- Federal Reserve predicts a rate cut; potential crypto market adjustments.

- Bitcoin and Ethereum historically sensitive to policy changes.

- No direct, primary-source commentary from key crypto figures yet.

According to Jinshi reports, the Federal Reserve’s median forecast indicates a 50 basis point rate cut slated for 2025, impacting U.S. monetary policy dynamics.

This potential rate cut may influence crypto markets, historically affecting Bitcoin and Ethereum, key assets sensitive to macroeconomic changes. Immediate market reactions remain speculative at this juncture.

Fed’s 2025 Rate Cut and Crypto Market Sensitivity

The Federal Reserve’s forecast of a 50 basis point rate cut in 2025, emerging from the Federal Open Market Committee discussions, is seen as a pivotal monetary policy shift. While Jerome Powell has not officially confirmed this prediction via primary communication channels, the anticipation suggests significant macroeconomic considerations in future decision-making processes.

Crypto markets anticipate changes, especially for Bitcoin (BTC) and Ethereum (ETH), which historically react to macroeconomic shifts. Although no crypto-specific actions have been linked to the forecast, the potential for increased risk-taking by investors remains a point of interest.

Responses from key crypto figures have not surfaced in primary sources. The crypto community and market analysts watch closely, awaiting expert insights or impactful steps by major players to substantiate market forecasts.

Historical Fed Rate Cuts: Impact on Bitcoin and Ethereum

Did you know? Historically, Fed rate cuts have often spurred bull markets, notably boosting Bitcoin and Ethereum due to their liquidity and status as “hard” assets during 2019-2020 cycles.

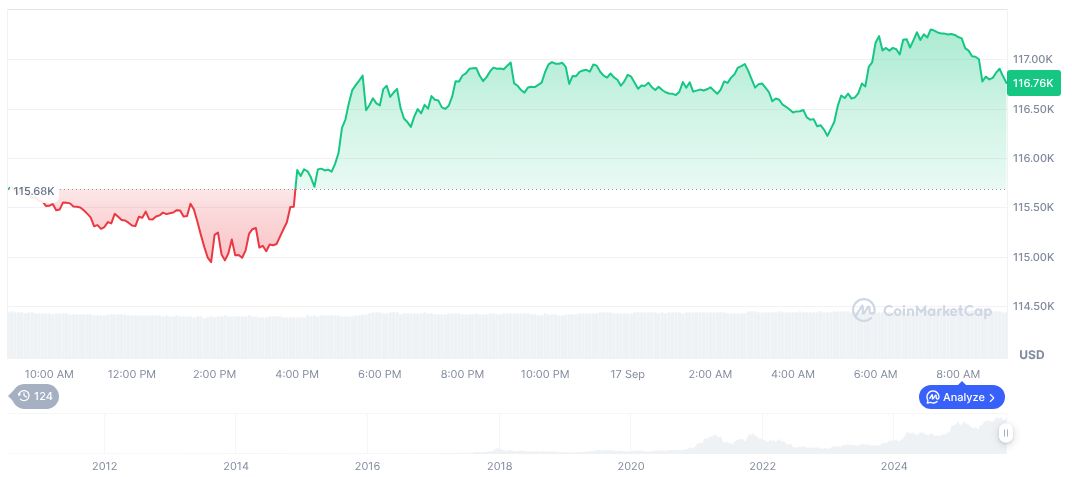

As of CoinMarketCap’s recent report, Bitcoin (BTC) is priced at $116,043.88, wielding a market cap of $2.31 trillion, while accounting for a 57.43% market dominance. The cryptocurrency has shown a minor decrease of 0.60% over 24 hours but increased by 1.96% over the week.

Insights from Coincu’s research team indicate potential market stabilization or bullish trends for major cryptocurrencies, contingent on the Fed’s policy execution. The emphasis on historical patterns highlights possible gains, yet credible, immediate primary data remains crucial for precise forecasting.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |