Traders forecast a rally toward $30 for Chainlink (LINK) by the end of September as the token traded near $24 today, Sept.12. Their conviction is tied to recent corporate adoption, the growth of Chainlink’s reserve, and speculation over a potential LINK exchange-traded fund (ETF). Technical signals also align with this bullish outlook.

Trader Calls for $30 With Strong Conviction

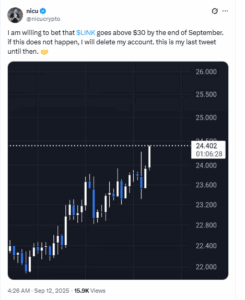

Crypto trade Nicu declared on X that LINK would hit $30 before September ends, even pledging to delete his account if wrong. While such statements often sound like bravado, they usually show strong conviction tied to market conditions.

In this case, traders are not betting blindly. They see a convergence of developments — corporate moves, reserve growth, and ETF speculation — that create a strong backdrop, supportive of higher LINK prices.

On Sept. 9, Nasdaq-listed wealth manager Caliber announced that it had added LINK tokens to its corporate treasury. The firm became the first U.S. public company to adopt a LINK-focused strategy.

For traders, this matters because it resembles how Bitcoin entered corporate finance in 2020, when firms like Strategy (formerly MicroStrategy) added BTC to their balance sheets. The move validated Bitcoin’s role beyond speculation. Now, with Caliber’s treasury addition, LINK is starting to gain similar recognition. Traders view this as proof that Chainlink is maturing into an asset that institutions may hold long term.

Strength of Chainlink Reserve Creates Bullish Signals

Chainlink’s own strategic reserve has also grown in recent months. By September, it held 280,049 LINK worth about $6.8 million, with an average cost basis of $22.44 per token.

The reserve is funded by the project’s revenue streams, both on-chain and off-chain. This means that the tokens are accumulated organically through usage of the Chainlink network. For traders, this creates two bullish signals: it locks tokens out of open circulation, reducing supply pressure, and it shows the network is profitable enough to sustain a reserve.

Chainlink also entered the U.S. regulatory discussion after Grayscale filed an S-1 registration with the Securities and Exchange Commission (SEC) for a Chainlink ETF. Approval is far from guaranteed, but the filing itself has symbolic weight.

In past cycles, ETF filings for Bitcoin and Ethereum boosted institutional interest and drove significant inflows once approved. Traders now view the possibility of a LINK ETF as another layer of legitimacy, one that could attract larger pools of capital into the asset. This narrative supports confidence in bullish targets like $30.

LINK Chart Structure Supports $30 Prediction

On the TradingView daily chart, LINK price trades within an upward channel that started in July. The lower boundary of this channel sits near $24, which has acted as strong support in recent sessions. Holding this level keeps the uptrend intact.

The next resistance zone is between $27 and $28, where LINK previously faced rejection. A breakout above this level would leave the psychological $30 target as the next upside marker.

Momentum indicators support the bullish case. The Relative Strength Index (RSI) stands around 56, showing positive momentum without overbought pressure. LINK also trades above both the 20-day and 50-day exponential moving averages (EMAs), suggesting that buyers remain in control.