Arthur Hayes, co-founder of BitMEX and current head of investment firm Maelstrom, sold his entire Hyperliquid (HYPE) tokens this week. The tokens were worth around $5.1 million at the time of the sale. He booked a profit of nearly $823,000, or about 19%, in just over a month of holding. On-chain data confirmed the sale, with blockchain trackers showing Hayes’ wallet offloading the 96,628 HYPE tokens.

Hayes announced on X that he made the move to fund a deposit for a Ferrari 849 Testarossa. The remark quickly went viral, as it contrasted with his earlier public statements about HYPE’s long-term potential.

Hayes Made 126× Call Before $5M Exit

Only weeks before the sale, Hayes had made a highly bullish call at the WebX 2025 conference in Tokyo. He argued that Hyperliquid’s derivatives exchange could capture massive volumes as stablecoin use expands and DeFi grows. Based on that thesis, he suggested that HYPE’s price could rise 126× over the next three years.

By selling so quickly after making such a bold prediction, Hayes fueled suspicion that his public optimism was meant to create confidence while he prepared to exit.

You May Also Like: Is Arthur Hayes Really a Memecoin Shiller?

Hyperliquid faces a large supply event starting November 29, 2025. Around 237.8 million HYPE tokens will begin to unlock over 24 months. At current prices, this represents about $11.9 billion in supply, or roughly $500 million each month entering circulation.

Even Hayes’ own fund, Maelstrom, has warned that this schedule is a “Sword of Damocles” hanging over HYPE. Estimates suggest buybacks and treasury mechanisms could absorb only 17% of the monthly flow, leaving about $410 million per month exposed to potential selling. Even if all tokens are not immediately dumped, the perception of massive supply is enough to pressure sentiment.

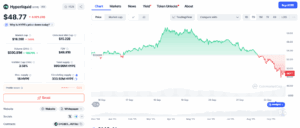

Following Hayes’ disclosure, HYPE’s price fell 8%, dropping to $48.77. HYPE had rallied more than 660% since launch, rising from ~$6.50 to near $50 before Hayes’ exit. That steep appreciation gave early holders like Hayes ample room to profit.

Traders accused Hayes of making an outsized bullish forecast to encourage confidence before quietly selling HYPE at higher prices. Some accused Hayes of acting “like a pump.fun rugger,” claiming he had promoted a bullish forecast to boost confidence only to sell into strength. Others said the sale showed a recurring pattern of hyping projects and then exiting at the first rally, behavior they argued damages trust in an industry already battling credibility issues. Many other called Hayes’ Ferrari remark a slap in the face for retail investors who believed his 126× outlook.