Ethereum (ETH) price recovered past the $4,100 region on Sept. 29 as buyers rallied to extend the recent rebound. Though the momentum remained fragile, a push higher could shift market dynamics.

ETH bulls targeted the $4,200 price level to improve their chances of restarting a rally for the token. Moreover, the buildup of short liquidations above current levels suggested that any recovery might force traders to cover, amplifying upside pressure. Such a move would risk triggering a short squeeze. Analysts maintained their outlook on ETH, weighing whether the rebound could extend into stronger gains.

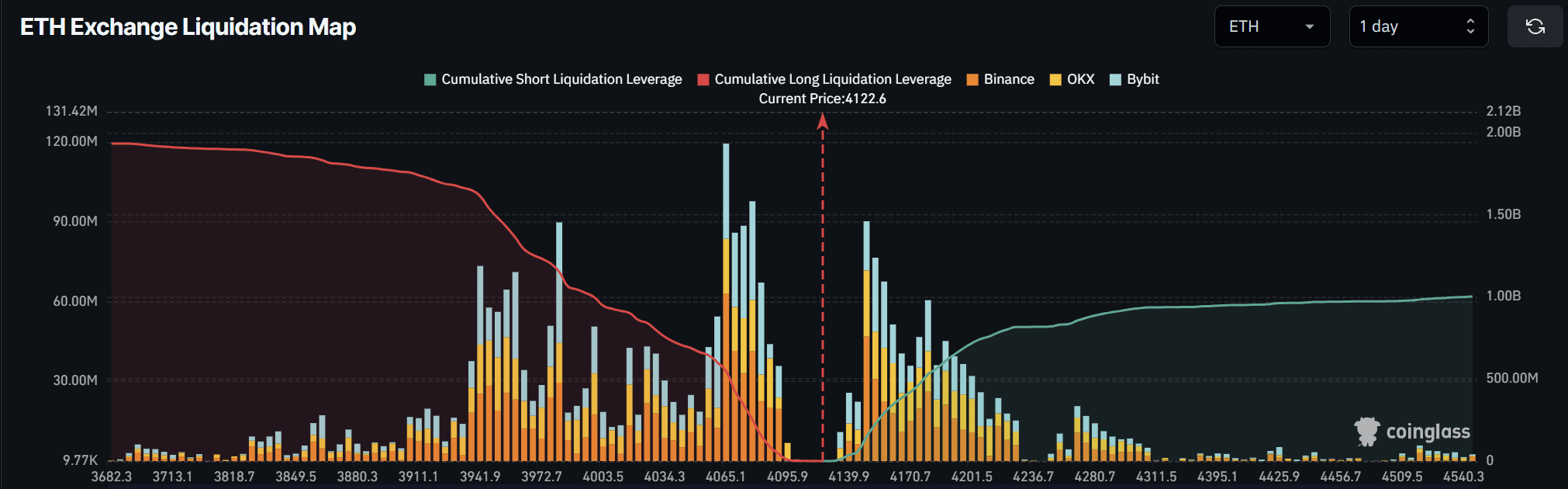

Shorts Stacked Above Current Levels Build Squeeze Risks

The weak recovery left Ethereum at a delicate point, but positioning data showed the stakes had grown heavier.

Coinglass liquidation maps revealed a sharp cluster of short liquidations just above the $4,100–$4,250 band. The alignment meant that even a modest extension higher could have forced traders out of losing bets, turning defensive exits into aggressive buy pressure. Furthermore, the data highlighted that a move above $4,200 would risk the liquidation of over $717 million in short positions.

