Ethereum (ETH) price traded near $4,450 on Oct. 3 after the token spiked above $4,550 for the first time in two weeks. ETH price’s recovery gained traction as traders treated ETH as a relatively safe haven during the U.S. government shutdown.

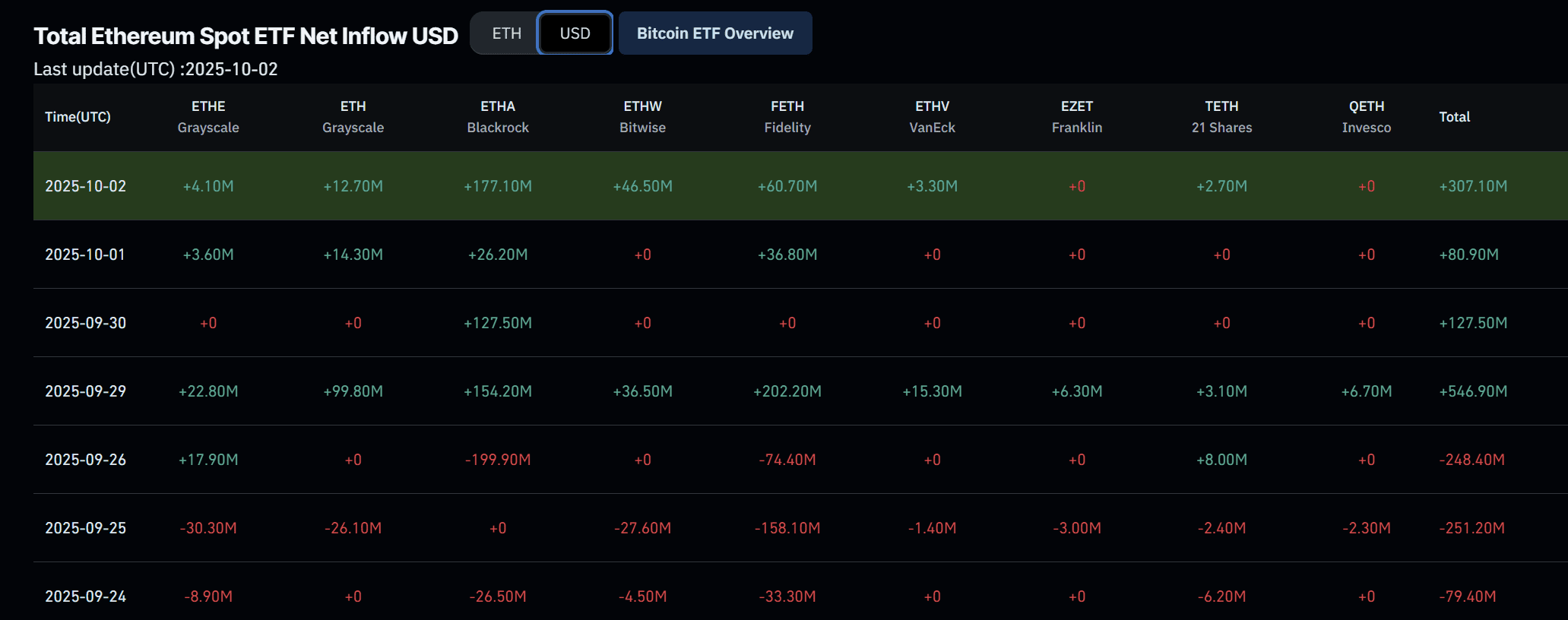

However, it seems $4,500 is still a difficult hill to climb for bulls, with bears successfully defending the resistance level. Meanwhile, spot Ethereum ETFs recorded more than $307 million in net inflows on Oct. 2, led by BlackRock and Fidelity. Analysts reinforced the bullish outlook, with The Traveling Trader and Titan of Crypto pointing to targets above $5,000, suggesting momentum could carry ETH into stronger territory in the weeks ahead.

