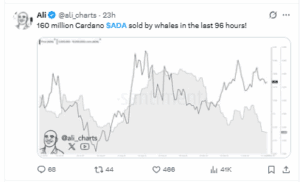

Cardano (ADA) faced renewed pressure this week as whales sold 160 million tokens in just four days. At prices near $0.90, the exits amount to more than $140 million. Whales control a large share of supply, and such concentrated selling often weighs on short-term price action. The selloff followed ADA’s 120% rally from $0.40 in June to nearly $1 in September, suggesting that large holders are realizing profits after strong gains.

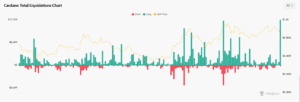

$18M in Liquidations Show Bullish Traders Hit Hard

The pressure extended to derivatives markets. Data from Coinglass showed $18.1 million in liquidations over the past 24 hours, including $17.6 million in long positions and just $488,000 in shorts. In the last 12 hours alone, $15.5 million worth of long positions were closed as ADA price moved lower.

Liquidations occur when traders borrow funds to increase their exposure and the market moves against them, forcing positions to close. The imbalance toward long liquidations highlights that bullish traders absorbed the steepest losses during ADA’s pullback. While such wipeouts can intensify short-term selling, they also remove excess leverage, sometimes allowing markets to stabilize once weaker positions are cleared.

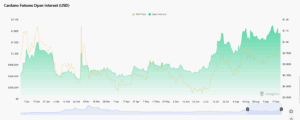

Despite whale selling and long liquidations, Cardano’s futures activity has remained elevated. Open interest in ADA futures climbed back above $1 billion, a level last seen in March.

Open interest measures the total value of outstanding futures contracts, and higher levels indicate greater speculative activity. This shows that while whales are reducing spot holdings, smaller traders and speculators are continuing to add leveraged positions. The divergence between whale selling and futures inflows raises the risk of heightened volatility if either side of the market fails to absorb pressure.

ADA Tests $0.80 Support as Momentum Weakens

The daily ADA/USD chart shows momentum shifting in favor of sellers. ADA has slipped below both its 20-day exponential moving average (EMA) at $0.85 and its 50-day EMA at $0.84. EMAs track short-term price trends, and falling beneath them signals that buyers are losing control of momentum.

The Relative Strength Index (RSI) has cooled to 42, down from levels near 60 earlier this month. RSI measures buying versus selling strength, with values above 70 considered overbought and below 30 oversold. At 42, ADA reflects weakening demand but is not yet at oversold levels.

Cardano price action is testing support around $0.82, the lower boundary of the ascending channel that has guided ADA’s rally since June. A decisive drop below $0.80 would signal a break of that structure and could open the way toward $0.76 and $0.70. Both levels align with longer-term trend markers, including the 100-day and 200-day EMAs. On the upside, reclaiming $0.85 would be the first sign of renewed strength, with potential for a move back to $0.90 and the psychological $1.00 barrier.