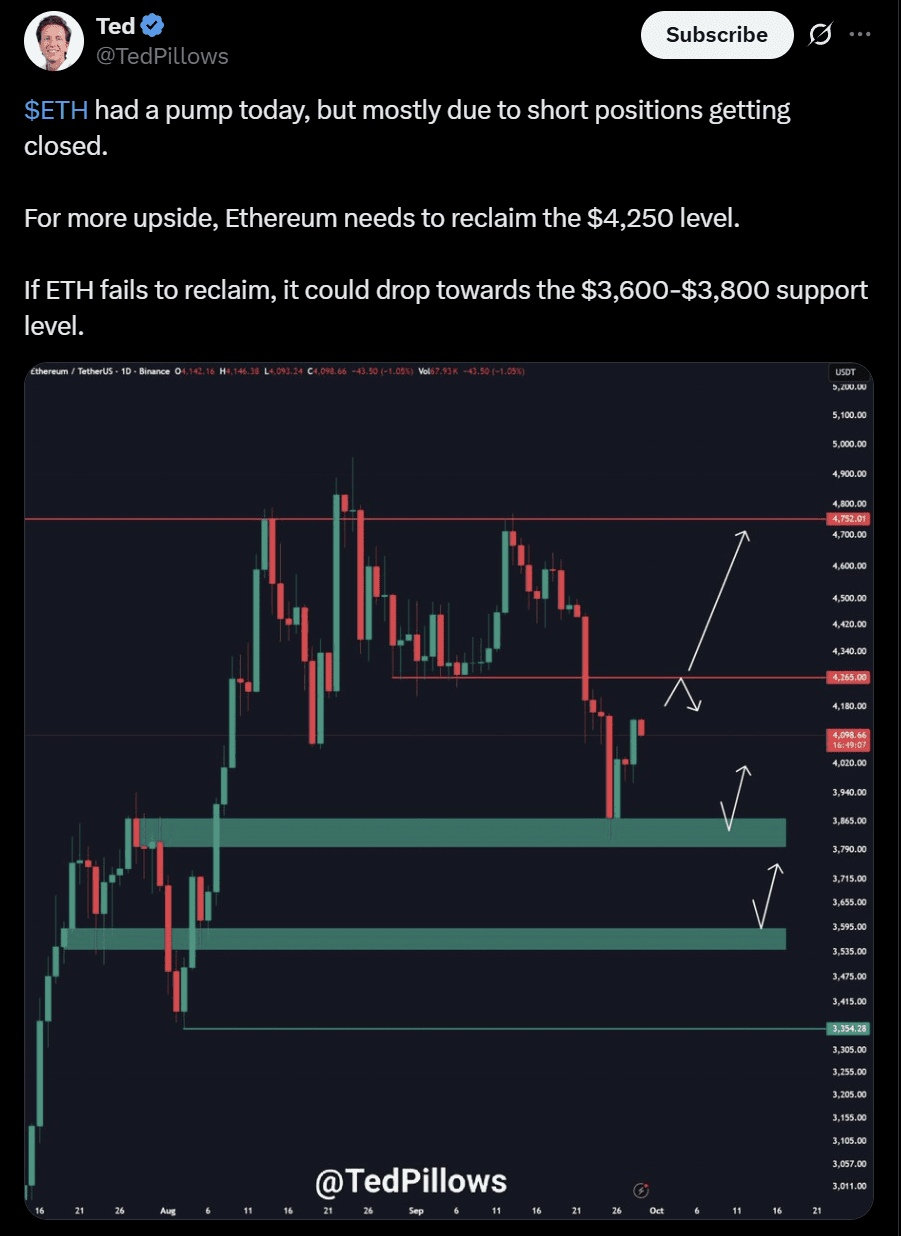

The setup was echoed in analyst Ted’s outlook on Sept. 29, in which he noted that the token’s latest uptick came mostly from shorts getting closed.

Ted stressed that ETH needed to reclaim the $4,250 region to avoid fresh downside toward $3,600–$3,800. The overlap between his chart and the liquidation heatmap added weight to the immediate picture: price gains could shift quickly if that reclaim occurred.

The combination of liquidation pressure and a visible reclaim zone shaped the near-term narrative. With shorts stacked heavily above, Ethereum only required momentum to tip the balance. Market history showed that similar setups often resulted in swift, outsized moves once liquidation levels were breached. That context explained why traders framed the bounce less as a routine recovery and more as a potential squeeze.

By late Sept. 29, ETH had not yet confirmed such a break. Still, the underlying buildup of short exposure provided a defined trigger. If momentum carried past those liquidation bands, the reaction risked flipping defensive trades into sudden fuel for a larger advance.

