BNB Chain memecoins delivered outsized gains this week. One wallet turned $3,500 into $7.9 million in three days, according to Lookonchain data. Activity rose across BNB Chain trading pairs as new tokens launched and posts on X drew fresh attention.

BNB Chain memecoins: small bets, big numbers, verified by Lookonchain data

BNB Chain memecoins produced sharp returns for several wallets. The address “0xd0a2” reportedly flipped $3,500 into $7.9 million in three days. Lookonchain data documented the sequence and the speed of the move.

Another BNB Chain memecoins example is “hexiecs.” The wallet placed $360,000 into the “4 token.” The value later showed over $5.5 million, per Lookonchain data. The trade unfolded as BNB Chain trading volumes climbed.

A third BNB Chain memecoins case is “brc20niubi.” The address deployed $730,000 and realized about $5.4 million. Lookonchain data cited a 1,200x return. These trades centered on very new listings with thin liquidity.

BNB meme season: the 4 token, Changpeng Zhao, and fast BNB Chain trading

The 4 token gained reach after Changpeng Zhao reshared a post to 8.9 million followers on October 1. Soon after, “0x872” reportedly turned $3,000 into nearly $2 million within hours. Lookonchain data referenced a 650x return during this window.

The phrase BNB meme season appeared widely on X. Changpeng Zhao used the term while noting shifting onchain behavior. The remark kept BNB Chain memecoins in view and pulled more eyes to new launches.

These BNB Chain trading bursts clustered around large-audience posts. Liquidity stayed thin during early hours. As a result, BNB Chain memecoins moved fast when new buyers arrived.

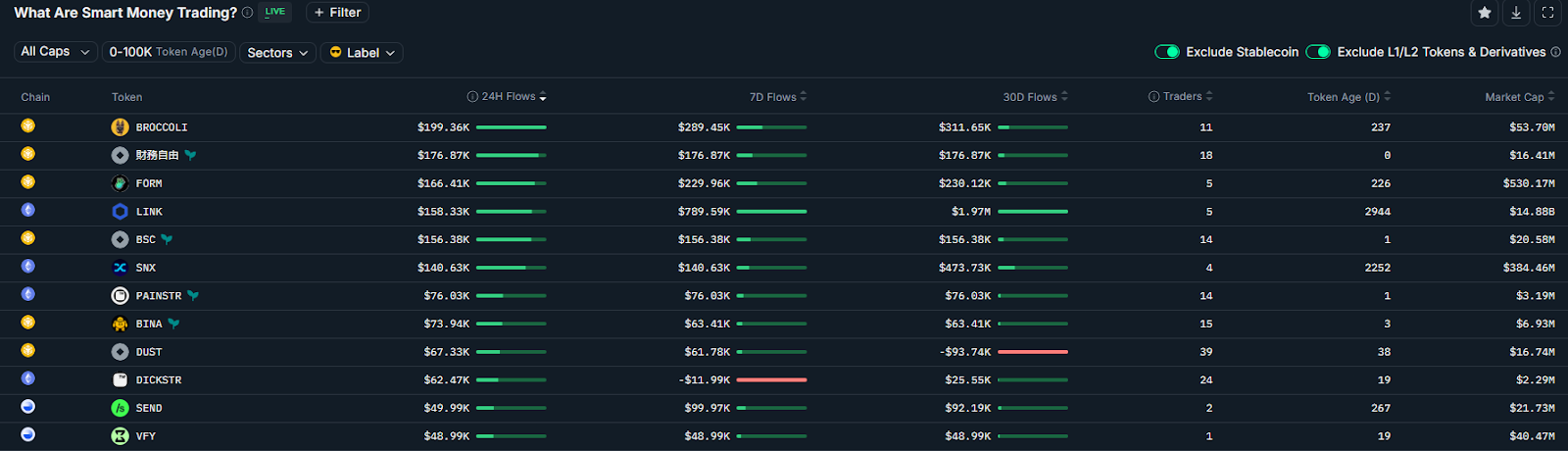

Nansen smart money flows and Bubblemaps traders show BNB Chain breadth

Nansen smart money dashboards showed a tilt toward BNB Chain memecoins. The three largest 24-hour buys among this cohort were BNB-native tokens. This pattern indicated tactical rotation into BNB Chain trading venues.

