- Fed Chair Powell emphasizes the temporary nature of tariff-induced inflation.

- The FOMC cuts the fed funds rate by 25 basis points.

- Cryptocurrency markets show muted reactions to the rate cut announcement.

Federal Reserve Chair Jerome Powell declared on September 18 that the inflationary impact of tariffs remains transitory, emphasizing a one-time pricing shift.

This statement potentially influences crypto markets, especially BTC and ETH, historically responsive to Fed monetary policy signals with anticipated interest rate adjustments.

Federal Reserve’s Rate Cut and Temporary Tariff Inflation

Federal Reserve Chair Jerome Powell reiterated that tariff-induced inflation effects are expected to be temporary. The FOMC decided to cut the fed funds rate by 25 basis points to a range of 4%–4.25%, aiming to address rising inflation and a weakening labor market.

Powell emphasized that the tariff impact is viewed as a one-time price shift, not an ongoing inflationary trend. This perception drives current monetary policy adjustments by the Federal Reserve, aligning with historical precedents from previous tariff impacts.

“A reasonable base case is that the effects on inflation will be relatively short-lived, a one-time shift in the price level,” Powell stated. “But it is also possible…” source

Market reactions have been generally muted, with no significant immediate changes observed in cryptocurrency markets or related commentaries from major crypto figures. The key message from Powell highlighted expectation management, forecasting that recent tariff effects would be short-lived and transitory.

Crypto Market Stability Amidst Economic Shifts

Did you know? Historically, similar Fed actions have led to short-term volatility but eventually stabilized, with inflation often decoupling from one-off price shifts caused by tariffs. Past trade tensions have shown similar patterns of temporary inflation impacts.

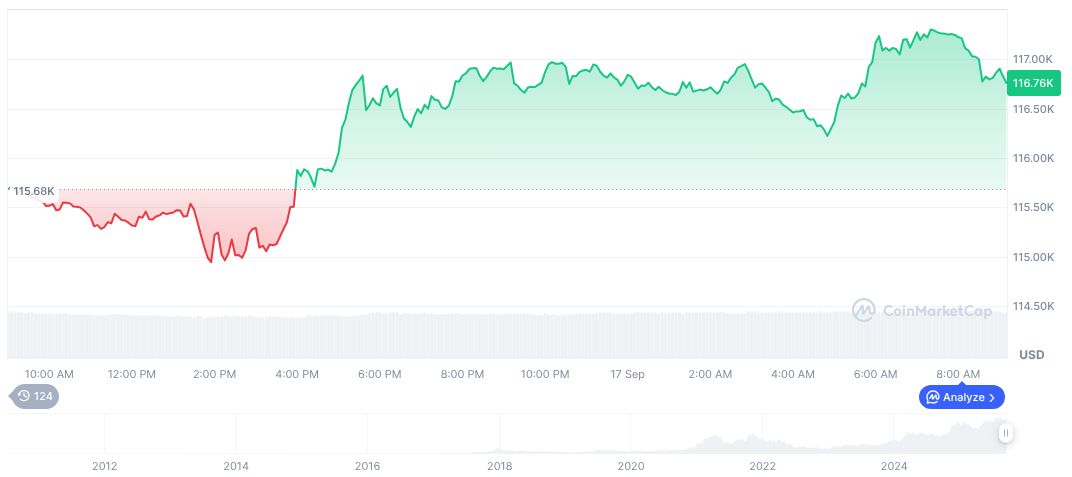

According to CoinMarketCap data, Bitcoin (BTC) is priced at $116,216.26, with a 24-hour trading volume of $59.64 billion, reflecting a 34.29% change. BTC’s market cap stands at $2.32 trillion, with a circulating supply of 19,922,331. Its 90-day price increased by 11.21%.

The Coincu research team highlights that interest rate cuts could historically trigger price increases in BTC and ETH due to increased risk appetite. Despite muted immediate reactions, cryptocurrency markets often respond positively to dovish monetary signals, though long-term effects depend on broader economic conditions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |