- Bitcoin price consolidation gives a bearish breakdown from the support of inverted pennant pattern, setting a stage for $55,000 BTC value in near term.

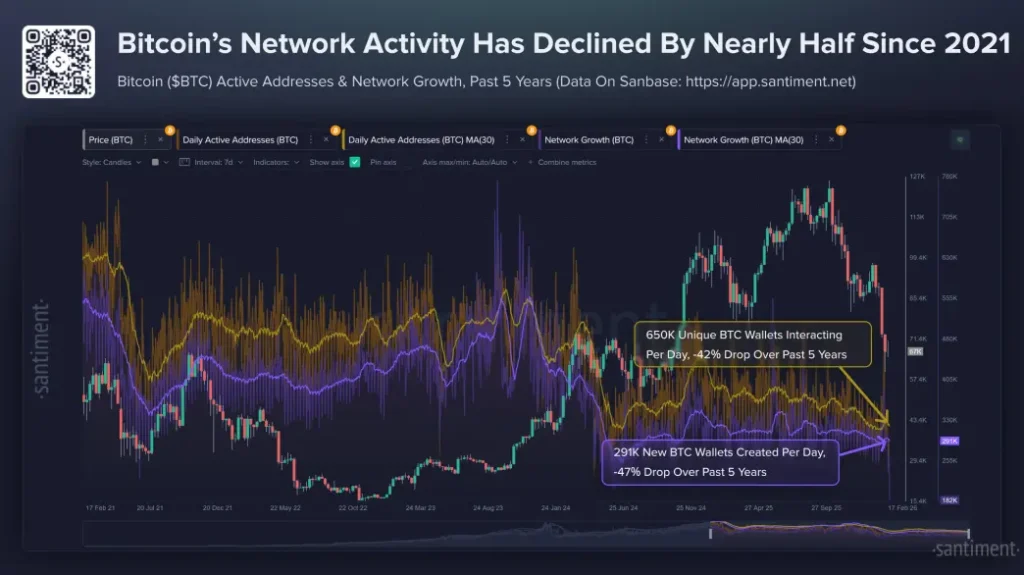

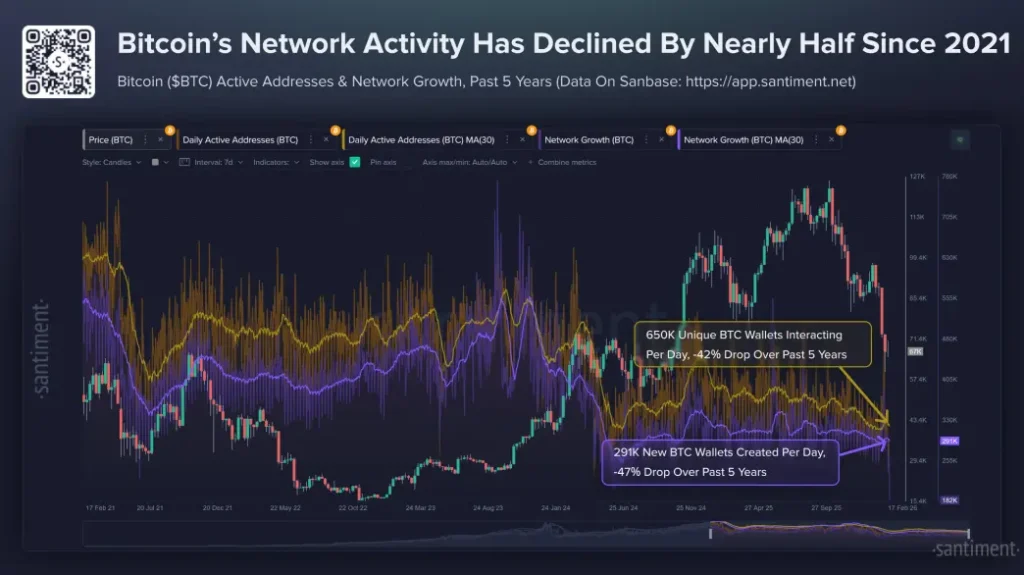

- BTC daily active addresses have declined by nearly 42% since February 2021.

- According to coinglass data, over $232.00 million were liquidated from the crypto market in the last 24-hours.

The crypto market slipped further on Wednesday, February 18th, as geopolitical tension and macroeconomic uncertainty triggered a risk off sentiment. The pioneer cryptocurrency, BTC, plunged roughly 2% in the last 24-hours to currently trade at $66,238. The falling Bitcoin price sparks a bearish breakdown from the key support of the bearish pennant pattern, suggesting a risk of continued correction in the market. The declining network activity further accentuates that the coin price is far from establishing a stable bottom support.

On Chain Data Signals Cooling Retail Participation Since 2021

Bitcoin’s on-chain data shows a significant multi-year decline in direct network usage. Since February 2021, nearly 42% less unique addresses are active in the daily transactions. New address creation, a measure of fresh user onboarding, has dropped even more, by about 47% in the five-year period.

According to Sanitment’s data, the unique BTC wallet addresses has dropped to 650,000, a significant decline from the high recorded in previous market cycle. In addition, the newly created BTC basis has tumbled to 291k.

This steady decline in on-chain participation is happening on the backdrop of fluctuations in Bitcoin’s price, and a change in its market capitalization throughout 2025 and into early 2026. Transactional volumes and user engagement are still much lower than those in the highs of 2021 when daily active addresses topped one million on a regular basis amid broader adoption spikes.

Such trends point to declining everyday utility and lower grassroots activity on the Bitcoin network, which may be an indication of problems for continued organic growth unless such trends are reversed.

A meaningful recovery in these metrics – an increase in active addresses and a speedy network expansion – would likely be necessary to support stronger, longer-term price momentum and broader ecosystem revival.

Bitcoin Price Completes Bear Pennant Pattern

Currently, the Bitcoin price is down 1.76% to reach a trading value of $66,309. The selling pressure can be attributed to the escalating conflict between the U.S. and Iran and the Department of Homeland Security remaining partially shut down.

An analysis of the 4-hour time frame chart shows that the falling BTC price gave a decisive breakdown from the support trendline of a bearish pennant pattern. The chart setup developed during the last two weeks of consolidation when price resonated within two converging trendlines.

The downsloping trendline 20, 50, 100, and 200 EMA of the 4-hour chart shows the mid-term trend is strongly bearish.

The prior downtrend before this sideways trend indicates that the recent movement bolstered sellers to recoup prevailing bearish momentum. If the breakdown sustains, the Bitcoin price would plunge roughly 17% and test the bottom trendline of a channel pattern.

Since August 2025, the BTC price has been resonating within two parallel-walking trendlines of a channel pattern, offering trades a dynamic resistance and support. For buyers to renew recovery momentum in this asset, an upside breakout from the channel’s resistance trendline is needed.

Also Read: Dragonfly Capital Closes $650M Fourth Fund Amid Slow Venture Trends