Chainalysis reports $75 billion in seizable crypto on public blockchains. The estimate covers funds linked to illicit crypto activity. It arrives while US Bitcoin Reserve discussions continue.

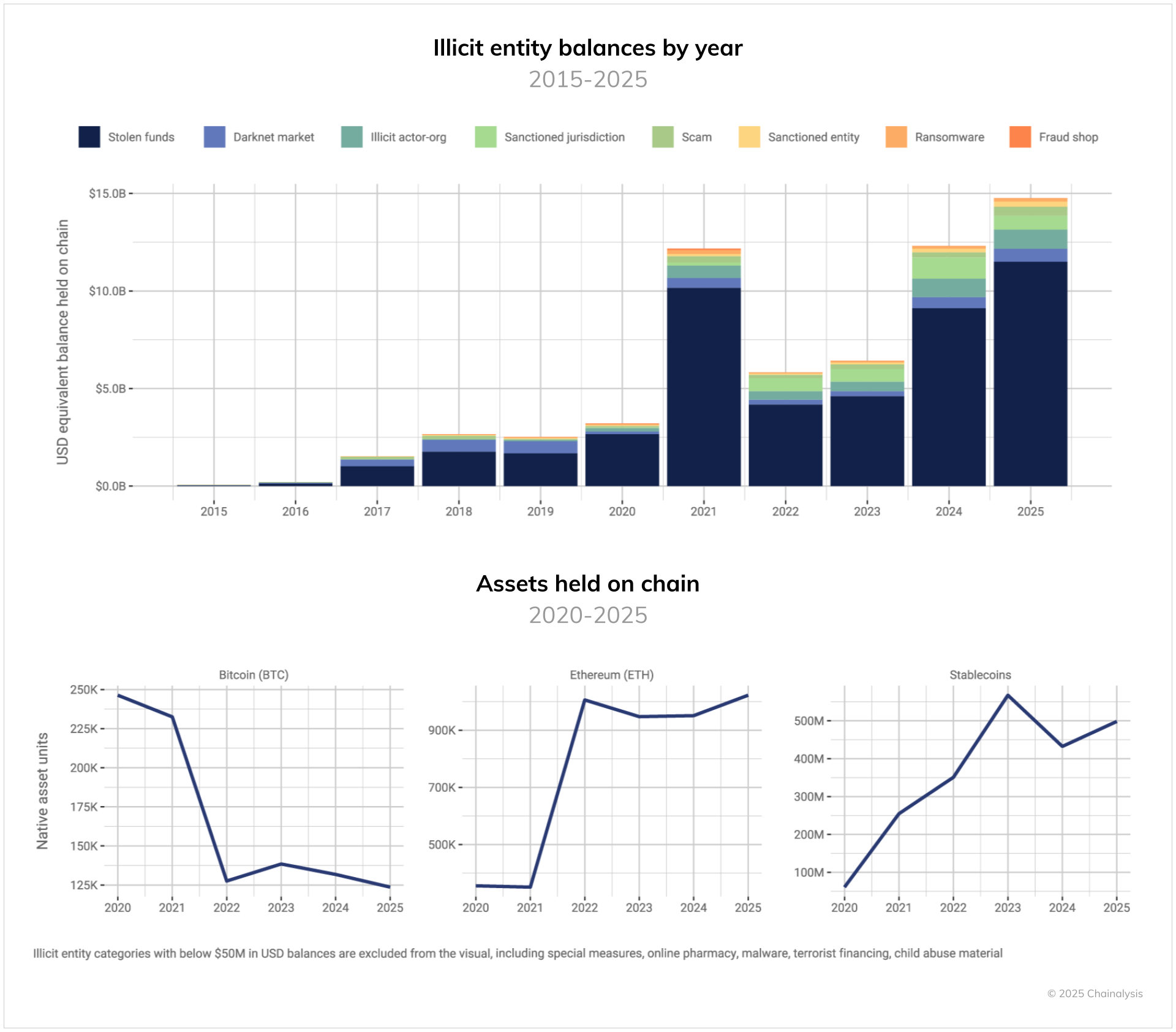

The split includes about $15 billion at illicit entities. It also includes over $60 billion held in wallets with downstream exposure. Chainalysis says the totals rely on entity attribution and clustering.

The research presents current onchain balances, not projections. It frames asset forfeiture as a practical question, not theory. Therefore, it intersects with the Digital Asset Stockpile idea now under review.

Illicit crypto mix — Bitcoin share, stablecoins rise, stolen assets

About 75% of the illicit crypto value sits in Bitcoin (BTC). However, stablecoins take a growing share of flows. Chainalysis highlights the shift in the asset mix.

Stolen assets form the largest category in the holdings. The data includes exchange and service compromises. It also captures follow-on movements across chains.

Darknet markets account for a major block of balances. Chainalysis attributes more than $40 billion to operators and vendors. The figure underscores concentration within a few clusters.

Asset forfeiture pathway — US Bitcoin Reserve, Digital Asset Stockpile

The US Bitcoin Reserve and Digital Asset Stockpile proposals remain active. Policymakers examine asset forfeiture as a budget-neutral path. Chainalysis positions the onchain view as enabling evidence-based action.

The report states:

“[T]he cryptocurrency ecosystem presents law enforcement with an unprecedented opportunity: billions of dollars in illicit proceeds are sitting on public blockchains and are theoretically seizable if authorities can coordinate action.”

The remark links seizable crypto to interagency process.

Co-founder Jonathan Levin told Bloomberg the data lifts asset forfeiture to “a completely different level.” He added, “It does change how countries think about that.” The Bloomberg interview ties the figures to policy planning.

Enforcement snapshot — Canada TradeOgre seizure, process and reaction

Authorities in Canada seized about $40 million in digital assets from TradeOgre. Officials cited unregistered activity and money laundering risks. The case shows how asset forfeiture proceeds when legal thresholds are met.

The TradeOgre action drew community criticism. Some users argued the steps exceeded regulatory bounds. The exchange case illustrates tension between access and compliance.

Process remains case-specific and evidence-driven. Outcomes depend on venue rules and cooperation. Nevertheless, blockchain transparency supports tracing for courts and agencies.

Scale context — 0.14% illicit transactions, UNODC comparison, transparency

Chainalysis reports 0.14% of all 2024 volume as illicit transactions. The share has trended lower in recent years. The metric reflects tagged flows across networks.

For comparison, UNODC estimates 2%–5% of global GDP laundered through traditional finance. The baseline off-chain number is much larger. Methods differ, but the contrast is clear.

Blockchain transparency shapes perception and reporting. Public ledgers make funds visible and traceable. As a result, illicit crypto appears prominent, yet measurement stays granular.

Policy intersection — reserves, stablecoins, exchanges under scrutiny

The US Bitcoin Reserve debate runs alongside rising stablecoins usage. The seizable crypto mix spans BTC and dollar-pegged tokens. Therefore, enforcement and reserves may overlap in practice.

Exchanges remain core to compliance controls. Registration and AML records drive investigations. Cases like TradeOgre place focus on platform obligations.

Chainalysis’ $75 billion figure informs planning and cooperation. Agencies map clusters, track downstream exposure, and assess stolen assets. The data supports tasking for cross-border teams and evidence handling.