Dogecoin (DOGE) traded at $0.1847 on Oct. 30, down 6% in the past 24 hours, as analysts warned that defending the $0.18 support is crucial for bulls to maintain the memecoin’s long-term uptrend. Analysts say this zone could determine whether DOGE maintains its long-term ascending trend or risks a breakdown below the channel.

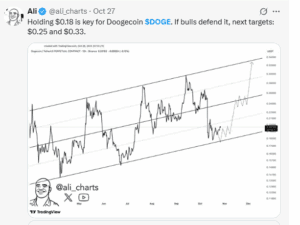

Analyst Ali Martinez highlighted $0.18 as the defining level for Dogecoin price’s next move. The memecoin has repeatedly rebounded from this support since early 2025, forming the base of an ascending channel that extends toward resistance levels at $0.25 and $0.33. Martinez noted that holding this structure could validate the next bullish leg within that broader pattern.

The daily chart shows Dogecoin trading inside an ascending parallel channel, with the lower boundary aligning closely with the $0.18 support. The upper resistance lies near $0.33, consistent with Martinez’s target range.

DOGE Technical Indicators Hint at Potential Reversal

Dogecoin’s short-term momentum remains weak, with the price trading below its key exponential moving averages.

This setup indicates that bulls must reclaim the $0.20–$0.21 zone to confirm renewed strength. Meanwhile, the Relative Strength Index (RSI) has dropped to 38.22, approaching oversold territory — a region that often precedes short-term reversals if buying pressure returns.

Based on the ascending channel structure and RSI positioning, a rebound from $0.18 could trigger a short-term move toward $0.25, aligning with mid-channel resistance. Sustained momentum beyond that could lift DOGE toward $0.33, the upper boundary of the pattern and a previous rejection zone from April and July 2025.

Conversely, a daily close below $0.18 would invalidate the bullish channel setup and increase the likelihood of a retracement toward $0.16, where Dogecoin last consolidated before its August rebound.

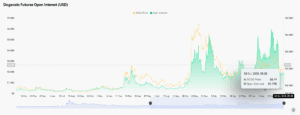

Derivatives Show Neutral to Bullish Positioning

Additionally, besides technical setup, derivative data shows neutral positioning. Dogecoin’s open interest (OI) stood at $1.79 billion, a sharp decline from earlier peaks above $4 billion in September. The fall suggests lower speculative leverage, which often stabilizes markets and reduces volatility risk.

The funding rate remained slightly positive at +0.0036%, showing balanced sentiment among long and short traders. Such neutral positioning typically indicates that traders are waiting for confirmation before placing directional bets.

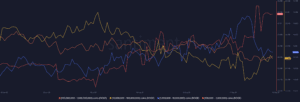

On-chain data from Santiment shows diverging trends among Dogecoin’s largest holder groups. Wallets holding between 100 million and 1 billion DOGE have gradually increased accumulation. On the other hand, medium-sized addresses holding between 1 million and 100 million DOGE have reduced exposure since mid-September.

Moreover, this redistribution indicates that larger holders are positioning near the lower boundary of Dogecoin’s ascending channel, potentially viewing current levels as a buying opportunity. Historically, similar accumulation by high-value wallets has preceded local rebounds in DOGE’s price momentum.