Key takeaways

-

Polymarket’s federal lawsuit against Massachusetts could determine whether prediction markets are regulated solely by the CFTC or also by states.

-

The dispute centers on whether event contracts qualify as financial derivatives under the Commodity Exchange Act or as gambling under state laws.

-

The lawsuit followed state-level actions against platforms like Kalshi, with Massachusetts and Nevada moving to restrict sports-related prediction contracts.

-

A ruling in favor of Polymarket could establish uniform national oversight and prevent a patchwork of differing state regulations.

Prediction markets are platforms where people trade contracts based on the outcomes of future events. Recently, they have been in the news due to a major legal battle in the US over regulatory authority. Central to the dispute is Polymarket’s federal lawsuit against Massachusetts. The outcome of this case could determine whether these markets are regulated exclusively at the federal level or whether states can also enforce their own rules.

This article explores Polymarket’s federal lawsuit against Massachusetts. It examines the broader legal clash over whether prediction markets fall under the exclusive authority of the US Commodity Futures Trading Commission (CFTC) or under state gambling laws. It also analyzes how the case could reshape regulatory control, market access and the future of US event-based trading platforms.

A federal lawsuit with broad implications

In February 2026, Polymarket filed suit in the US District Court for the District of Massachusetts to preempt enforcement by state regulators that would require it to comply with Massachusetts gambling laws. The company contends that Congress has granted exclusive authority over “event contracts,” the core products of prediction markets, to the CFTC. According to Polymarket, this renders state efforts to stop or limit its operations unlawful.

