Cardano (ADA) may be entering what one market analyst calls its “most bullish state.” According to crypto chartist Javon Marks, the token could be setting up for a rally of over 432%, potentially driving prices well above $5 and even toward $8 if momentum holds. His analysis points to a breakout pattern that has historically triggered extended price surges for ADA.

Marks argues that ADA has already begun its bullish cycle. In his view, a completed accumulation phase now sets the stage for higher levels. His chart shows a series of higher lows and a potential continuation breakout structure. From this base, he calculates an upside projection of more than 432%.

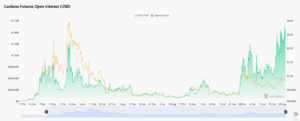

Futures Open Interest Surges Past $2B as Traders Pile In

Supporting this outlook, derivatives data show rising engagement from traders. Cardano’s futures open interest — the total value of outstanding derivative contracts — has surged to levels not seen since the 2021 bull cycle.

According to Coinglass data, open interest has recently climbed past $2 billion, tracking closely with ADA’s spot price recovery above $0.90. In past cycles, spikes in open interest have preceded large price swings, as more leveraged positions increase market volatility.

The chart also shows that open interest growth in 2021 coincided with ADA’s rally to record highs of $3.2. A similar build-up today suggests traders are positioning for significant moves, although it also raises the risk of sharp corrections if positions unwind.

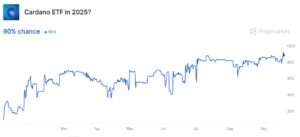

SEC’s Upcoming ETF Decision Seen as a Potential Catalyst

Beyond technicals and derivatives, regulatory progress may act as the trigger for ADA’s next phase. On Sept. 18, the U.S. Securities and Exchange Commission (SEC) approved new listing standards for commodity-based exchange-traded products (ETPs). The move simplifies how exchanges like Nasdaq and NYSE Arca can launch crypto-linked funds, potentially opening the door for altcoin ETFs.

Grayscale has already filed for a spot Cardano ETF, and prediction markets now price the odds of SEC approval at more than 90%. A decision deadline looms in October. If approved, the ETF could attract institutional inflows into ADA, similar to how Bitcoin and Ethereum ETFs boosted demand in earlier cycles.

Analysts argue that even the anticipation of approval may strengthen bullish sentiment, while a rejection could temporarily weigh on the price.

RSI Reading Leaves Room for ADA to Extend Rally

Cardano is currently trading near $0.91, just below the crucial resistance range between $0.92 and $0.94. A decisive breakout above this level could confirm the continuation of its bullish structure.

ADA price has managed to hold above its 20, 50, 100, and 200-day exponential moving averages, which are clustered between $0.76 and $0.88. This alignment signals strong underlying momentum and reinforces the bullish case for further gains.

Since July, ADA has been moving within an ascending channel, with the lower boundary providing consistent support around $0.85. If this channel holds, the immediate upside target could extend toward $1.10.

Momentum indicators also support the view that ADA token has room to climb further. The Relative Strength Index (RSI) is currently at 56.8, which shows neutral momentum. This reading suggests that the market is not yet overbought, leaving space for continued upward movement before hitting potential exhaustion.

The combination of Javon Marks’ $5–$8 projection, surging futures open interest, and a pending ETF decision places Cardano at a pivotal moment. Technical indicators show ADA building strength inside an ascending channel, but the $1.00 level remains the first critical test.

Should ADA price break higher, momentum from derivatives traders and potential ETF approval could validate Marks’ bold outlook. If rejected at resistance or met with regulatory delays, ADA may consolidate further before attempting another move.