Analysts Split Between ETH Recovery Claims and Correction Warnings

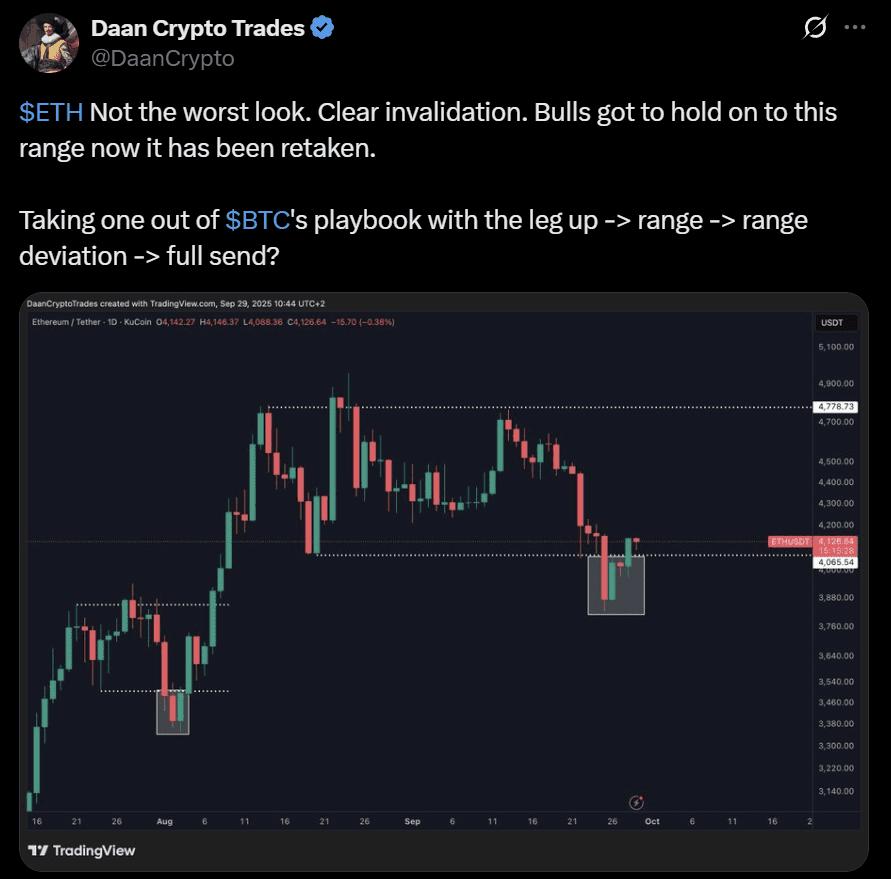

The short squeeze risk did not exist in isolation. Analysts tracked other signals that shaped Ethereum’s path. Some leaned toward a bullish continuation, pointing to structural reclaim patterns that often preceded stronger rallies. Independent market commentator Daan Crypto Trades noted in an X post that the ETH USD pair had retaken a key range after a failed breakdown.

The analyst argued that bulls needed to defend this reclaim, framing it as a potential springboard for further upside. Daan’s view reflected the range deviation that previously sparked fast expansions once momentum stabilized.

Longer-term charts added another layer. Analyst Ted pointed out that Ethereum price had rallied nearly 250% from its cycle bottom.

The analyst maintained that while corrections were natural, the broader structure remained supportive of higher valuations once the near-term weakness played out. His emphasis on the eventual return to growth placed the recent volatility within a larger bullish channel that had guided the price for years.

Still, not every signal leaned in the same direction. Max Crypto highlighted a CME gap around $4,050, warning that futures gaps often acted like magnets for price.

The suggestion implied that ETH might retest lower zones before mounting a stronger push. The validator exit queue also highlighted potential pressure, with over two million ETH awaiting withdrawal. Any meaningful release of that supply could shift liquidity conditions in ways that limited immediate upside.

Technical gauges added to the cautious tone. The daily RSI recovered from oversold levels but remained below neutral, showing momentum had not fully reset. ETH’s rebound into clustered moving averages also left resistance stacked above. That alignment suggested bulls required more conviction to sustain a breakout.

Need to know which Fed reports to watch for this week? Read here to know more.