Ethereum’s native token, Ether (ETH), price reclaimed $4,500 on Oct. 8 after dropping to $4,430 in a marketwide pullback a day prior, with whales and corporate treasuries supporting the rebound.

Analysts Zyn, Michaël van de Poppe, and CryptosBatman flagged room for upside, citing macro trendlines, ETH/BTC rotation risk-reward, and a repeat bull-trap reversal. Traders now watch whether the price builds above recent highs to confirm follow-through. Keep reading to stay updated with the latest ETH analysis.

Macro Fundamentals Strengthen Ethereum’s Recovery Prospects

Ethereum’s rebound aligned with renewed whale accumulation and rising corporate treasury demand. On Oct. 8, Bit Digital (NASDAQ: BTBT) confirmed it had purchased an additional 31,057 ETH, raising its total holdings to more than 150,000 ETH.

The company said it viewed Ethereum as central to its “ETH + AI” strategy, marking one of the largest single-day treasury expansions this quarter.

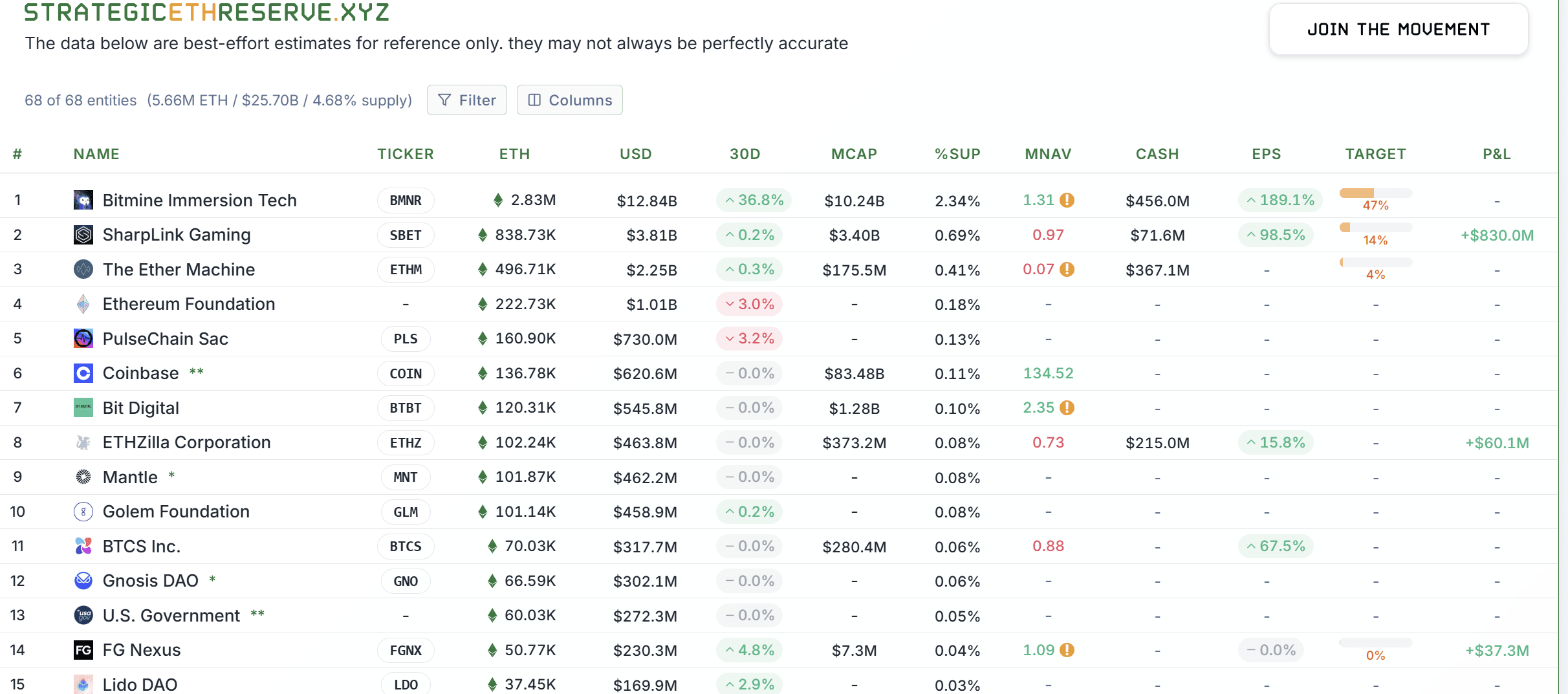

According to data from StrategicETHReserve. xyz, the purchase placed Bit Digital among the top six entities globally holding Ethereum.

