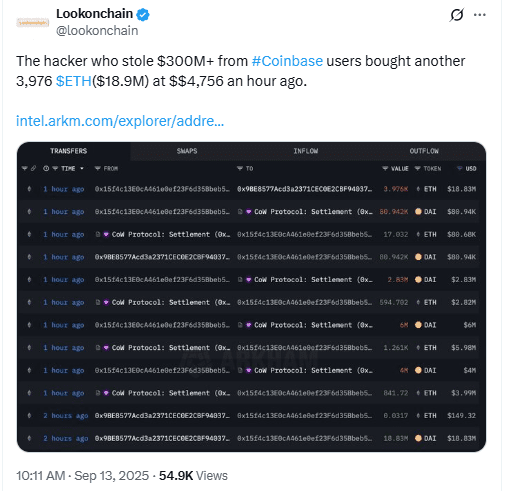

A wallet linked to the Coinbase hacker bought 3,976 ETH for $18.9 million on Saturday. The address paid about $4,756 per ETH, according to onchain data. The Ethereum price pushed above $4,700 that day and printed a local high near $4,763.

Coinbase Hacker Buys 3,976 ETH at $4,756 — Onchain Data

The wallet used 18.911 million DAI to fund the ETH purchases. Transfers arrived in several chunks before the orders hit the market. The inflows ranged from $80,000 to $6 million.

The address then executed multiple buys rather than one sweep. Each ETH transaction is visible on public block explorers. The activity shows a staged accumulation using stablecoin liquidity.

The move coincided with ETH trading near a two-week high. During the session, Ethereum crossed $4,700 and reached about $4,763. Later in the day, ETH hovered near $4,718, up 4.5% on the day.

Arkham Intelligence, Lookonchain Track ETH Buys and DAI Funding

Arkham Intelligence flagged the Coinbase hacker wallet as the ETH orders were prepared. The platform’s labels link the address to prior movements. The latest flow reused the same stablecoin routing.

Lookonchain posted a chart of the address’s transfers and swaps. The visualization mapped the DAI consolidation and the subsequent ETH buys. It highlighted the hour-by-hour sequence.

Analysts have tracked this wallet since earlier this year. It is reportedly tied to a $300M+ social-engineering campaign that targeted Coinbase users. In May, ZachXBT wrote, “Our number is likely much lower than the actual amount stolen as our data was limited to my DMs and thefts we discovered onchain.”

Previous Trades: Solana Purchase and July ETH Accumulation

The same address bought about $8 million in Solana (SOL) last month. The buys came across several orders. SOL later traded below the reported entry.

Earlier, in July, the wallet added 4,863 ETH for about $12.55 million. It also purchased 649 ETH for roughly $2.3 million. The average price then was near $3,562 per ETH.

Across these dates, the flows follow a similar pattern. Funds move in via DAI. Orders then execute in batches and settle into holdings.

Hyperliquid Trader’s $303M ETH Long Delivers $6.86M Realized Profit

Separately, a trader on Hyperliquid turned $125,000 into a large leveraged long on ETH. Over about four months, the position expanded through compounding and high leverage. The notional size reached $303 million.

At one point, the trader’s equity peaked near $43 million. As conditions cooled, the account unwound a 66,749 ETH long. The reduction occurred before a broader reversal.

The trader exited with $6.86 million in realized profit. That outcome equals roughly 55x the initial deposit. The sequence is documented on Hyperliquid trade data and community trackers.