Ethereum’s native token, Ether (ETH), has dropped by over 7.60% this week, almost hitting $4,000 at one point in time.

The drop accompanies a sudden surge in whale distribution, indicating largest ETH holders are not confident about price appreciation anymore. That has triggered analysts to make bearish calls for the second-largest crypto. Let’s have a look.

Analysts Flag Bearish Signals as Ethereum Loses Steam

Ethereum’s sharp decline pulled focus to bearish signals that had been building for weeks.

Independent crypto analyst NebraskaGooner referenced a post from late Aug. 2025, which noted that his Top Goon X indicator—which uses momentum signals and markers (green +, red X, flags) to spot trend reversals and continuations—flashed a sell-approaching alert.

The same signal had marked the top near $3,400 last year before a deep correction.

Gooner highlighted in the Sept. 22 post that the alert was unfolding after ETH rallied to the 0.786 Fibonacci retracement before reversing lower. Moreover, the analyst warned that losing the 0.236 retracement near $4,384 would leave the token vulnerable to sharper losses.

Other analysts pointed to weakening structures on broader timeframes.

Rafaela Rigo highlighted that Ethereum’s weekly chart turned bearish for the first time since April 2024, when the token traded near $1,775. The signal reflected a rejection candle alongside fading momentum on the MACD and RSI. Such flips on weekly charts tend to carry weight, since they mark broader shifts in sentiment rather than short-lived pullbacks.

Not all voices saw the move as purely negative. Michaël van de Poppe positioned the crash as a buying opportunity and argued that $3,600 to $3,900 formed the first meaningful demand zone. The analyst described the area as a potential entry point for swing traders looking ahead to the next advance.

Shorter-term views echoed that stance. Trader Lucky noted that the ETH USD pair tested the September low near $4,100 and described a rebound from that level as likely.

The mix of warnings and dip-buying hopes left Ethereum at a crossroads. The $4,100 to $3,900 zone now stood as the immediate line between renewed downside and signs of resilience.

Whale and Institutional Selling Add to Bearish Pressure

The warnings from technical analysts found support in onchain activity, where large holders moved aggressively ahead of Ethereum’s decline.

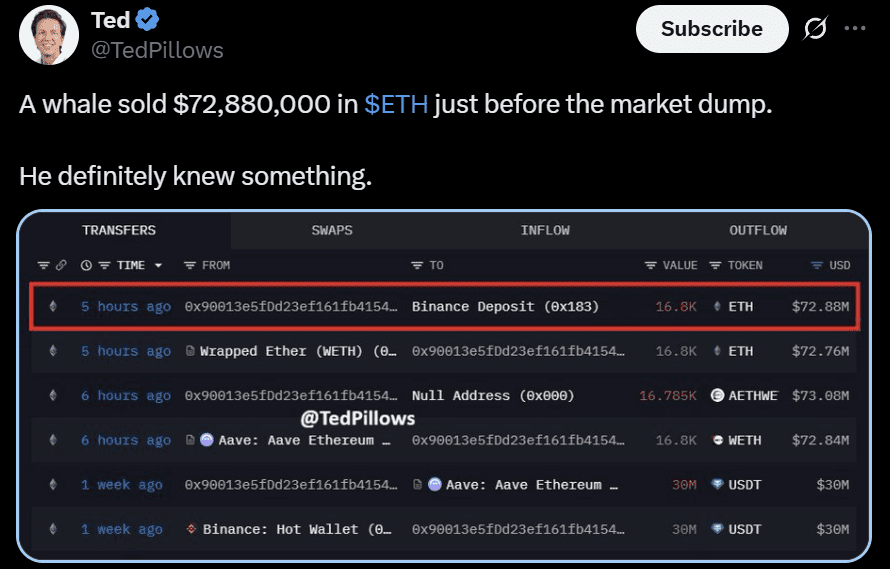

Independent analyst Ted shows that a whale transferred more than 16,800 ETH, worth nearly $73 million, to Binance just hours before the market broke lower on Sept. 22. The timing of the deposit raised concerns that insiders were positioning for weakness, adding fuel to the sell-off.

Institutional flows echoed the same caution. Blockchain trackers flagged transactions from Grayscale, which offloaded $23 million in Bitcoin and $16.5 million in Ethereum through Coinbase Prime.

The sales came as prices were already sliding, amplifying the sense that bigger players were trimming exposure rather than absorbing demand. Such actions tend to weigh on sentiment, since they suggest that both whales and funds preferred to exit into strength rather than ride out volatility.