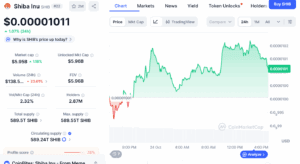

Shiba Inu (SHIB) is up 1.5% in the past 24 hours and 7% over the week, trading at $0.00001019. Yet it remains 41% lower than a year ago, while rival Dogecoin (DOGE) has gained 43% in the same period. So, for the long-time SHIB holders — will their patience ever pay off, and can the SHIB price realistically reach the long-dreamed $0.01?

The Mathematics Behind the Dream

When Shiba Inu launched on Ethereum in July 2020, it began as a meme-driven community experiment. Five years later, it has matured into a multi-token ecosystem with its own Layer-2 blockchain, stablecoin plans, and governance system. Yet the one-cent goal has become both a rallying cry and a mathematical wall.

At today’s price of about $0.00001015 and a circulating supply of roughly 585 trillion tokens, Shiba Inu’s total market capitalization stands near $6 billion. If the token were to ever reach $0.01, the implied valuation would exceed $5.85 trillion—greater than the GDP of most nations and more than twice Apple’s current worth. In other words, to touch that price, SHIB would need to appreciate by roughly 82,000% from its current level.

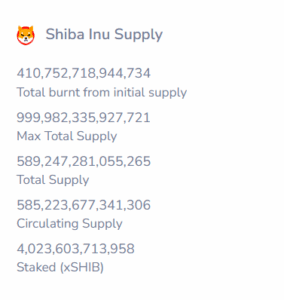

Even during the euphoric 2021 bull run, when Ethereum co-founder Vitalik Buterin burned 410 trillion SHIB and the token briefly surged over 1,000%, the market cap never crossed $40 billion. That moment showed SHIB price’s explosive potential—but also the hard ceiling imposed by its enormous supply.

Why Burns Are Central to SHIB’s Future

The only realistic path toward higher valuations lies in token burning—the permanent removal of tokens from circulation. SHIB’s community has embraced this concept more than almost any other project, turning burning into a recurring event tied to network activity, merchandise, and community campaigns.

As of October 2025, data from the SHIB burn tracker show more than 410.7 trillion tokens permanently destroyed, leaving a total supply near 589.2 trillion. Around 585.2 trillion remain in circulation, while just over 4 trillion are staked. The latest 24-hour data recorded a 234% increase in burn rate, with nearly 16 million SHIB sent to dead wallets.

However, these figures reveal the scale of the challenge more than the progress. Even with spikes like this, SHIB’s annual burn volume amounts to less than a fraction of 1% of total supply. At this pace, it would take centuries to reduce the circulating tokens enough to meaningfully change valuation.

Shibarium—the project’s Layer-2 Proof-of-Stake network launched in August 2023—was designed partly to solve this. Every transaction on Shibarium contributes to automatic SHIB burns. In theory, greater network activity means faster deflation. In practice, the chain’s daily transactions have not yet reached a level that could trigger large-scale burns. Even if Shibarium processed one million transactions per day, the total monthly burns would remain in the low billions of tokens—far below the trillions required annually to push SHIB toward $0.01.

Ecosystem Expansion Focuses on Utility and Governance

Despite these structural constraints, Shiba Inu’s evolution has been substantial. Its ecosystem now spans five tokens—SHIB, LEASH, BONE, SHI, and TREAT—each serving distinct roles. Shibarium provides scalability and low-cost transactions, while BONE powers its gas fees. TREAT, launched in early 2025, functions as a governance and engagement token and helped raise $12 million for the development of a privacy-focused Layer-3 network. The upcoming SHI stablecoin aims to expand the project’s financial utility, and ShibDAO is transitioning governance to community-based voting.

This diversification signals a strategic shift: SHIB is no longer positioned purely as a speculative meme coin but as a platform for decentralized finance and gaming applications. Yet from a valuation standpoint, these utilities support gradual stability—not a parabolic price leap.

Looking at historical performance and current burn rates, SHIB’s path to one cent remains mathematically improbable under present conditions. The supply is too large, and the burn rate too slow. To achieve that milestone, either the total supply would need to fall by more than 99%, or the global crypto market would need to expand to levels unseen in financial history.