Bitcoin price has rebounded more than 4% since February 19, helping it recover above $68,200. This bounce offered temporary relief after weeks of weakness. However, new technical and on-chain signals now show that Bitcoin may be approaching its most dangerous level of 2026.

A combination of bearish chart structure, heavy supply clusters below price, and rising leverage risk suggests a deeper correction could begin soon.

Bearish Pattern and Largest Supply Cluster Create Immediate Risk

Bitcoin’s 8-hour chart currently shows a head-and-shoulders pattern. This is a bearish reversal structure that forms when price creates three peaks, with the middle peak higher than the others. It signals weakening buying strength and increasing selling pressure.

At the same time, Bitcoin has formed a hidden bearish divergence between February 6 and February 20. During this period, the Bitcoin price created a lower high, meaning the recovery failed to fully regain its previous peak.

However, the Relative Strength Index, or RSI, formed a higher high.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

RSI measures buying and selling momentum on a scale from 0 to 100. When RSI rises, but price fails to rise equally, it shows that buying strength is weakening. This pattern often appears before price declines or pullbacks.

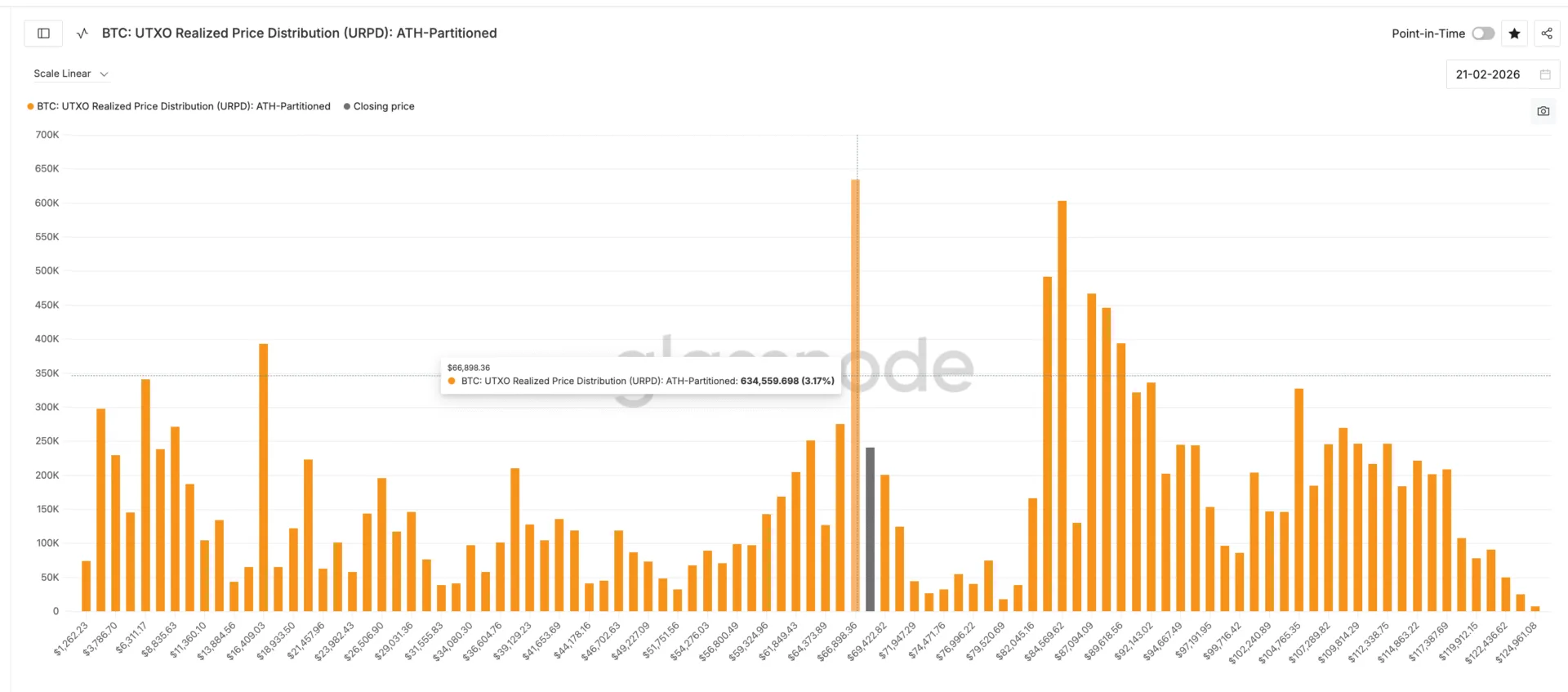

The biggest risk now comes from Bitcoin’s on-chain cost basis levels. Data from the UTXO Realized Price Distribution, or URPD, shows that the largest supply cluster sits at above $66,800. This level holds 3.17% of Bitcoin’s total circulating supply.

Another major cluster sits at $65,636, holding an additional 1.38% of supply.

These levels are important because they represent prices at which many investors bought Bitcoin. If Bitcoin falls below these levels, holders may begin selling to avoid losses. This can accelerate the price decline quickly.

Together, these clusters represent more than 4.5% of Bitcoin’s supply concentrated just below the current price. This creates a high-risk zone directly under Bitcoin’s support. That explains the biggest price warning

If Bitcoin closes below this region, the head-and-shoulders pattern realization could gain strength.

Rising Leverage and ETF Outflows Increase Liquidation Threat

Derivatives data shows rising liquidation risk as Bitcoin rebounded. Open interest, which measures the total value of active futures positions, has increased from $19.54 billion on February 19 to about $20.71 billion now, during the bounce.

