DBS said it will list Franklin Templeton’s sgBENJI token on DBS Digital Exchange and pair it with Ripple’s RLUSD stablecoin. The bank framed the link as a way for accredited and institutional clients to swap between RLUSD and sgBENJI and then earn yield from the underlying money market fund.

Franklin Templeton will issue the sgBENJI token on the XRP Ledger, which allows settlement on XRPL while DBS handles exchange access and custody for eligible clients. The parties signed a memorandum of understanding to deliver the trading flow and to support lending against positions.

DBS added that it is evaluating the use of sgBENJI as collateral for credit, either through bank repo transactions or via third party platforms with DBS acting as collateral agent. The plan places RLUSD at the center of the trading leg while keeping custody and credit risk inside the banking perimeter.

CME sets October 13 start for options on XRP futures

CME Group announced plans to list options on XRP futures on October 13, pending regulatory review. The exchange said the contracts will include standard and micro sized strikes with daily, monthly and quarterly expiries, expanding its crypto derivatives beyond Bitcoin and Ether.

The addition of XRP options gives institutional desks a regulated venue for hedging and volatility trades around existing XRP futures. CME positioned the launch as a response to client demand for more complete risk tools across liquid crypto assets.

Options on Solana futures will go live on the same date under the same review conditions. Together, the listings broaden the menu for U.S. regulated crypto derivatives at a time when securities products are also evolving.

SEC adopts generic listing standards that could ease XRP ETF launches

Meanwhile, the U.S. Securities and Exchange Commission today approved rule changes letting major exchanges use generic standards to list spot commodity and digital asset ETFs. The change shortens timelines and replaces many case by case waivers that previously slowed approvals.

Exchanges including NYSE, Nasdaq and Cboe can implement the framework, which market participants say should reduce approval windows to as little as seventy five days. Analysts view the step as opening a clearer route for products tied to assets such as XRP when sponsors meet the new disclosure and custody requirements.

The move follows July guidance from the SEC that previewed this shift in disclosure and listing mechanics for crypto funds. Issuers have since updated filings to align with the new path.

Ripple directs twenty five million RLUSD to U.S. nonprofits

Earlier this week, Ripple said it will donate twenty five million RLUSD to Accion Opportunity Fund and Hire Heroes USA. The firms will receive funds in RLUSD rather than cash, which introduces wallet operations and exchange off ramps into the grant process.

Ripple said the transfer aims to speed distribution while exposing recipients to on chain rails they may use in future programs. The company highlighted small business lending and veteran employment initiatives as the focus areas for this round.

Coverage across industry media reiterated the recipients, the stablecoin funding method and the September 15 timing. The gift adds to Ripple’s 2025 philanthropy total.

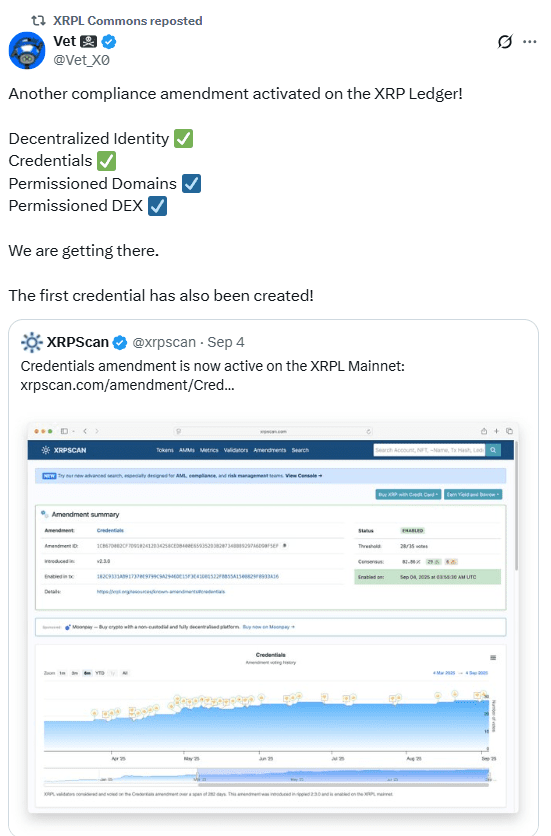

The XRP Ledger activated the Credentials amendment, adding a native framework for managing identity attestations on chain. The feature draws from the W3C Verifiable Credentials model and enables KYC or AML checks within XRPL transactions while preserving privacy.

XRPL community trackers show the amendment reached supermajority and is now enabled on mainnet. RippleX developers and ecosystem accounts confirmed activation as validators updated to rippled version 2.3.0.

With Credentials live, issuers and applications can reference credential IDs in on chain operations. That design supports permissioned or compliance gated use cases that large financial institutions often require.