The site showed top treasuries now control over 5.6 million ETH, or nearly 4.7% of the circulating supply. That figure continued to grow through early October, underscoring how accumulation by long-term holders has intensified even as prices consolidated.

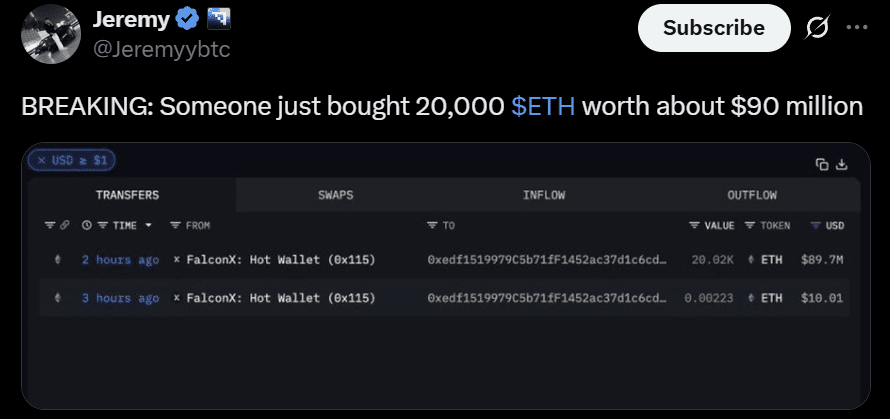

Separately, onchain data highlighted a large inflow, with roughly 20,000 ETH—worth nearly $90 million—moved into accumulation wallets. Market tracker Jeremy BTC reported the transaction on X, noting that the activity likely came from an institutional desk.

The coordinated accumulation by ETH treasuries and large players signaled growing confidence that Ethereum’s valuation remained below its perceived fair range.

Furthermore, the timing coincided with the release of the Federal Reserve’s September meeting minutes, which hinted at a gradual easing cycle and softer inflation expectations. The narrative supported risk assets, including cryptocurrencies, by suggesting longer-term rate normalization. With institutional inflows and corporate holdings climbing, Ethereum appeared to be regaining its macro narrative.

Analysts Highlight Upside Structure As Ethereum Builds Momentum

The strengthening onchain structure gave analysts fresh confidence in Ethereum’s near-term path. Independent analyst Zyn maintained his long-term projection around the $9,000 region.

The analyst referenced Ethereum’s multi-cycle logarithmic trendline, which previously aligned with the 2017 and 2021 tops. Zyn argued that the market was still trading in mid-cycle expansion and had not shown the exhaustion signals typical of a peak phase.

