Dash (DASH) price surged over 27% on Oct. 10 to reach around $44.6, extending its explosive rally from late September 2025. The token has climbed over 146% in just two weeks, marking its strongest performance since 2021.

The rally helped the DASH USD pair reach levels it last saw in December 2024. However, the move lacked any apparent project-specific trigger, except for maybe increased use cases and marketing. The most recent spike likely came due to renewed attention on privacy-focused cryptocurrencies.

The momentum appeared to build after the Ethereum Foundation’s recent post defending digital privacy rights reignited interest in assets like Zcash and Dash.

Analysts Double Down on Structural Breakout

Dash’s technical structure reinforced the broader privacy-led momentum that drove the token higher through early October 2025. Market analysts shared charts suggesting that Dash’s rally marked more than a passing speculative move. Instead, it appeared to be the early phase of a structural turnaround after years of decline.

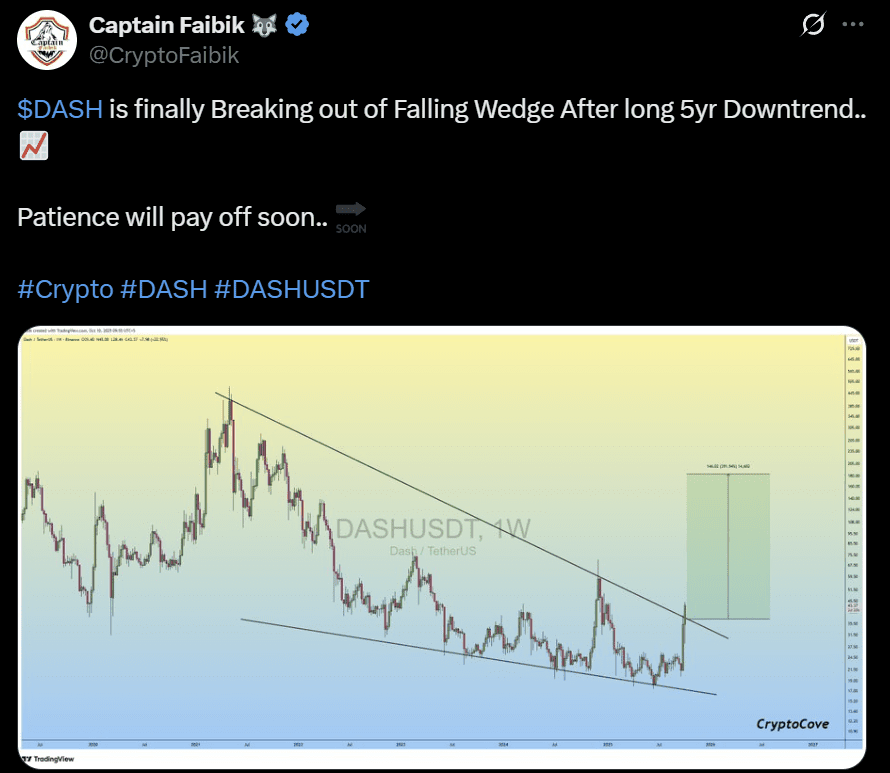

For instance, independent analyst Captain Faibik emphasized that DASH price had broken out of a five-year falling wedge. This is a formation that often precedes trend reversals.

Faibik’s weekly chart showed a decisive breakout candle above the upper trendline, accompanied by rising momentum and volume. The analyst projected the next major resistance zone between $140 and $180. He also noted that patience could pay off as the pattern completed its long consolidation phase.

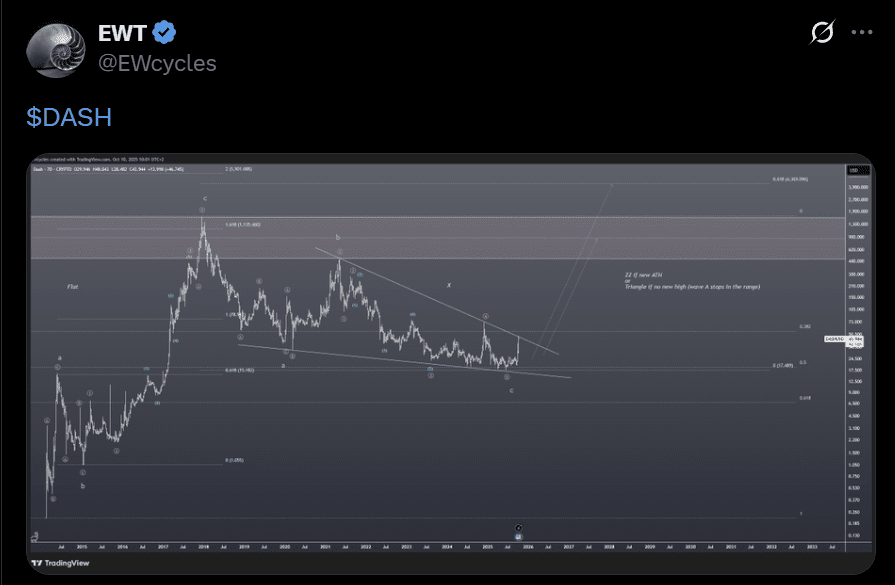

Meanwhile, market watcher EWT took a more long-term view using Elliott Wave structures. The analyst’s multi-year chart suggested that Dash price had likely finished its corrective cycle within a large flat pattern. This was a rebound from a key support zone near $15.