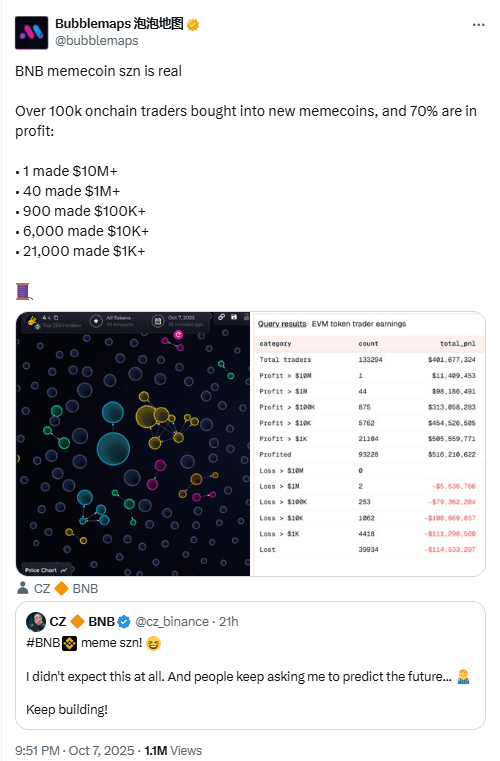

Bubblemaps traders data counted over 100,000 buyers in new BNB Chain memecoins before Tuesday. About 70% showed profit at that time. This breadth aligned with rising DEX volumes and unique addresses.

Outcomes concentrated at the top. One address booked over $10 million. Forty wallets cleared $1 million. About 900 wallets earned more than $100,000. The spread reflected both Nansen smart money flows and wider Bubblemaps traders activity.

DeFi context: BNB Chain memecoins and records in DEX volumes

Marwan Kawadri, DeFi lead and head of EMEA at BNB Chain, tied interest to usage metrics. “BNB Chain has always been strong in DeFi, but right now, it’s becoming the heartbeat of onchain trading,” he said. He pointed to records in active addresses and DEX volumes.

Kawadri added:

“What you’re seeing with ‘BNB meme szn’ is the market waking up to the fact that BNB Chain has become the leading ecosystem for trading.”

His view placed BNB Chain memecoins inside a broader surge in BNB Chain trading.

These remarks aligned with fast turnover across BNB-based DEXs. Spikes in unique addresses supported the BNB meme season theme. The backdrop helps explain why BNB Chain memecoins found quick liquidity.

Origin and risk: how the 4 token started, and why sentiment drives BNB Chain memecoins

Reports link the 4 token to a phishing event on BNB Chain. The attacker reportedly made about $4,000. Community attention later turned the episode into a meme, and then into a tradable token.

Early BNB Chain trading happened in thin books. Social posts amplified discovery. In that setup, BNB Chain memecoins can move sharply on small inflows.

Memecoins remain high risk. They have no intrinsic value and rely on social sentiment. When sentiment changes, prices can swing quickly on BNB Chain trading pairs.

BNB Breaks Multi-Year Trendline, Enters Price Discovery; $1,486–$1,983 Fib Levels in Focus

BNB broke a multi-year trendline in July and continued higher. The token now trades in price discovery, with Fibonacci levels guiding reference points, according to Lark Davis.

BNB is up over 600% from the bear-market low, Davis said on X. The weekly chart shows the trendline break held after July. That move marked a shift in market structure.

The next Fibonacci extension sits at $1,486 for 2.618. A further extension marks $1,983 for 3.618. Traders often use these levels after new highs.

Davis asked if $2,000 is possible before year-end. He did not give a forecast. The post framed levels rather than outcomes.

The shared chart overlays Fibonacci bands on BNB/USDT (1W, Binance). It also highlights prior rejection zones since 2021. An inset from Artemis ranks BNB Chain by 24-hour fees versus peers.