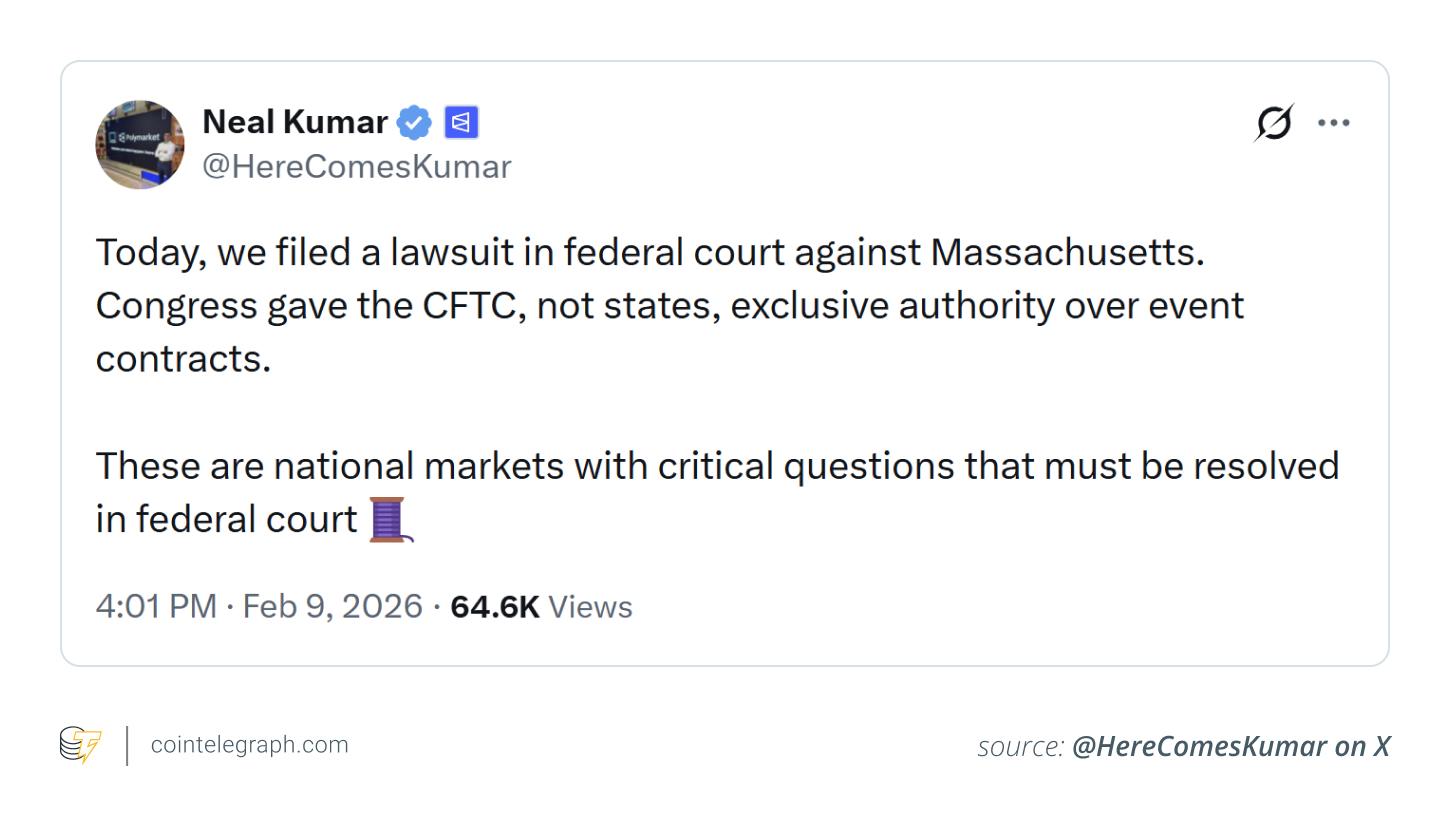

Polymarket chief legal officer Neal Kumar argues that the dispute involves national markets and that the relevant legal questions should therefore be resolved in federal court. The company opposes piecemeal enforcement by individual states. He said that restricting markets could hinder industry development.

Where it all started: State actions against Kalshi

The lawsuit’s timing was deliberate. It came shortly after Massachusetts courts acted against rival platform Kalshi, blocking sports-related contracts under state gambling laws. A judge upheld a preliminary injunction requiring Kalshi to prevent residents from accessing certain markets without a gaming license. The court directed that these markets be treated as unlicensed sports wagers.

Massachusetts’ approach to prediction markets has received support from similar state-level actions elsewhere. In Nevada, regulators obtained a temporary restraining order against Polymarket’s sports-related offerings, arguing that they violated the state’s sports betting regulatory framework.

Did you know? Corporations have used prediction markets to forecast product launches and internal project deadlines. Some companies quietly rely on employee-based markets because aggregated crowd opinions often outperform traditional executive forecasts.

What is at stake: Federal vs. state authority

The lawsuit centers on a jurisdictional dispute. Polymarket claims its event contracts, whether covering elections, economics or sports, are financial derivatives under the CFTC’s Commodity Exchange Act. In this view, federal law supersedes state gambling statutes, preventing states from independently banning or regulating these markets.

Massachusetts and other states argue that when prediction markets resemble gambling, particularly in the context of sports, they must comply with state gambling frameworks to safeguard consumers and maintain local licensing and age requirements.

If federal courts side with Polymarket, it could strengthen the case for uniform national oversight, preventing a “patchwork” of varying state-level rules or prohibitions. Conversely, upholding state authority would allow states to apply their own gambling laws to platforms operating nationwide.

Did you know? Prediction markets sometimes rival opinion polls in forecasting election outcomes. Universities have studied them for decades as tools for measuring collective intelligence and information efficiency.

Why Polymarket’s lawsuit matters

Prediction markets have experienced growth, with rising trading volumes and visibility. Data tracked by Dune showed that prediction markets recorded about $3.7 billion in trading volume in a single week in January 2026, an all-time high.

As platforms like Polymarket and Kalshi gain mainstream traction, states are pushing to apply protections comparable to those governing traditional gambling. This dynamic has prompted action by multiple states.

The CFTC’s stance has added complexity to the issue. While the federal agency has long regulated derivatives markets, including certain event contracts, it has faced pressure to stay out of specific disputes or to restrict prediction contracts involving war or terrorism.

Did you know? Prediction markets are structured using blockchain smart contracts, automatically settling trades once an outcome is verified. This automation reduces counterparty risk but raises new regulatory and oracle-related challenges.

How jurisdictional disputes are reshaping event contracts

Polymarket’s legal action represents just one element of the broader legal and regulatory disputes surrounding prediction markets across the United States. Courts in jurisdictions such as Massachusetts and Nevada are currently examining the limits of state authority, while federal officials and legislators deliberate over comprehensive guidelines. The outcomes of these proceedings will likely influence how companies structure and offer event contracts.

Whether courts ultimately uphold Polymarket’s federal argument or affirm state authority, the decision will have long-lasting implications for the growth of prediction markets. It will shape user access to these platforms and the balance regulators strike between innovation and consumer protection.

Cointelegraph maintains full editorial independence. The selection, commissioning and publication of Features and Magazine content are not influenced by advertisers, partners or commercial relationships.