Analysts Place Bold Targets On Rally

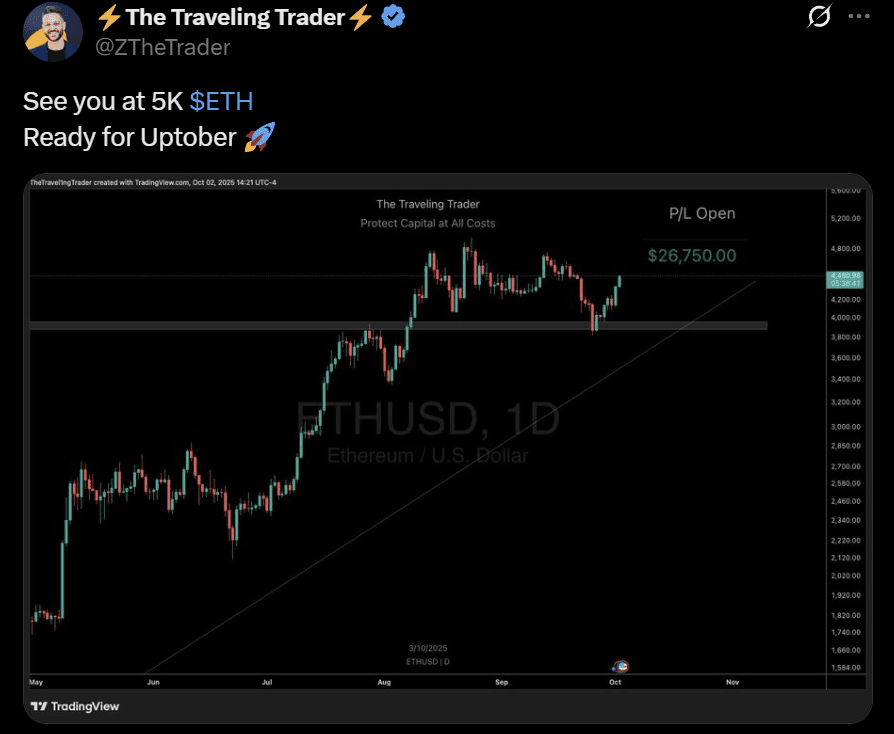

Analysts quickly linked the surge in institutional demand with aggressive technical projections. The Traveling Trader projected ETH price to reach $5,000, pointing to strong support near the $3,800 to $4,000 range.

The analyst described October as a historically favorable month for cryptocurrencies, framing the rally as likely to extend further. However, given the bearish pressure near $4,500, bulls might have their work cut out.

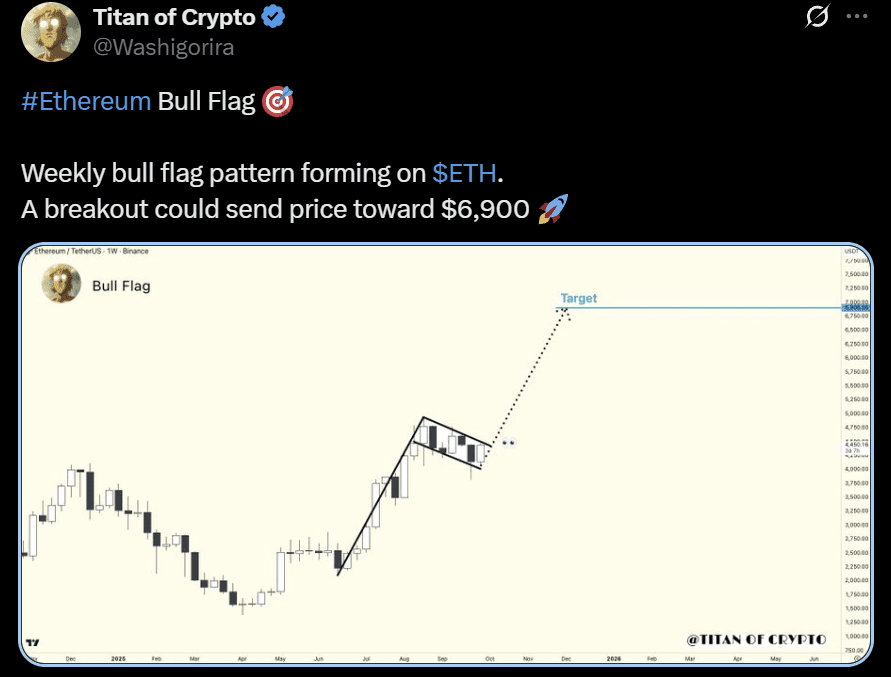

Meanwhile, another analyst, with the name Titan of Crypto on X, took a broader view. The market commentator identified a weekly bull flag pattern, arguing that a breakout could lift ETH price toward $6,900 in the coming sessions.

Titan of Crypto’s call reflected confidence that the broader uptrend, intact since midyear, remained firmly in place despite recent volatility.

