Dogecoin (DOGE) is trading at $0.195, down nearly 1% in the past 24 hours. However, the token remains up 17% over the past year, outperforming its meme-coin rivals Shiba Inu (SHIB) and Pepe (PEPE), which are down 45% and 27%, respectively.

Now, analysts are turning bullish again. One analyst on X described the setup as the “resurrection of the meme coin,” predicting that a decisive move above $0.218 could trigger a rally toward $0.50, provided the breakout is supported by strong trading volume.

DOGE Consolidates Above Key Support, Eyes $0.218 Break

The TradingView chart shows Dogecoin trading within a broad ascending channel that has defined its price structure since early 2025. The lower boundary near $0.18 has repeatedly served as a strong support zone. The upper range near $0.30 marks the next major resistance region.

The coin currently trades below a dense cluster of exponential moving averages — the 20-day EMA at $0.2037, 50-day at $0.2172, 100-day at $0.2183, and 200-day at $0.2199.

This narrow convergence between $0.217 and $0.220 reinforces the analyst’s claim that $0.218 is the crucial level to watch. A daily close above it would confirm a trend reversal and could set the stage for a sustained upward movement toward the top of the channel.

RSI and Funding Rate Indicate Accumulation, Not Exhaustion

The Relative Strength Index (RSI) currently sits around 43, placing Dogecoin in a neutral zone. This reading shows that neither buyers nor sellers are in control. This suggests that the market may be in an accumulation phase rather than an exhaustion period. The RSI reset from earlier overbought levels has created room for potential upward expansion once momentum returns.

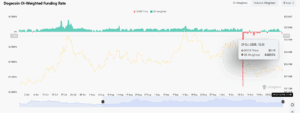

CoinGlass funding data also aligns with this outlook. Dogecoin’s open-interest-weighted funding rate stands near -0.005%, indicating a slight short bias among traders.

Historically, such setups have preceded quick upward spikes as short positions get liquidated when price breaks resistance. This is a dynamic that could add further fuel if DOGE price clears the $0.218 threshold.

Ecosystem Growth and ETF Odds Boost Long-Term Confidence

Dogecoin’s broader ecosystem has expanded considerably in recent weeks, supporting the analyst’s bullish projection. On Oct. 23, KuCoin launched KuPool, a mining service that includes Dogecoin and Litecoin. This addition enhances the coin’s proof-of-work infrastructure and strengthens network participation within the KuCoin ecosystem.

On Oct. 15, Thumzup Media, which holds approximately 7.5 million DOGE, announced that it had started testing Dogecoin-based user payouts in its social engagement app. The company aims to use DOGE for cross-border microtransactions. This will potentially increase the token’s real-world usage among digital creators and advertisers.

Meanwhile, the MyDoge team has proposed a Layer-2 upgrade intended to introduce scalability and smart contract features to the Dogecoin blockchain. If implemented, the upgrade could address Dogecoin’s throughput limitations, currently capped around 30–40 transactions per second. The upgrade could help integrate more utility-driven use cases.

Also, Following the Litecoin and Hedera ETF debuts, speculation around a Dogecoin ETF intensified. The market recalled comments made earlier in January 2025 by Bloomberg ETF analyst Eric Balchunas, who said Dogecoin had a 75% probability of being among the next altcoins to secure approval after Bitcoin.

Further Reading: Will a Dogecoin ETF Be Next — And Can It Push DOGE Higher?

$0.50 DOGE Target Hinges on Breakout Confirmation

From a technical perspective, Dogecoin remains in a sideways accumulation phase between $0.18 and $0.22, but the structure implies tightening consolidation ahead of a decisive move. A confirmed breakout above $0.218 could open the path to $0.30, and, if momentum sustains, the analyst’s $0.50 target becomes attainable in the medium term.

However, failure to break above resistance could keep the token trapped within its current range or push it toward $0.16, where the ascending channel’s lower boundary sits. In percentage terms, a rally from the current level of $0.195 to $0.50 would represent roughly a 156% upside, underscoring the risk-reward balance at this juncture.