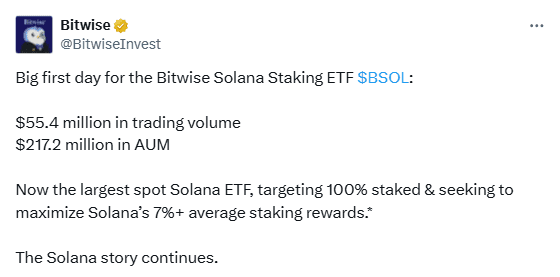

Bitwise’s spot Solana ETF (BSOL) opened with strong demand. It attracted $69.5 million in first-day inflows, beating the $12 million debut for Rex-Osprey’s Solana Staking ETF (SSK). Traders also pushed Solana ETF volume to roughly $55.4 million on day one as about 2.17 million BSOL shares changed hands.

Debut flows and Solana ETF volume

Investors favored BSOL from the open. Net creations reached $69.5 million, establishing the fund as the early leader among new Solana products. Farside’s flow tallies confirmed the gap with SSK.

Meanwhile, secondary trading was active. BSOL printed about 2,177,806 shares with an intraday range near $25.49–$26.59, implying ~$55–57 million in notional turnover. The strong tape supported smooth price discovery.

Furthermore, the first session framed initial liquidity conditions. Spreads remained orderly for a launch, and volume accelerated into the close. The readings give market makers a baseline for day-two depth.

Two structures, two signals

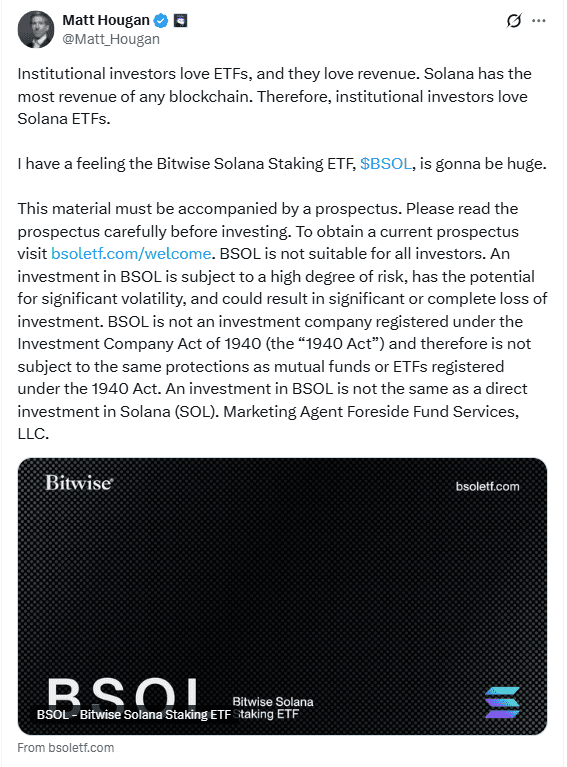

BSOL offers direct spot Solana exposure with in-house staking. Bitwise targets 100% staked assets and aims to pass through the network’s ~7% average staking rewards to holders. The wrapper keeps the position fully on SOL.

By contrast, SSK uses a blended approach. It holds about 54% in spot SOL, 43.5% in the CoinShares Physical Staked Solana ETP, and a small remainder in JitoSOL, short-term government obligations, and cash or other assets. The design mixes direct tokens with an external ETP sleeve.

Investors appear to be weighing simplicity against diversification. Early flows suggest preference for a pure spot path that internalizes staking. However, SSK’s structure may appeal to allocators seeking a multi-component basket.

Fees, staking, and listings

Bitwise set BSOL’s management fee at 0.20%, waived for the first three months. The fund listed on the New York Stock Exchange and positions itself to maximize staking participation within the portfolio.

SSK trades on the Cboe with a 0.75% total expense ratio. It distributes staking rewards monthly, currently classified as return of capital for tax purposes. The approach channels yield via its mixed holdings.

Consequently, fee differentials and income treatment create a clear contrast. BSOL leans on a single-asset, low-fee model; SSK balances components but charges more. The launch-day split in flows reflects that calculus.

