Key Insights:

- In the latest Bitcoin news, the investors are awaiting a likely Fed rate cut today and preparing for fresh liquidity.

- Arthur Hayes says the Federal Reserve is ready to do more than just a rate cut and predicted BTC price to hit $1 million.

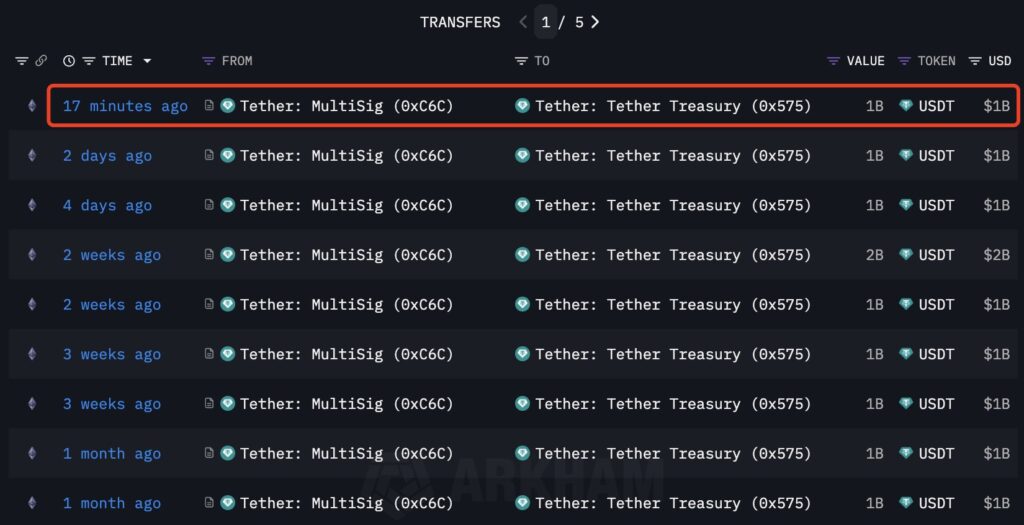

- Tether minted $1BN USDT, new whales are accumulating BTC, and there is a record $7.5T in money market funds waiting to move.

In the latest Bitcoin news, Arthur Hayes drops his latest BTC price prediction, sparking market discussions.

The former BitMEX CEO isn’t interested in polite forecasts, nor is he one to shy away from seemingly outlandish calls. Today, Hayes isn’t just bullish. He’s calling for a $1 million Bitcoin.

Fed rate cuts are possibly coming, liquidity is flowing, institutions are circling, and the Federal Reserve looks ready to rewrite the rules. Is this what sets the Bitcoin price loose?

Bitcoin News: The $1 Million BTC Setup

The mood in the crypto market is unmistakable. With a rate cut from the Fed all but assured, traders are positioning themselves for a sudden injection of fresh liquidity.

The evidence is everywhere, especially with Bitcoin price holding the $116k support.

Meanwhile, the world’s largest stablecoin issuer, Tether, minted another $1 billion USDT overnight. That’s not just routine housekeeping, it’s rocket fuel.

Dollar-pegged liquidity standing by to flood crypto exchanges the moment the music starts.

Meanwhile, money market funds in the US have swelled to $7.5 trillion, a mountain of cash waiting for an excuse to seek risk again.

Historically, this pile is passive, parked in short-term bonds for safety. But with interest rates coming down, inflation quite slain, and headlines shouting about whale moves in Bitcoin, investors are growing restless.

More Players Enter the Bitcoin Market

A newly created wallet gobbled up 5,817 Bitcoin from exchanges (over $680 million at current prices). That’s not retail.

That’s an institution, or a whale with hedge fund ambitions. Leading analysts like Crypto Rover flagged the transaction almost instantly.

Are we witnessing the beginning of another MicroStrategy moment? Perhaps. What’s certain is that big money isn’t scared off by September’s usual volatility.

In fact, they’re using the chop to build positions.

Smart money moves quietly. It doesn’t chase green candles.

Large transactions, Bitcoin ETF accumulation patterns, and OTC deals are signs. Each reveals a new chapter in the ongoing surge in Bitcoin price.

Market structure is changing. Retail is yielding ground to institutions with longer timeframes and deeper pockets. Could a $1 million BTC price be on the cards?

Fed’s Third Mandate: Yield Curve Control

Arthur Hayes’ eye isn’t just on current Bitcoin price action. He’s warning of something bigger.

Forget the Fed rate cut for a moment. The Federal Reserve is preparing for a “third mandate,” Yield Curve Control (YCC).

This is uncharted territory. Think of it as rate cuts on steroids.

In traditional monetary policy, the Fed sets overnight lending rates and hopes the market plays along.

Yield Curve Control goes further. The Fed sets explicit targets on long-term interest rates, then buys enough government bonds to force those rates below its threshold.

The result: borrowing costs in the economy are held down by brute force, no matter what the bond market thinks.

The floodgates open. Liquidity surges beyond anything quantitative easing (QE) achieved. Risk assets, stocks, Bitcoin, and even gold, respond with explosive moves.

When will it happen? Hayes is betting that pressure will build until something breaks.

Too much debt, too few buyers, and a fiscal reality impossible to ignore. When the Fed blinks and hits the “YCC” button, it’s game over for dollar-based assets and game on for BTC price.

From Doom Loop to Moon Shot

Arthur Hayes isn’t alone. Macro analysts are poring over the data, watching Treasury yields rise, and wondering how long before the Fed snaps.

The latest “doom loop” thesis goes like this: As inflation persists and deficits balloon, central banks are forced to print.

With fewer takers for debt (especially at negative real rates), the only buyer left is the Fed itself. YCC arrives not by choice but by necessity.

Hayes says that’s the trigger for $1 million Bitcoin. As governments dilute currency value and capital controls intensify, digital bearer assets like BTC price and gold will rally to levels once deemed impossible.

The Next Chapter in Bitcoin News: What to Watch

Is another institution quietly filling its Bitcoin coffers right now? On-chain Bitcoin news data says yes.

Whale wallets grow, exchange reserves fall. Each new round of Fed policy drama brings more volatility, and the rallies get stronger.

Money market funds may look sleepy for now, but don’t expect them to snooze much longer.

And when Tether mints billions, it’s time to keep an eye on crypto liquidity and BTC price. In the words of Hayes, “LFG.”