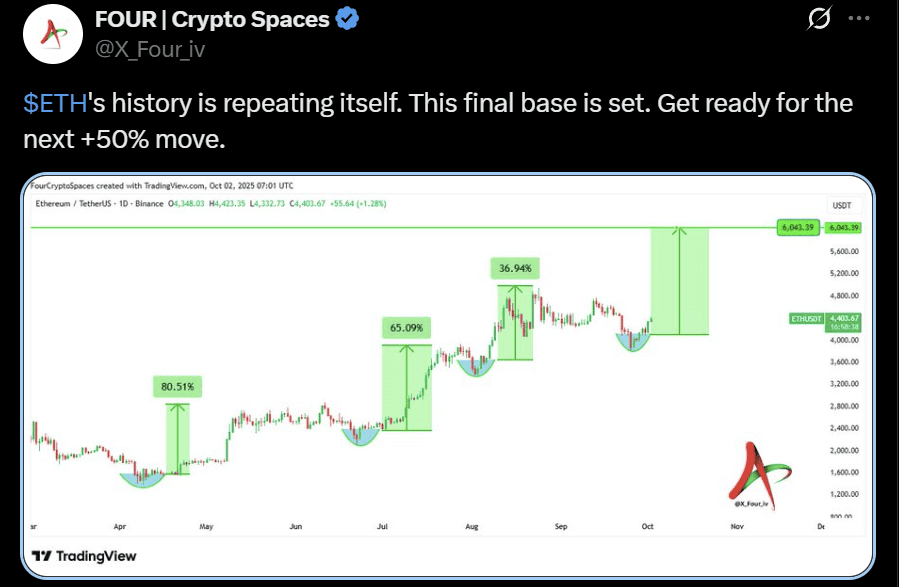

Another analyst, Four Crypto Spaces, underscored a repeating sequence of base-building rallies that previously fueled gains of 80%, 65%, and 37%.

The account projected a similar pattern now, speculating that ETH could climb more than 50% to revisit the $6,000 region. The comparison stressed rhythm and momentum as central to the token’s advance. Analyst Dr. Stoxx highlighted ETH’s movement inside a rising channel and focused on a consolidation wedge that formed within it.

Stoxx argued the structure favored a breakout higher, with price action still aligned to the larger bullish channel.

While each analyst used different methods, their calls converged on steep upside expectations. Current price action suggests $5,000 is more likely than $7,000, with the latter being a more hope-based than technicals-based projection.

Institutional Flows and Leverage Risks Drive Ethereum’s Surge

The aggressive price targets followed rising capital inflows into spot Ethereum ETFs. On Oct. 2, the products logged more than $307 million in net entries, with BlackRock and Fidelity leading the tally.

The fresh wave of institutional buying added weight to the narrative that ETH was increasingly treated as a haven asset during the U.S. government shutdown. The steady inflows also suggested that investors were positioning for longer-term exposure rather than reacting to short-term volatility.

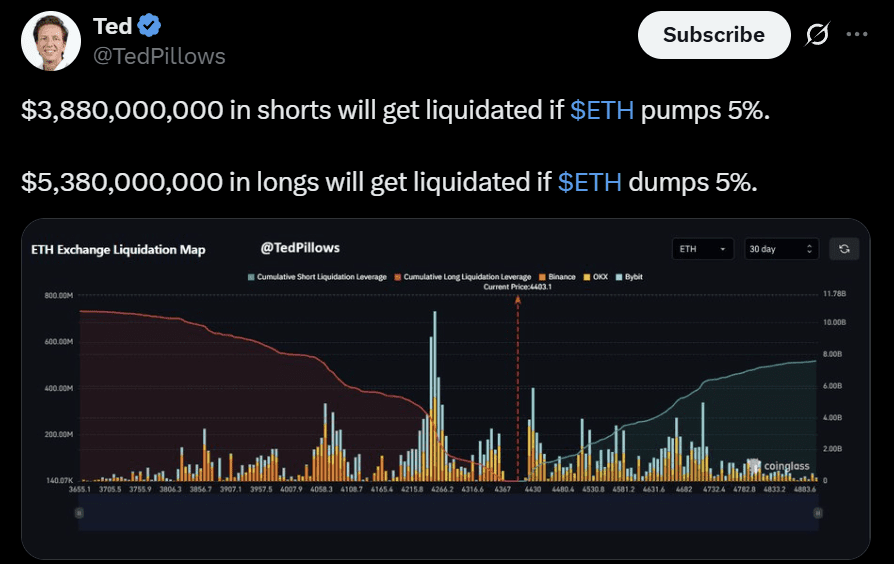

Derivatives data added another layer to the outlook. Independent analyst Ted highlighted that nearly $3.9 billion in short positions would face liquidation if ETH rose by only 5%. A similar move lower would put more than $5.3 billion in long positions at risk.

The setup left ETH vulnerable to either direction, but it also created the potential for a short squeeze if the rally extended. The prospect of cascading liquidations added momentum to the argument that institutional flows could amplify volatility rather than calm it.

The combination of steady ETF demand, safe-haven positioning, and a leveraged market created the backdrop for Ethereum’s latest advance. Each factor pointed to heightened activity, with ETF inflows supplying the base and liquidations threatening to magnify moves in both directions.

Institutional flows, technical breakouts, and leverage risks are colliding — check back for real-time updates on where Ethereum goes next.