Bitcoin (BTC) price traded near $115,000, down a notch from the day’s high near $117,300. BTC price reached the price mark for the first time in nearly 4 weeks. The price remained slightly muted as traders avoided large positions ahead of the Federal Reserve’s Sept. 17 policy meeting.

CME’s FedWatch tool predicted a 93.8% chance of a quarter-point cut and a 6.2% chance of a deeper 50 bps cut. The decision carries weight across risk assets, as lower borrowing costs historically improved liquidity and investor appetite. For Bitcoin, a cut could ease macro pressure and open space for renewed demand. Attention now turns to on-chain flows, where recent trends hint at shifting supply dynamics.

Liquidity Signals Point Toward Cautious Optimism

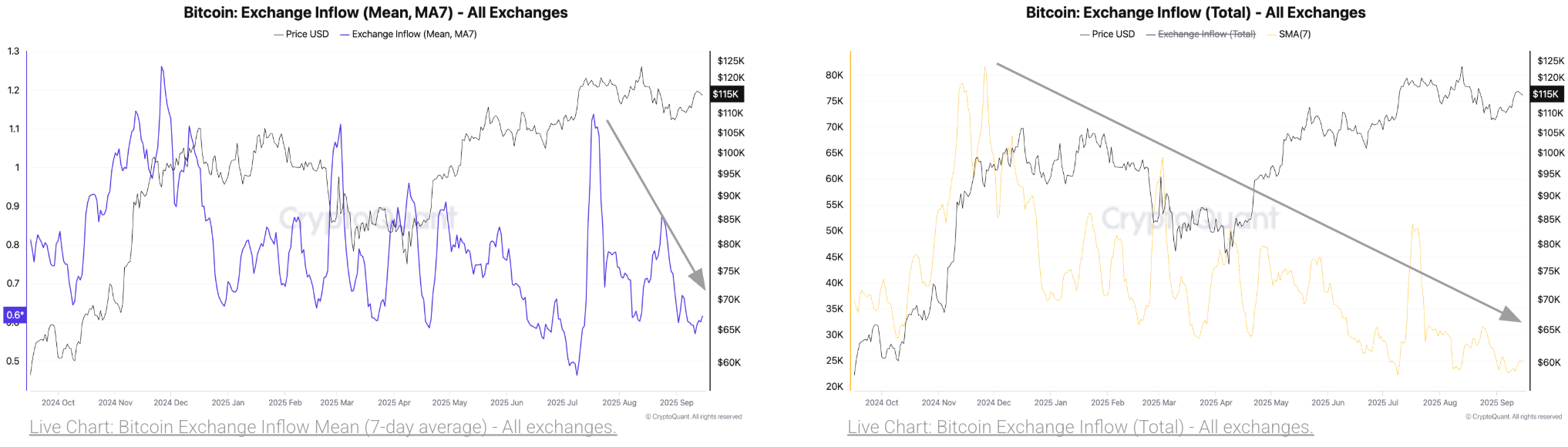

The focus on the Fed’s decision sharpened as fresh on-chain signals shaped Bitcoin’s outlook. CryptoQuant’s recent report showed exchange inflows falling to their lowest in over a year.

Deposit sizes also shrank, cutting the average by nearly half since July. Those shifts signaled reduced sell pressure from large holders, suggesting that long-term investors were less inclined to liquidate positions ahead of the rate cut. At the same time, stablecoin deposits on exchanges climbed sharply, hinting that traders were preparing dry powder in anticipation of market moves. The combined picture portrayed a market preparing for an easing cycle rather than rushing to the exits.

Other assets showed diverging trends, with altcoins seeing higher deposit activity even as Bitcoin and Ethereum inflows weakened. The contrast pointed to traders seeking shorter-term opportunities in smaller tokens, while the larger market leaders retained a more measured tone.

The implications for Bitcoin were clear. A backdrop of reduced exchange supply and heightened stablecoin inflows set the stage for potential upside should demand strengthen after the Fed decision. The signals matched patterns that often preceded rallies in past cycles, reinforcing optimism that macro easing could align with favorable on-chain conditions.

