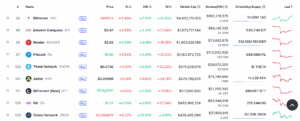

ZBCN has quickly recovered from its Oct. 11 crash, triggered by former U.S. President Donald Trump’s renewed tariff threats on China. The token surged nearly 19% in the past 24 hours following the broader DePIN rally fueled by renewed AI and infrastructure momentum. It outperformed other top DePIN tokens such as Theta Network (THETA), Render (RENDER), and Filecoin (FIL), which gained between 2% and 6% over the same period.

So, does ZBCN really have the potential to grow further? Read this analysis to know.

Understanding ZBCN and Zebec Network

Zebec Network is a blockchain platform built to make real-time payments and payroll streaming possible using digital currencies. Moreover, it aims to connect traditional finance with blockchain by allowing users and businesses to send, receive, and manage funds instantly.

Its native token, ZBCN, powers the entire ecosystem. It is used for governance, staking, transaction fees and rewarding users who help the network grow.

Zebec also operates within two fast-growing sectors — Real-World Assets (RWA) and Decentralized Physical Infrastructure Networks (DePIN). These are areas where blockchain is linked with real-life applications such as payments, infrastructure, and data storage.

What Could Drive ZBCN’s Growth?

1. A Deflationary Model That Builds Value Over Time

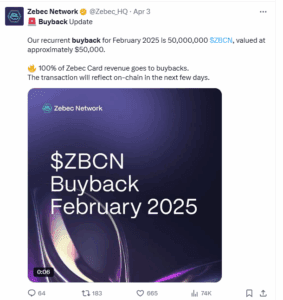

Zebec has designed ZBCN to become scarcer as the network grows. The project runs a monthly buyback and burn program that removes tokens from circulation using revenue earned from Zebec Cards and transaction fees.

This means the more people use Zebec’s payment and payroll services, the more tokens are burned. As supply shrinks and usage increases, the value of each token could rise. Zebec’s past buybacks already removed more than 50 million ZBCN, and the network aims to cut total supply by 10–12% each year through this process.

2. Zebec Network Expansion and Real-World Integration

Zebec is expanding beyond crypto circles. Its acquisition of Science Card, a fintech company in the UK, allows users to spend digital assets directly and link blockchain payments with traditional banking.

This move connects Zebec to a broader audience and helps make crypto spending practical in the real world. The project’s focus on Real-World Assets (RWA) and Decentralized Physical Infrastructure Networks (DePIN) shows it wants to build utility, not just rely on speculation.

3. Favorable Market Conditions

ZBCN’s growth this week also shows broader strength in the DePIN and AI-linked infrastructure sector. According to market data, AI and blockchain infrastructure tokens saw strong gains after renewed interest in high-performance computing projects and increased liquidity in the Binance ecosystem.

Binance’s monthly futures volume rose to $2.55 trillion, its highest in 2025, signaling that institutional and retail traders are actively returning to infrastructure-related assets. ZBCN benefited directly from this sector-wide rally, which pushed several DePIN tokens higher despite overall crypto market volatility. If these trends continue, projects like Zebec that blend DePIN with payments could remain in the spotlight.

4. Strong Technical Base For ZBCN

ZBCN’s price chart supports the improving outlook. The token has broken out of a descending channel, a pattern that often signals the end of a prolonged correction. It is currently trading above key moving averages, including the 50-day and 200-day EMAs — a sign of medium-term strength.

Momentum indicators such as the Relative Strength Index (RSI) are near 55, showing that the market is neither overbought nor oversold. If the price holds above $0.0040, analysts expect ZBCN price to test resistance near $0.0060, with possible upside toward $0.0070 if volume continues to rise.

The Risks Still Remain

However, despite the bullish signals, ZBCN’s growth is not guaranteed. Here are some of the main challenges:

-

Sustaining demand: If usage of Zebec Cards and payment services slows down, buybacks could shrink and reduce deflationary pressure.

-

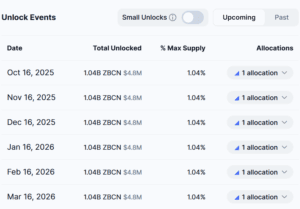

Token unlocks: Large token releases from team or investor allocations may add short-term selling pressure.

-

Competition: Zebec faces strong rivals in both the DePIN and payments sectors, such as Render, Filecoin, and Theta.

-

Market volatility: Like most altcoins, ZBCN remains sensitive to global macro trends and investor sentiment.