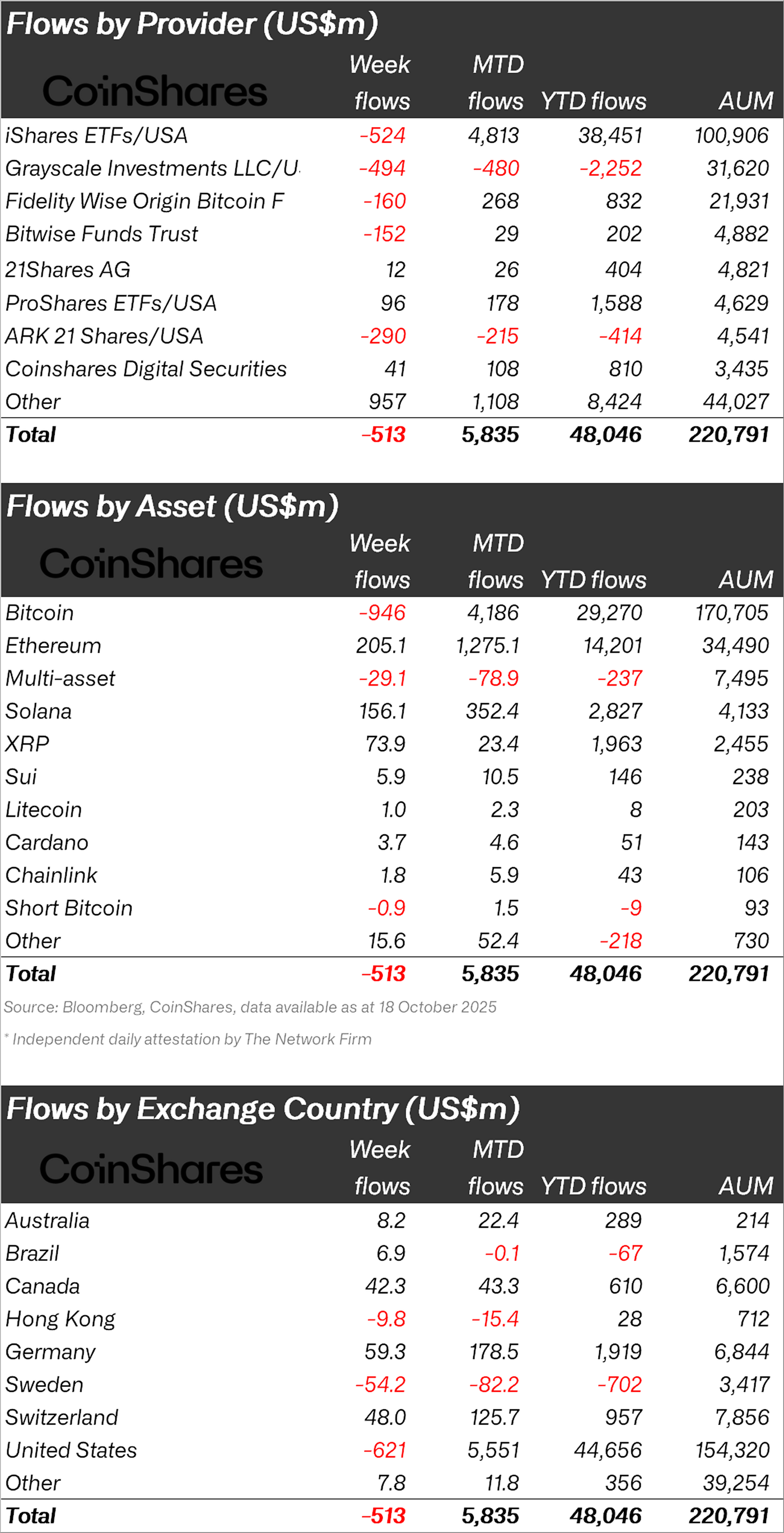

Crypto asset exchange-traded products (ETPs), led by Bitcoin, saw a total of $513 million in outflows following the liquidity issues on October 10.

While the market became more volatile, most ETP investors didn’t react strongly. In contrast, on-chain investors were more cautious, contributing to bearish sentiment.

Despite the outflows, trading volumes remained robust, reaching $51 billion for the week, nearly double the average weekly volume for 2025.

Bitcoin Suffers Largest Outflows, While Ethereum and Altcoins Gain Traction

Bitcoin, the flagship cryptocurrency, was the primary driver of the outflows. Specifically, $946 million exited Bitcoin ETPs last week.

Year-to-date, Bitcoin has seen $29.3 billion in inflows—still trailing the pace set in 2024, when $41.7 billion was recorded.

Despite recent outflows, Bitcoin’s long-term investor base remains strong, as evidenced by its dominant market position.

Meanwhile, Ethereum saw an influx of $205 million as investors capitalized on the price dip. Notably, the largest weekly inflow was into a 2x leveraged Ethereum ETP, which attracted $457 million in new capital.

XRP and Solana Benefit from ETF Hype

Solana and XRP ETPs also recorded impressive inflows last week, driven by continued excitement around their upcoming ETF launches. Solana gained $156 million in inflows, while XRP received $73.9 million in fresh investment.

The buzz around their ETF launches in the U.S. has contributed to renewed investor enthusiasm.

US Investors Pull Back, While Europeans and Canadians Seize Opportunity

Outflows were overwhelmingly concentrated in the United States, where $621 million was pulled from digital asset ETPs.

In contrast, European and Canadian investors remained bullish, viewing the market weakness as a buying opportunity. Germany saw inflows of $54.2 million, Switzerland $48 million, and Canada $42.4 million.

Market Outlook

As the market recovers from the October 10 liquidity shock, investors are closely watching the spot prices of Bitcoin, Ethereum, XRP, and other top crypto assets.

The crypto market has risen 2.46% over the past day to $3.76 trillion, with Bitcoin reclaiming the $111,000 level. Notably, Bitcoin is up 2.58% today, while XRP is up 2.39%, trading at $2.47.

With strong trading volumes and renewed inflows, many are hopeful that the final quarter of 2025 holds a lot of promise for investors.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.