Market reaction and next listings

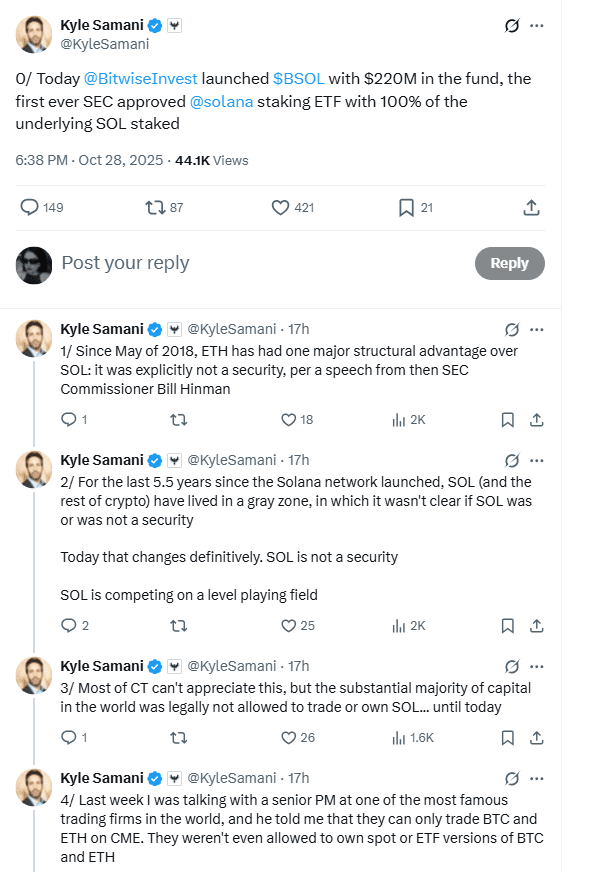

Industry voices underscored the step-change in access. Multicoin’s Kyle Samani called the debut a “watershed moment,” noting that much institutional capital could not own SOL before this week. The listing opens the door to mandates bound to ETFs.

Bitwise’s Matt Hougan argued demand should build because institutions “love ETFs” and “love revenue,” pointing to Solana’s on-chain fee generation. His view aligns with BSOL’s staking-pass-through pitch. The fund’s AUM passed $217 million around launch, per Bitwise’s update.

Moreover, additional competition arrives immediately. Grayscale’s GSOL spot ETF also received approval and begins trading Wednesday, adding another venue for SOL exposure. Subsequent sessions will show how flows rotate across products.

Price backdrop and outlook

The launch came as crypto markets softened. SOL fell about 3.1% to $194 over 24 hours, while Bitcoin pulled back from $116,000 intraday. The risk tone likely tempered some first-day enthusiasm in secondary trading.

Prediction markets remained cautious. Users on Myriad saw roughly a 32.7% chance of SOL posting a new all-time high this year. That probability frames expectations as funds start to accumulate assets.

Even so, day-one prints set a clear marker. BSOL led on inflows and handled meaningful Solana ETF volume with tight execution. The next few sessions will test whether creations persist and whether liquidity broadens across the SOL ETF lineup.