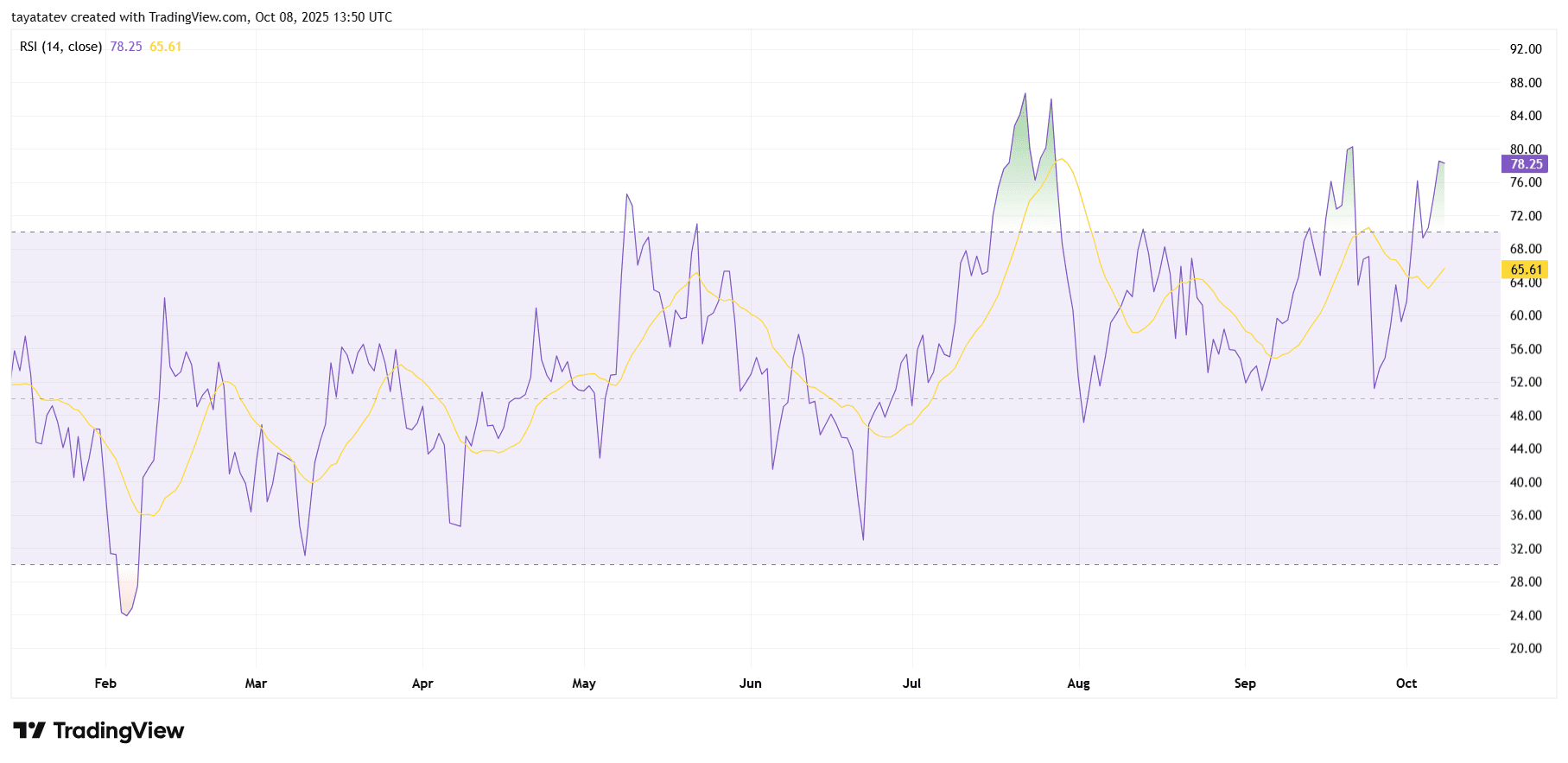

BNB’s daily Relative Strength Index rose to 78.25 on October 8, pushing deeper into the overbought zone. The signal line stood at 65.61, showing a wide gap that reflects strong momentum.

Throughout the summer, the RSI frequently tested the 70–80 band during rallies, with each pullback finding support near the mid-50s. That pattern kept the overall trend intact and aligned with BNB’s steady price climb.

In recent weeks, the RSI broke above 70 again and held that level, while the signal line turned upward. The divergence between the RSI and signal line widened, pointing to accelerating buying pressure.

Previous overbought readings in early August were followed by short consolidation phases rather than deep corrections. Current levels suggest BNB remains in a momentum-driven phase, with traders watching how long the oscillator can sustain above the 70 threshold.