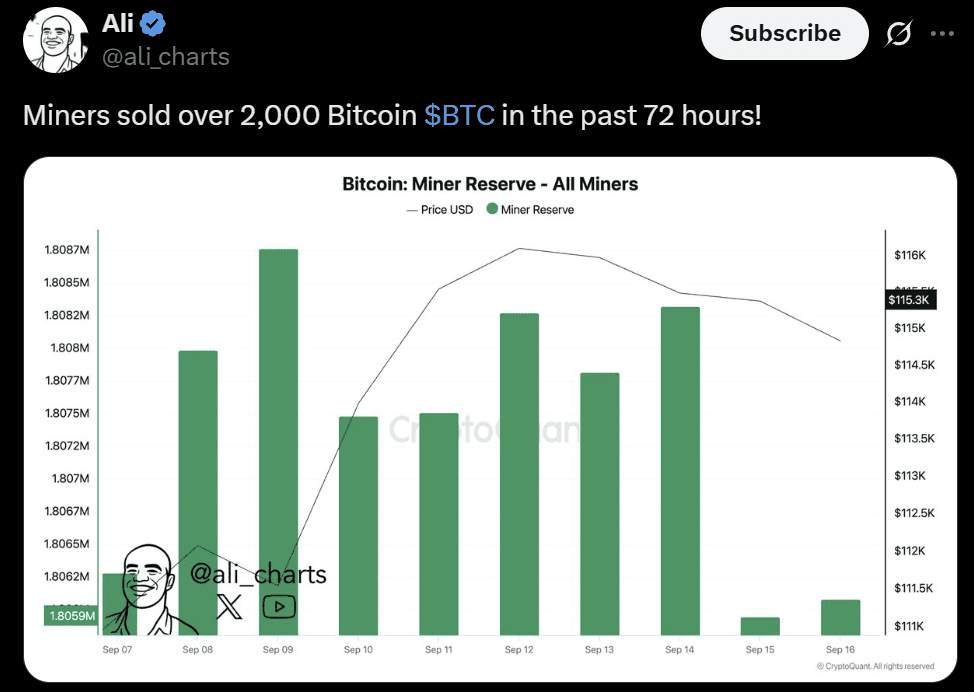

Yet, miners added a note of caution. Ali Martinez flagged that miners sold over 2,000 BTC in the last 72 hours, trimming their reserves even as prices held above $115,000. Miner sales did not automatically mark a bearish turn, but such spikes often attracted profit-taking from other holders. Furthermore, the timing suggested that while structural cues leaned bullish, short-term supply shocks could still temper momentum.

Analysts Frame Bitcoin’s Path Around Fed Decision

The miner movement left the BTC USD pair‘s path dependent on policy moves and how traders absorbed immediate selling pressure.

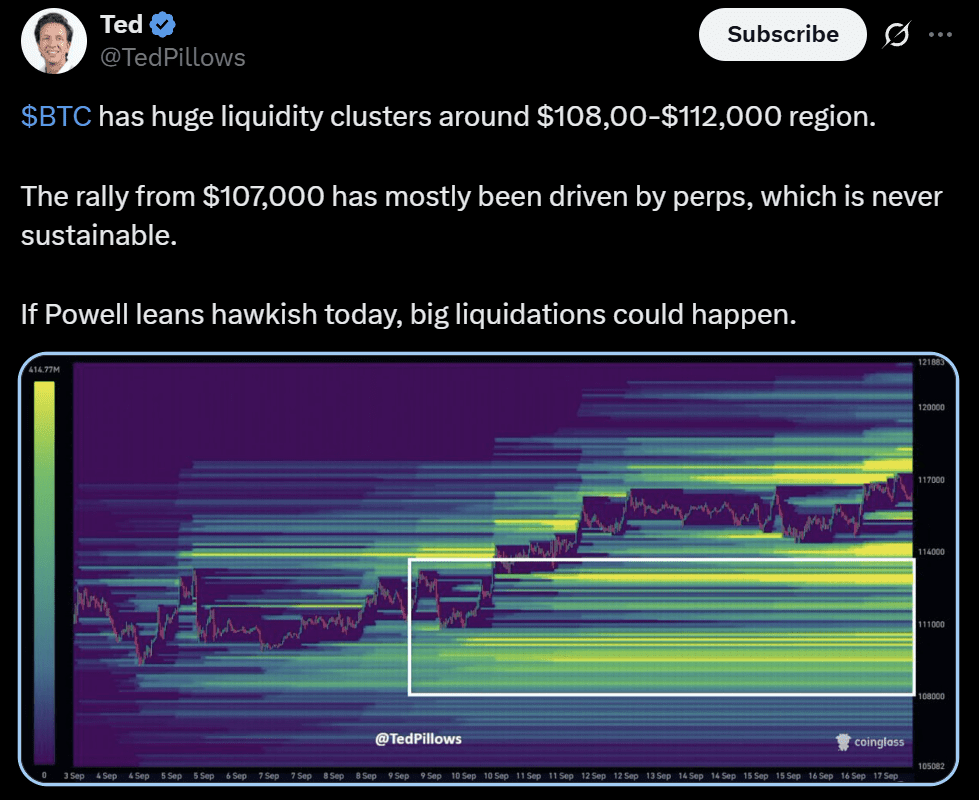

Meanwhile, analysts highlighted that liquidity pockets had built between $108,000 and $112,000, zones where order books grew dense in recent weeks. Ted Pillows warned that the rally from $107,000 leaned heavily on perpetual futures, a structure he argued was rarely sustainable.