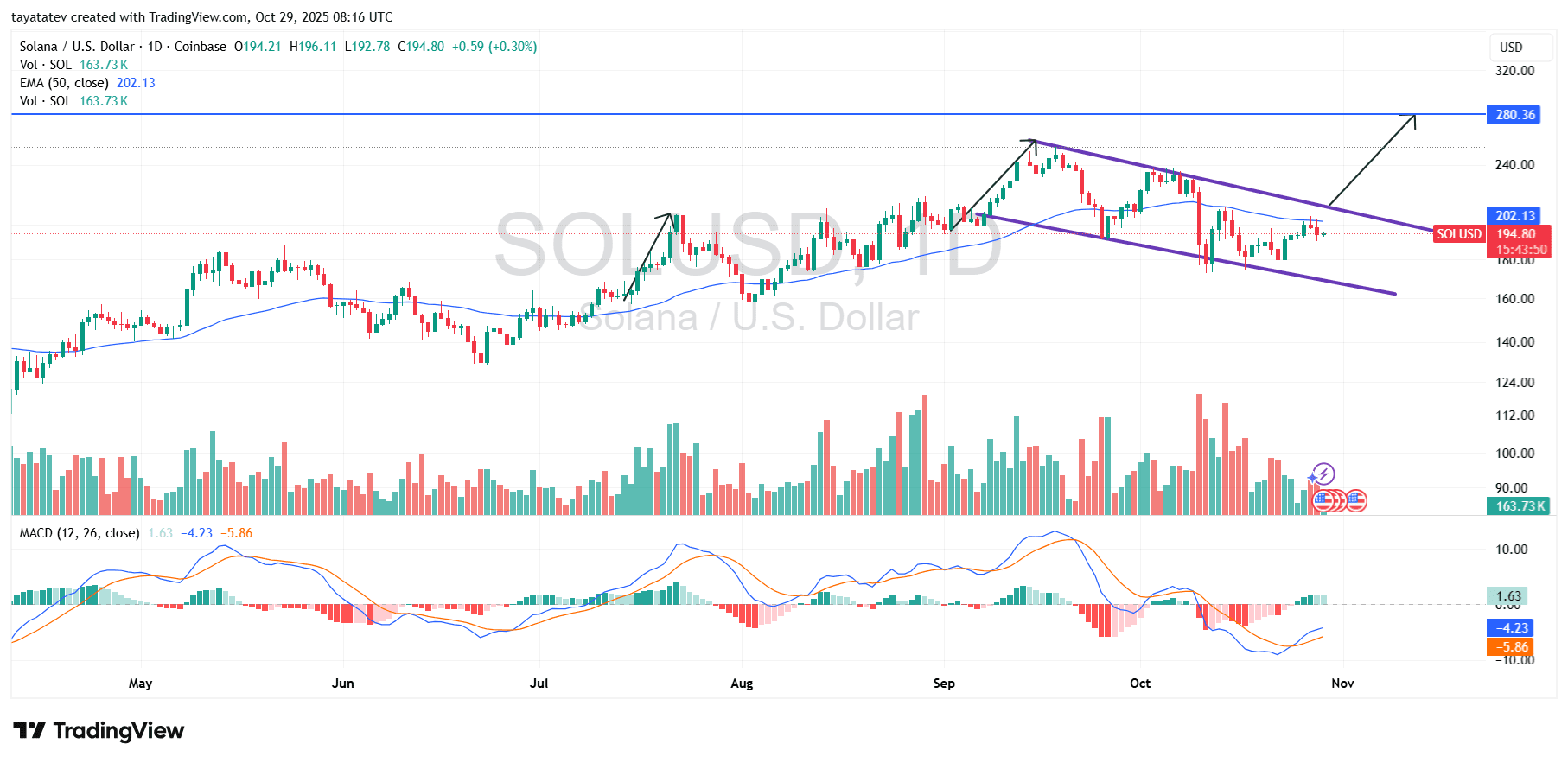

Solana (SOL/USD) — Oct 29, 2025 daily chart: bullish flag, trigger, and 86% measured target

The chart (Oct 29, 2025,) shows SOL at $194.80 trading inside a down-sloping channel after a strong August–September advance—this forms a bullish flag. A bullish flag is a brief, downward-tilting consolidation that follows a sharp rise and often resolves higher when price breaks the flag’s top. The pattern’s upper rail sits near $205–$210, while the 50-day EMA is ~$202.13, adding nearby resistance. The lower rail tracks the mid-$160s. MACD momentum is curling up with a pending crossover, and recent green histograms signal improving buy pressure.

A daily close above the flag’s upper trendline (~$205–$210) would confirm the breakout. Above that, price faces layered supply at $230–$240, then the annotated resistance near $280.36. Conversely, a close below ~$180 or a decisive break of the lower rail would weaken the pattern and delay the move, putting the mid-$170s back in play.

If the breakout confirms, the classic flag objective projects from the breakout level by the height of the prior impulse. Using your specified 86% advance from the current price $194.80, the upside objective lands near $362.33. Traders will often manage this in stages—first the 50-EMA reclaim (~$202), then a clean close over $210, followed by $240–$250, and finally the $280 zone—before evaluating continuation toward the $362 measured target.