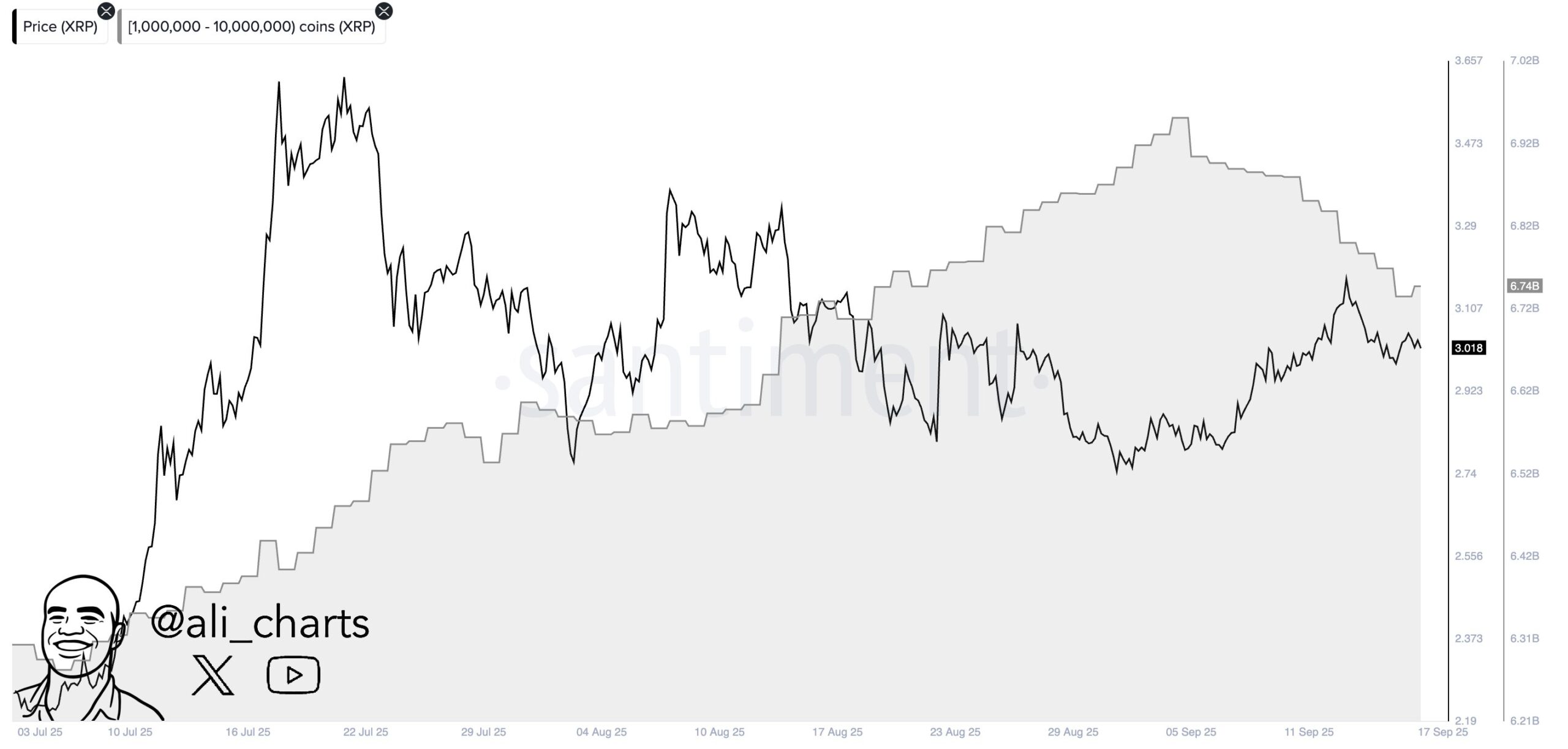

XRP whales reduce holdings as 200 million tokens leave large wallets

September 18, 2025. On chain data shows an xrp whale activity spike over the past two weeks. Addresses on the XRP Ledger holding 1 million to 10 million XRP reduced balances by roughly 200 million XRP. Ali on X shared the Santiment series that tracks this cohort.

The distribution trend centers on wallets often called xrp whales. These wallets sit below exchange treasuries yet above most retail xrp holders. Their moves can shift liquidity across XRPL venues as funds rotate between custody and trading accounts.

Meanwhile, the cohort’s supply slide followed steady accumulation through late August, according to the same chart. The series plots the whale band in gray against price in black for context. However, the observation remains non price news focused on wallet behavior.

Moreover, flows of this size can influence exchange inflows and settlement rails on the xrp ledger. Market desks watch whether the tokens move to known exchange addresses or remain in self custody. Either path signals different intents around transfers, staking, or corporate treasury needs.

Finally, the data does not identify individual entities behind the whale wallets. It aggregates balances across many holders to show cohort level activity. As a result, it frames the current shift as a broad change in positioning rather than a single address event.

