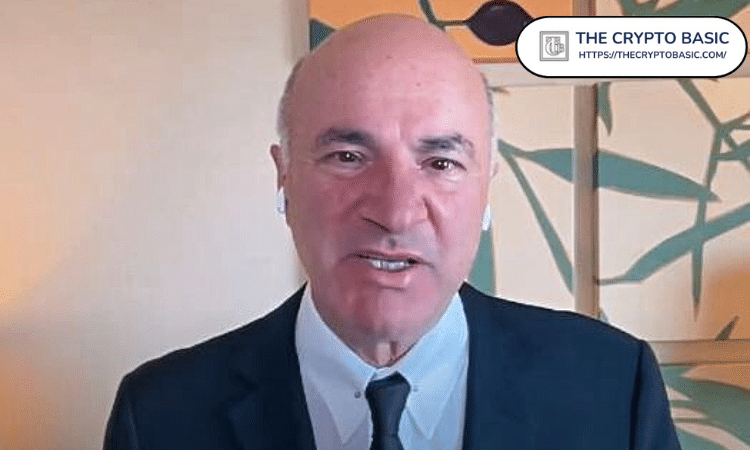

Investor and television personality Kevin O’Leary says he remains committed to Bitcoin despite its steep recent decline. However, he believes the current downturn signals more than a routine market cycle.

Specifically, in comments on X, O’Leary argued that the correction reflects a deeper structural shift in institutional behavior, as emerging risks, particularly those tied to quantum computing, begin influencing long-term investment decisions.

Bitcoin has fallen roughly 50% from its peak, a magnitude consistent with previous cycles. O’Leary noted that such drawdowns are not unusual in the asset’s history. Nevertheless, he emphasized that today’s market differs from earlier periods because institutional capital now plays a far more significant role.

Key Points

- O’Leary believes Bitcoin’s roughly 50% decline reflects institutional repositioning.

- The crypto crash, which wiped out 80–90% of many altcoins, triggered a major institutional reassessment of crypto exposure.

- Institutional investors are increasingly concentrating capital in Bitcoin and Ethereum while exiting weaker altcoins.

- Many institutions are capping Bitcoin allocations at around 3% of portfolios due to risk management and uncertainty.

- Quantum computing is emerging as a long-term theoretical threat influencing institutional caution.

October Crash Marked a Turning Point

O’Leary identified the broad market collapse in October as a key inflection point. During that period, Bitcoin declined dramatically, while many alternative cryptocurrencies suffered far more severe losses.

According to O’Leary, numerous smaller tokens fell between 80% and 90%, and many failed to recover. That widespread destruction of value prompted institutional investors to reassess their exposure to the sector. Factors such as liquidity, volatility, and long-term return potential came under closer scrutiny.

As a result, institutions began adjusting their capital allocation strategies, becoming more selective about where they deployed funds within the crypto market.

Institutions Concentrate on Bitcoin and Ethereum

Following that reassessment, institutional investors increasingly focused on Bitcoin and Ethereum. O’Leary said many large firms concluded that these two assets offer the most reliable combination of upside potential, liquidity, and market resilience.

This shift led to a concentration of capital in those assets, while many altcoins were sold off and failed to participate meaningfully in subsequent rebounds. The divergence, he explained, helps clarify why recoveries across the broader crypto market have appeared uneven.

In O’Leary’s view, this consolidation reflects a more disciplined, data-driven investment approach. Rather than chasing speculative opportunities, institutions are prioritizing assets with scale, liquidity, and proven durability.

Quantum Computing Emerges as a Strategic Concern

At the same time, O’Leary highlighted quantum computing as a new factor shaping institutional caution. While he described the threat as theoretical at present, he said the possibility that future quantum systems could compromise blockchain security is influencing portfolio decisions.

Accordingly, many institutions are limiting their Bitcoin exposure to approximately 3% of their portfolios until the technological outlook becomes clearer.

This caution coincides with continued market weakness. Bitcoin has now recorded four consecutive weekly declines and was trading at $68,206 at the time of writing, down 1.7% over the past week and 28.3% over the past month.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.