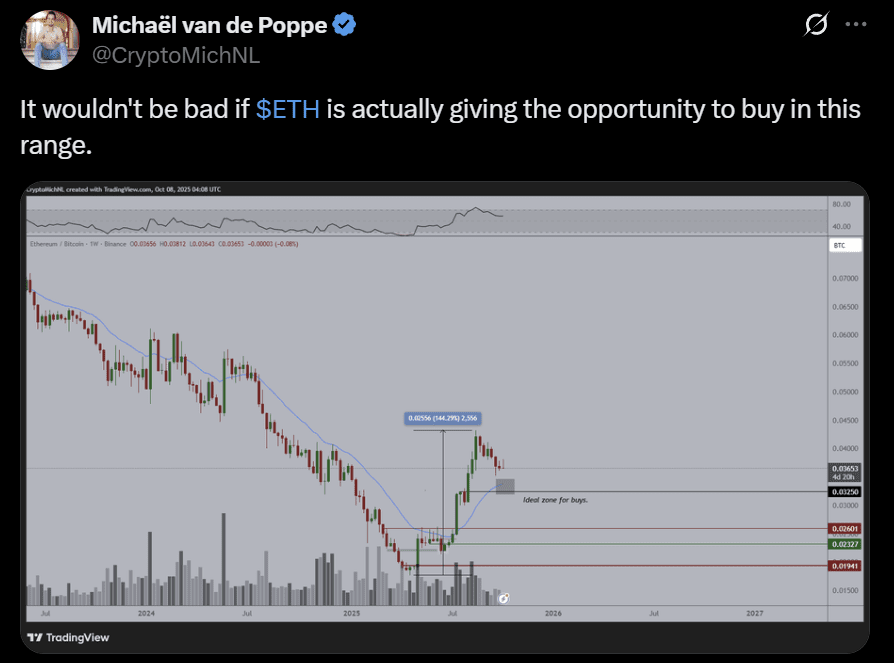

Additionally, veteran trader and analyst Michaël van de Poppe echoed a similar stance on the ETH/BTC pair. The trader noted that Ethereum hovered near the 0.032–0.035 BTC range, which had repeatedly marked cyclical bottoms in past rotations.

The setup created a favorable risk-reward window if Bitcoin dominance began to cool after its ETF-driven surge. Van de Poppe’s observation aligned with the recent shift in whale positioning and treasury inflows, both of which hinted at capital rotation into Ethereum.

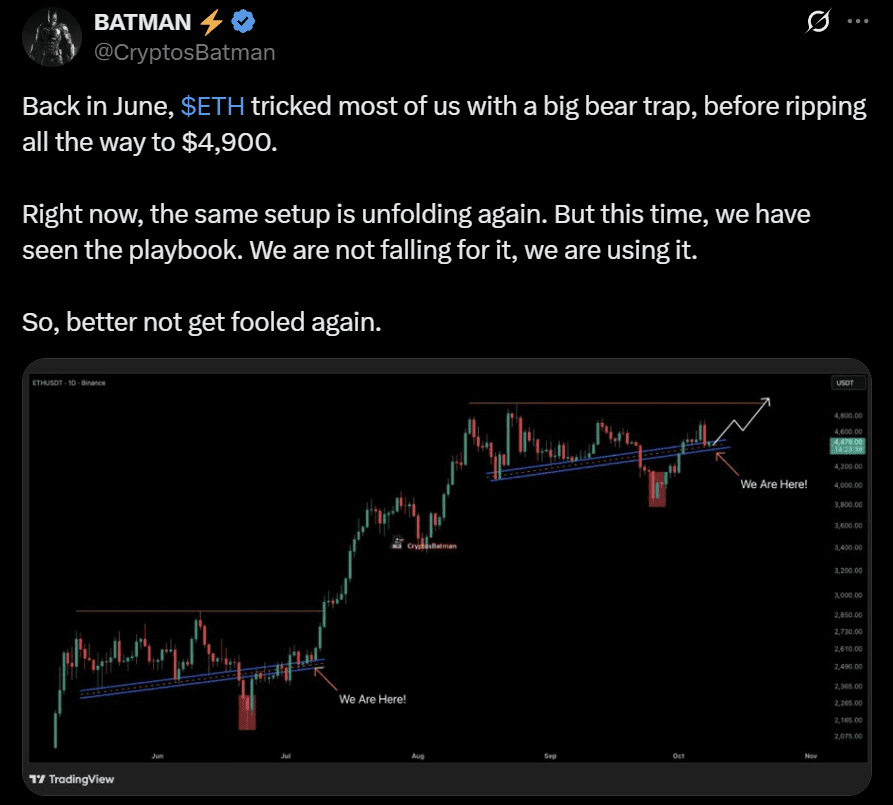

Meanwhile, another analyst, Batman, focused on shorter-term technicals. Batman pointed to Ethereum’s recurring bear-trap structure, where brief breakdowns below the rising channel preceded strong reversals.

The analyst noted the current pattern mirrored June’s setup, which carried ETH to $4,900, suggesting a potential continuation toward $5,200 if momentum held.

Liquidity cues from the latest FOMC minutes implied that the tightening phase was nearing an inflection point, easing pressure on risk assets. Whale and institutional accumulation suggested Ethereum was entering a steadier recovery built on structural rather than speculative strength.