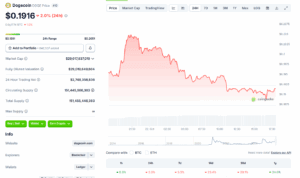

Dogecoin (DOGE) is trading near $0.19, down 1 % in 24 hours, 7 % this week, and over 20 % this month as escalating geopolitical tensions and a weakening global economy weigh heavily on risk assets. Amid this drawdown, one analyst argues the Dogecoin bull run has yet to start.

Dogecoin Is in Accumulation Phase

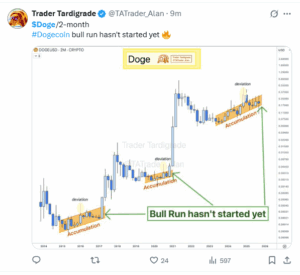

Crypto market analyst Trader Tardigrade shared a two-month DOGE price chart on X, showing repeating cycles of accumulation and deviation since 2016.

In crypto markets, “accumulation” refers to periods when long-term holders and institutions quietly build positions before volatility resumes. Tardigrade’s chart indicates DOGE remains in that accumulation zone—similar to setups that preceded major rallies in 2017 and 2021.

He noted that the next phase, or “deviation,” begins only when price breaks out of the upper band of the range.

For Dogecoin, that breakout point sits near $0.25, suggesting the current structure is preparatory rather than fully bullish.

This perspective aligns with recent technical readings that show muted momentum even as institutional initiatives around Dogecoin expand. On Oct. 20, the House of Doge, a Dogecoin-affiliated corporate entity, acquired a majority stake in Italian football club U.S. Triestina Calcio 1918.

The partnership, completed alongside Brag House Holdings, makes House of Doge the club’s largest shareholder. The agreement allows Dogecoin payments for tickets, merchandise, and concessions, marking one of the first full integrations of a memecoin into a European professional sports organization.

Derivatives Data Support Base Formation

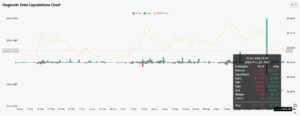

Derivatives data suggest traders are staying cautious rather than capitulating. Dogecoin’s total liquidations on Oct. 22 reached about $5.18 million in long positions versus $193 000 in shorts, mainly across Binance and Bybit.

Liquidations occur when traders’ leveraged positions are force-closed by exchanges, often revealing shifts in market sentiment. The limited short liquidation volume shows reduced panic, consistent with gradual position-trimming.

DOGE’s futures open interest—the total value of active contracts—stands near $1.85 billion, down from $3 billion earlier this month.

Falling open interest generally indicates traders closing positions rather than adding new leverage, which supports the idea of an ongoing consolidation phase.

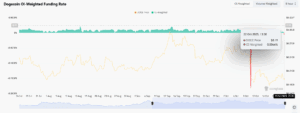

Meanwhile, the OI-weighted funding rate, which reflects the cost of holding leveraged long or short positions, sits around -0.004 %.

A negative rate means long traders are paying funding fees to shorts, showing mild bearish bias but also resetting excessive optimism.

Historically, such neutral readings have preceded accumulation stages that eventually lead to stronger directional moves.

DOGE Holds Support as Traders Await Breakout Confirmation

Technically, Dogecoin price is below its 20-day Exponential Moving Average (EMA) of $0.20 and its 50-day EMA of $0.22, confirming short-term weakness.

The Relative Strength Index (RSI)—a momentum indicator measuring the speed and magnitude of price changes—sits near 39, signaling limited buying pressure and mild oversold conditions.

A decisive close above $0.25 could validate Tardigrade’s thesis and target $0.30 to $0.32. Conversely, a drop below $0.18 may extend losses toward $0.16, keeping DOGE in a sideways trend. Separately, 21Shares has amended its S-1 filing for a spot Dogecoin ETF under the ticker TDOG, with Coinbase Custody listed as custodian.

The product remains under SEC review following delays from the U.S. government shutdown. If approved, it would make Dogecoin the first memecoin to enter U.S. spot ETF markets — a step that could broaden institutional exposure once regulatory clarity improves.