Pillows cautioned that if Chair Jerome Powell leaned hawkish, concentrated liquidity in that band could trigger a cascade of liquidations.

Not every outlook carried the same caution. Lark Davis pointed to a recurring seasonal pattern in September. The analyst noted that since 2020, every September FOMC meeting, apart from the 2022 bear stretch, was followed by a notable Bitcoin rally.

Davis’s view suggested that BTC price action hinged less on the immediate policy move and more on recurring investor flows during this period. The seasonal bias kept optimism alive despite short-term warnings.

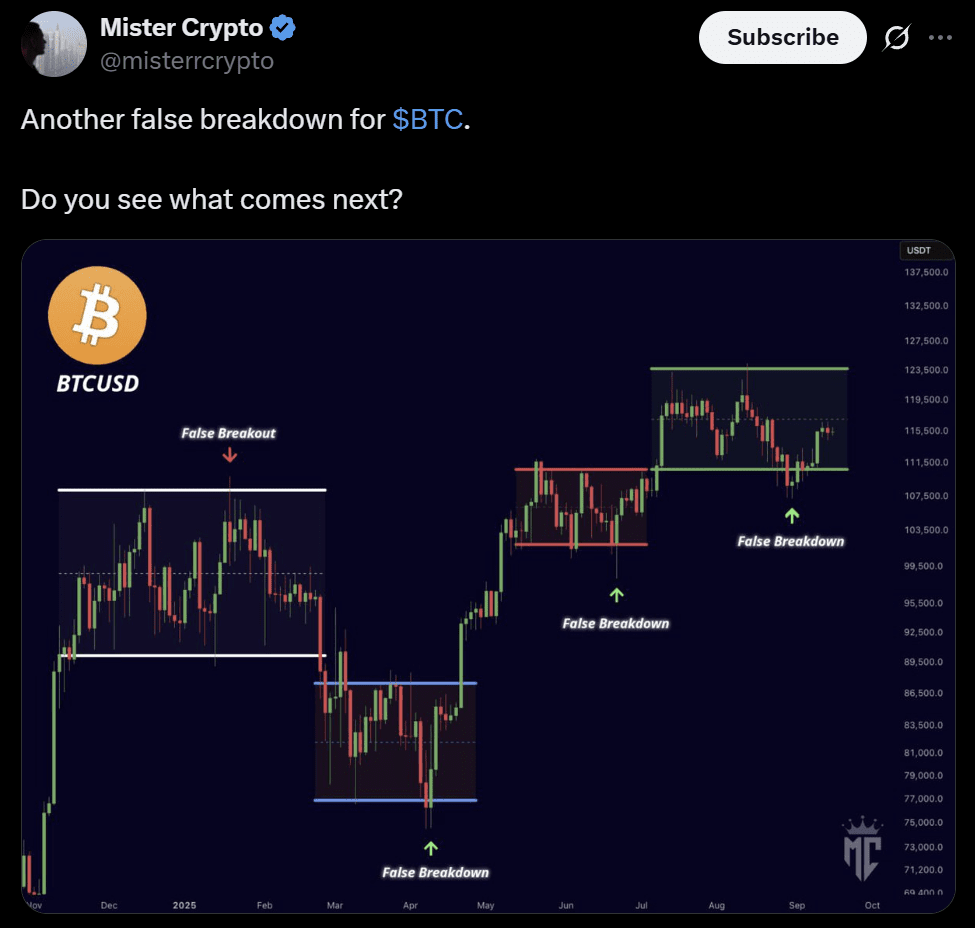

Technical commentary added another layer. Mister Crypto underscored how recent breakdowns had repeatedly proved false, with each dip reversing into sharp recoveries. He argued that failed breakdowns reflected underlying demand, which often reasserted once weak positions were cleared.

Together, the outlook showed a market balanced between structural support and tactical risks. With a Fed announcement imminent, traders weighed whether historical seasonality and resilient demand would overcome the pressure that heavy liquidity clusters and profit-taking might unleash. Above all, liquidity and on-chain flows tilted constructively, but leverage-driven rallies and miner selling could certainly still amplify volatility.