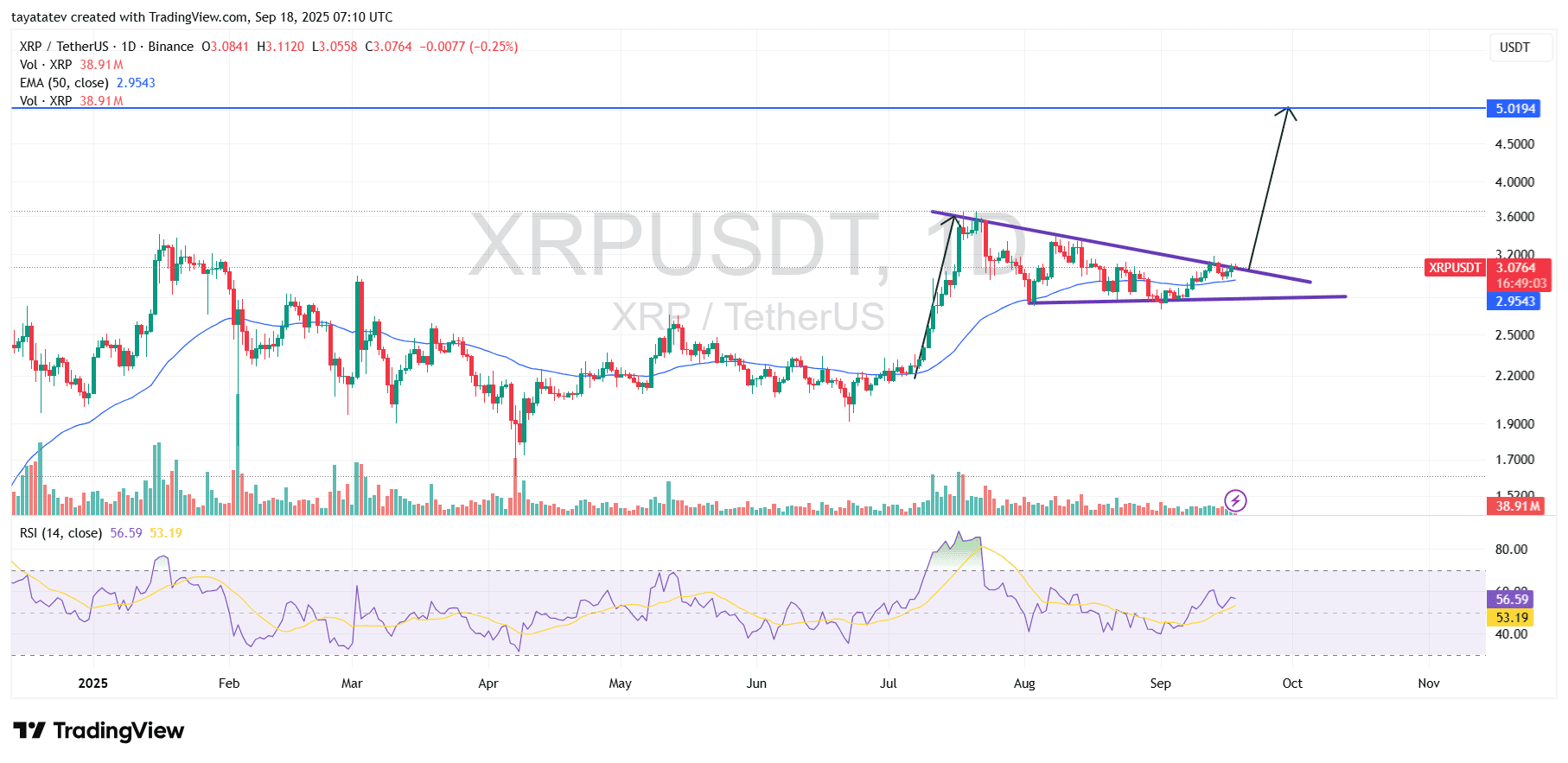

XRP forms falling wedge; measured breakout points to ~$5.01 (+63%)

On the XRP/USD daily chart from Binance, XRP price compresses inside a falling wedge below a descending trendline drawn from the early-August high. A falling wedge is a bullish consolidation where price makes lower highs and lower lows inside converging lines and often resolves upward once resistance breaks. The setup appears after July’s vertical advance, and the chart overlays a prospective breakout path to the earlier supply band.

Price trades near $3.076, while the 50-day exponential moving average (EMA 50) sits around $2.954. The wedge support tracks just above that EMA, showing buyers defending the same zone through September pullbacks. Meanwhile, the relative strength index (RSI 14) hovers near 56, which signals improving momentum but not yet overbought. Volume trends remain moderate, consistent with a coiling phase before validation.

If XRP confirms a breakout with a daily close above the wedge’s descending resistance and holds a retest, the measured objective aligns with a 63% advance from the current price to about $5.01. That target matches the horizontal reference drawn near $5.02 on the chart and reflects the typical follow-through seen when a falling-wedge breakout in XRP technical analysis sustains. Until confirmation, XRP price action remains inside the pattern, with the EMA 50 near $2.95 acting as first support.