The setup placed Dash at the beginning of a potential wave advance, with an initial target range between $105 and $150. Moreover, EWT’s chart also outlined an alternative scenario where the structure evolved into a triangle if the breakout failed to register a new high.

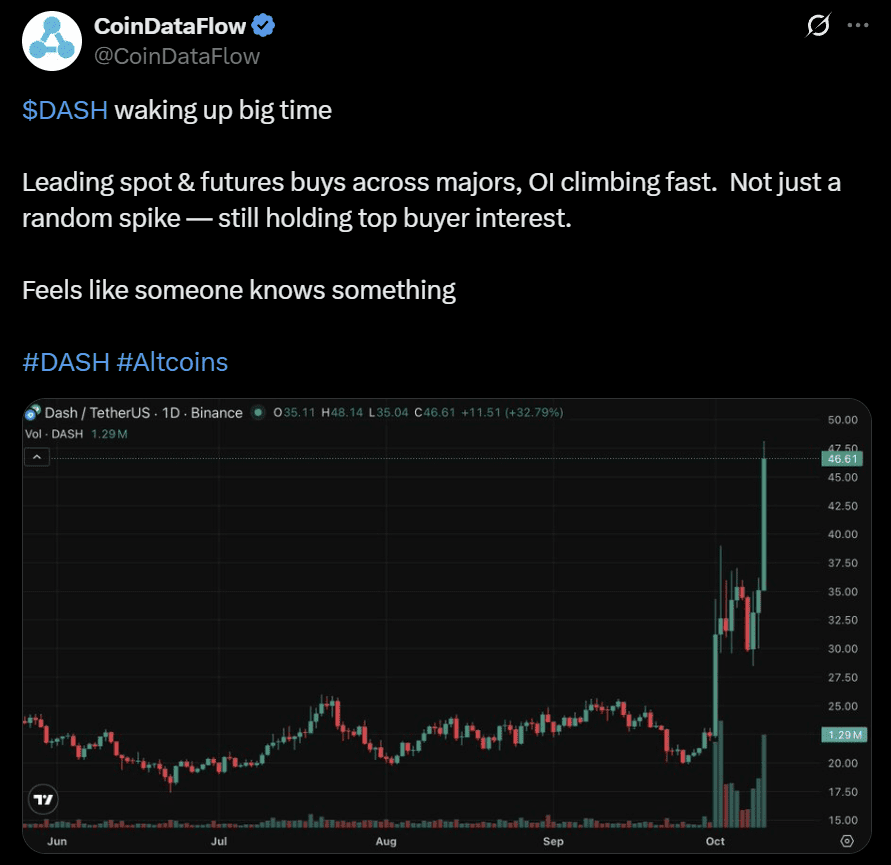

CoinDataFlow approached the rally from a market activity perspective. This highlighted a surge in spot and futures buying across major exchanges.

The post noted Dash’s growing open interest, implying that institutional and high-volume traders were positioning early. The combination of structural breakouts, historical reversals, and fresh volume spikes pointed to a recovery built on strengthening conviction rather than short-term speculation.

Broader Reach and Privacy Focus Drive Dash’s Rally

Dash’s rally was built on more than technical structure. The token’s renewed visibility among traders likely started as a mix of increasing adoption, capital rotation, and revived interest in older projects with real-world use cases. As newer altcoins consolidated, investors appeared to reallocate capital toward established networks with proven infrastructure and merchant reach.

An X user, TacoClown ICP, highlighted Dash’s expanding footprint. He cited acceptance with more than 265 exchanges and brokers, and over 159,000 merchants and services worldwide.

The post emphasized Dash’s instant, one-second transaction speed and borderless payment system, framing the project as one of the few networks still active in retail crypto payments. The metrics underscored that Dash’s utility narrative had quietly strengthened even before the October surge.

The second leg of the rally likely drew fuel from the broader privacy discussion reignited by the Ethereum Foundation’s recent post advocating digital privacy as a basic right. The statement pushed privacy-oriented assets such as Zcash and Dash into the spotlight, sparking a coordinated price reaction across the sector.

Traders viewed Dash’s hybrid profile — a payments-focused network with privacy features — as a middle ground between usability and confidentiality.

A government-backed attack on Binance founder CZ? Read here to know more