Ethereum (ETH) prices dropped over 8% in the latest market crash on Sept. 22, from $4,498 to lows near $4,077. The sudden decline sparked heavy liquidations, with long positions bleeding over $490 million in just a day.

Yet, despite the steep drop, some analysts argued the move could set the stage for a parabolic pump ahead. Social media speculations focused on whether Ethereum could defend the $4,000 level or risk deeper losses. Some warned of fresh downside targets, while others pointed to the dip as a setup for a parabolic rally ahead.

Analysts Split as Crash Sparks Talk of a Parabolic Pump

The sharp decline left traders questioning whether Ethereum’s breakdown marked the start of a deeper correction or only a short-term shakeout.

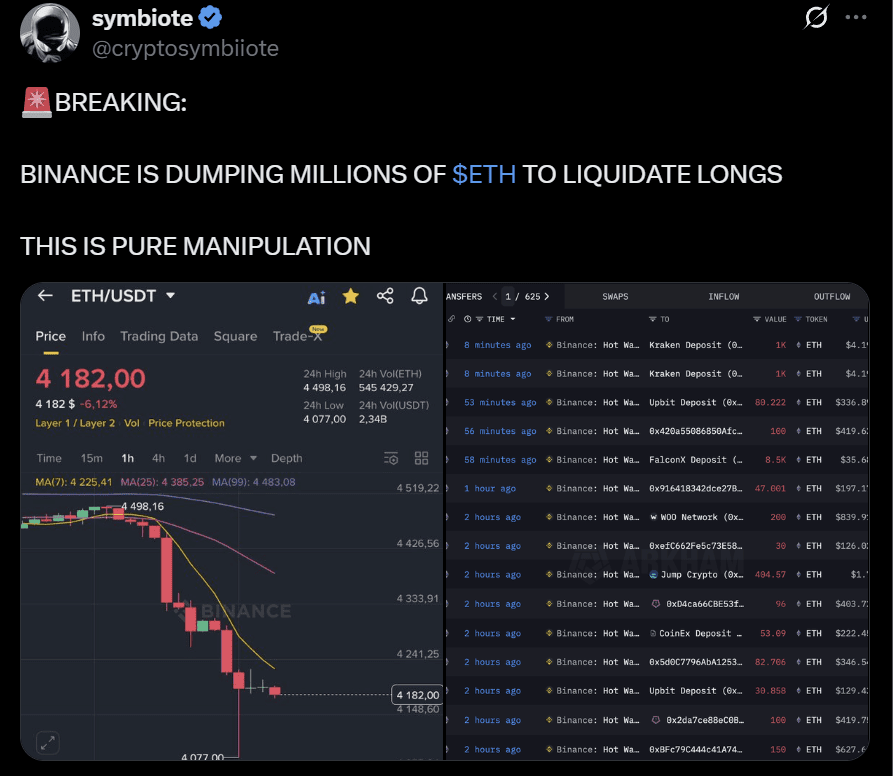

Market chatter quickly centered on exchange flows after independent analyst Symbiote shared Arkham data that flagged heavy transfers from Binance wallets.

Millions in ETH moved toward Kraken, Upbit, and other entities, fueling speculation that Binance had deliberately sold into the crash to trigger liquidations. The claims tied the sudden volatility to manipulation rather than organic selling, deepening uncertainty over what drove the market rout.

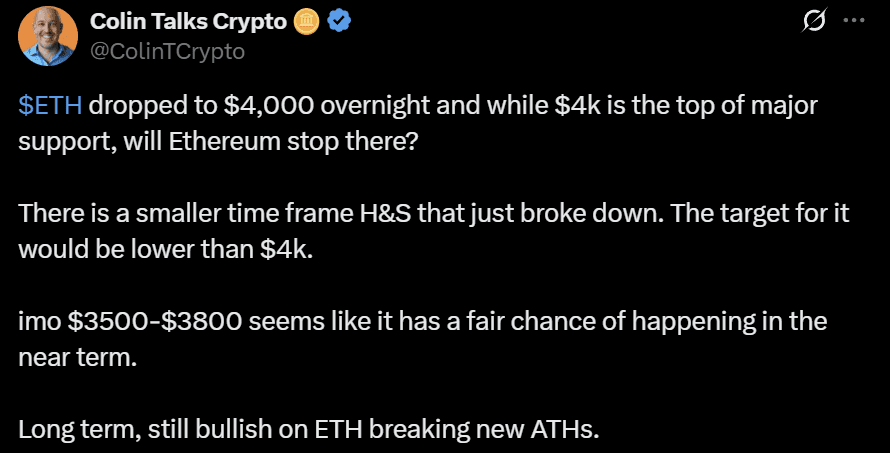

Technical signals added weight to the bearish case. Colin Talks Crypto highlighted a head-and-shoulders structure on the ETH USD pair‘s chart, with ETH breaching its neckline near $4,000. The analyst projected a potential move toward the $3,500–$3,800 range, noting the breakdown could extend losses if panic continued.

The shift aligned with short-term averages crossing bearishly below the 99-period level on Binance charts, suggesting momentum favored sellers in the near term.

Yet, the central debate hinged on whether the downturn signaled exhaustion or primed ETH for a rebound. Ash Crypto argued the breakdown was a retest of key support before a parabolic pump. The analyst’s chart outlined a path toward $5,000 by mid-October, hinging on ETH defending the $3,800–$3,900 region.

That view echoed the broader angle that the violent correction, while damaging, might serve as a launchpad for Ethereum’s subsequent rally. The contrasting calls underscored the split in sentiment. While bears pointed to manipulation and technical breakdowns, bulls framed the same drop as the setup for Ethereum’s next parabolic advance.

Ethereum Faces Support Test as Resistance Levels Tighten

ETH price’s latest downturn pushed price action closer to decisive levels, adding urgency to the debate over its next move. After slipping below short-term averages, the Ethereum token price failed to recover on Sept. 23. The daily RSI also weakened, holding near 40 and reflecting oversold conditions often accompanying extended declines.

The immediate support sits near $3,802, near the 100-day EMA trendline. ETH Price has not tested this level since early Aug. 2025, but the current trajectory has left the zone vulnerable.

A decisive breakdown here would likely invite further pressure and amplify liquidations, which could force ETH price to test the support near $3,276. If bulls step in, however, the $3,802 region could mark the turning point where momentum stabilizes before recovery attempts.

On the upside, Ethereum faced immediate resistance at $4,641. Flipping the immediate resistance would target resistance near $5,238. Together, these zones framed the upper boundary Ethereum needed to reclaim to reestablish bullish momentum.

Volume profile data also showed heavy clustering across the $4,200–$4,600 corridor, reinforcing ETH’s challenges in breaking higher without renewed buying interest.

Until Ethereum clears these resistance barriers, market bias remains tilted toward caution. Still, defending support at $3,802 would preserve the possibility of another attempt at higher levels, keeping the longer-term bullish thesis alive despite the current weakness.