.-listed crypto ETFs are flashing red across the board, with one notable exception.

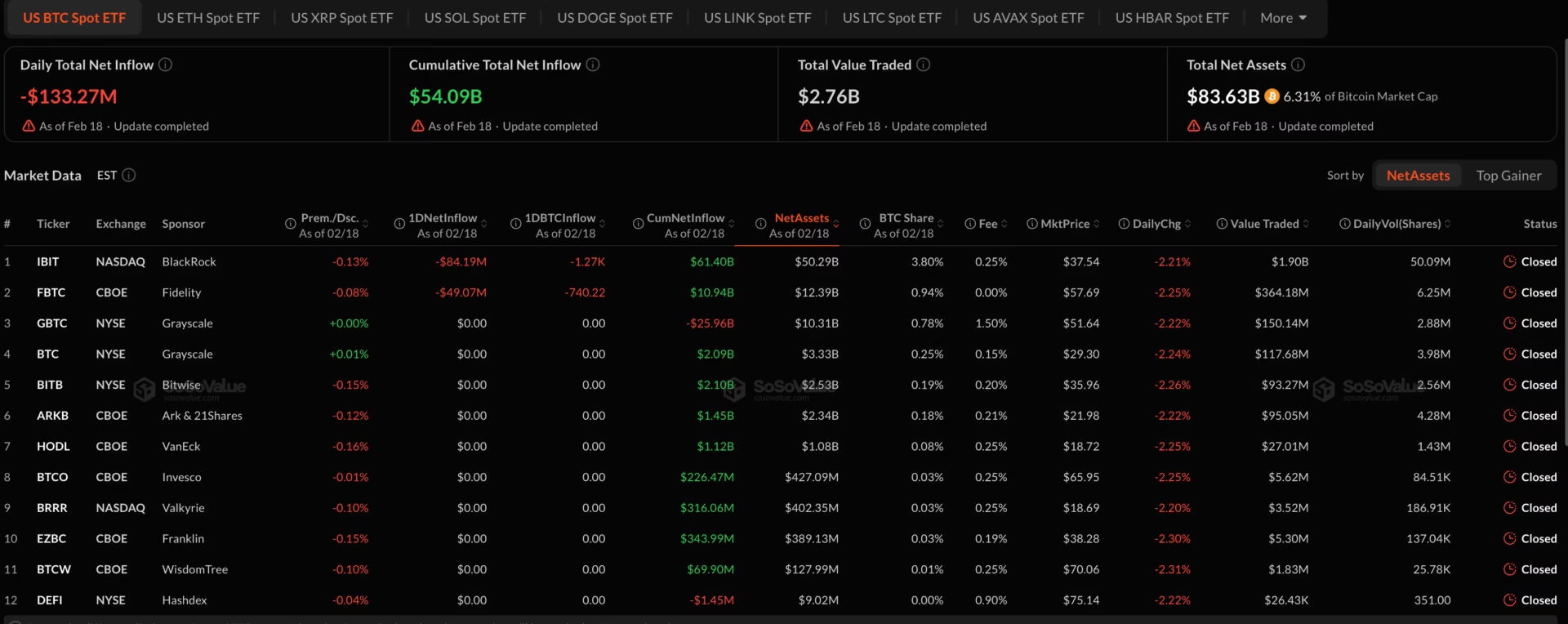

Bitcoin spot ETFs saw $133.3 million in daily net outflows as of Feb. 18, led by BlackRock’s IBIT, which shed $84.2 million, and Fidelity’s FBTC, which lost $49 million. Total net assets across bitcoin funds stand at $83.6 billion, roughly 6.3% of bitcoin’s market cap, but recent flows suggest institutions are trimming exposure rather than adding on dips.

Ethereum products followed a similar pattern. U.S. ETH spot ETFs recorded $41.8 million in net outflows on the day, with BlackRock’s ETHA losing nearly $30 million. Total net assets across ether funds sit at $11.1 billion, about 4.8% of ETH’s market cap.

The steady bleed comes as ether trades below $2,000 and struggles to build momentum despite broader expectations of rate cuts later this year.

XRP ETFs also slipped into negative territory, posting $2.2 million in daily outflows. Total net assets across XRP funds are just over $1 billion, or roughly 1.2% of XRP’s market cap. Price action in XRP has mirrored the cautious tone, with the token down over 4% on the day.

Solana, however, stood out.

U.S. SOL spot ETFs recorded $2.4 million in net inflows, pushing cumulative inflows to nearly $880 million. Bitwise’s BSOL led with $1.5 million in fresh capital. While modest in absolute terms, the inflow contrasts sharply with the broader risk-off positioning across bitcoin and ether products.

Elsewhere, smaller altcoin ETFs such as LINK saw marginal inflows, but the overall picture remains one of selective exposure rather than broad-based accumulation.

The divergence suggests investors are rotating within crypto rather than exiting entirely. With macroeconomic uncertainty lingering and the dollar firming, ETF flows offer a real-time read on where institutional conviction remains and where it is fading.