This means more traders have entered leveraged positions during the recovery.

At the same time, funding rates have turned positive. Funding rates are payments between long and short traders. Positive funding means more traders are betting on price increases. This creates a dangerous situation.

If the Bitcoin price starts falling, these leveraged long positions may be forced to close. This triggers a long squeeze, where bullish traders are pushed out of their positions. Such forced exits can create a liquidation cascade, adding extra selling pressure and accelerating the price drop.

Institutional sentiment also remains weak. Spot Bitcoin ETFs have now recorded five consecutive weeks of net outflows. This shows that institutional investors are still withdrawing capital rather than accumulating.

This reduces support during price declines.

Bitcoin Price Faces Critical Test Below Institutional Resistance

Bitcoin also remains below its monthly Volume Weighted Average Price, or VWAP, which sits near $70,000. VWAP represents the average price weighted by trading volume. Monthly VWAP is widely used as a proxy for institutional cost basis.

When Bitcoin trades below VWAP, it means the average institutional position is currently at a loss. This often causes institutions to reduce exposure or avoid new buying, explaining the ETF apathy.

A recovery above $70,000 would signal renewed institutional strength. But as long as Bitcoin stays below this level, recovery attempts may remain limited, and the broader structure remains bearish.

On the downside, Bitcoin’s first key support sits near $67,300. If this level breaks, the next support appears at $66,500, followed by $65,300. These levels align closely with the major supply clusters mentioned earlier. Failure to hold these levels could trigger the larger head-and-shoulders breakdown near the $60,800 neckline.

A breakdown can then trigger a price breakdown target of over 7.5%, hinting at a target price of $56,000, in the near-to-mid-term.

On the upside, Bitcoin must reclaim $68,200 to stabilize its short-term structure. However, a full recovery would require reclaiming the $70,000 VWAP level.

The post Bitcoin Price Flashes Biggest Warning of 2026: Is a Drop to $56,000 Coming? appeared first on BeInCrypto.

Article Source: beincrypto.com

The post Bitcoin Price Flashes Biggest Warning of 2026: Is a Drop to $56,000 Coming? appeared first on Crypto Adventure.