Forward Industries launched an institutional-grade Solana validator and staked its entire SOL treasury into the node. The company framed the step as a deeper operational role inside the Solana ecosystem. It moved all holdings to active participation rather than passive custody.

The stake totals about 6.8 million SOL, valued around $1.7 billion based on recent market levels. The company already holds one of the largest Solana treasuries among public entities. Therefore, the shift immediately changed validator rankings and delegation options for large holders.

Backers include Galaxy Digital, Jump Crypto, and Multicoin Capital. Their funding history explains Forward’s scale and access to infrastructure partners. As a result, the validator came online with institutional tooling from day one.

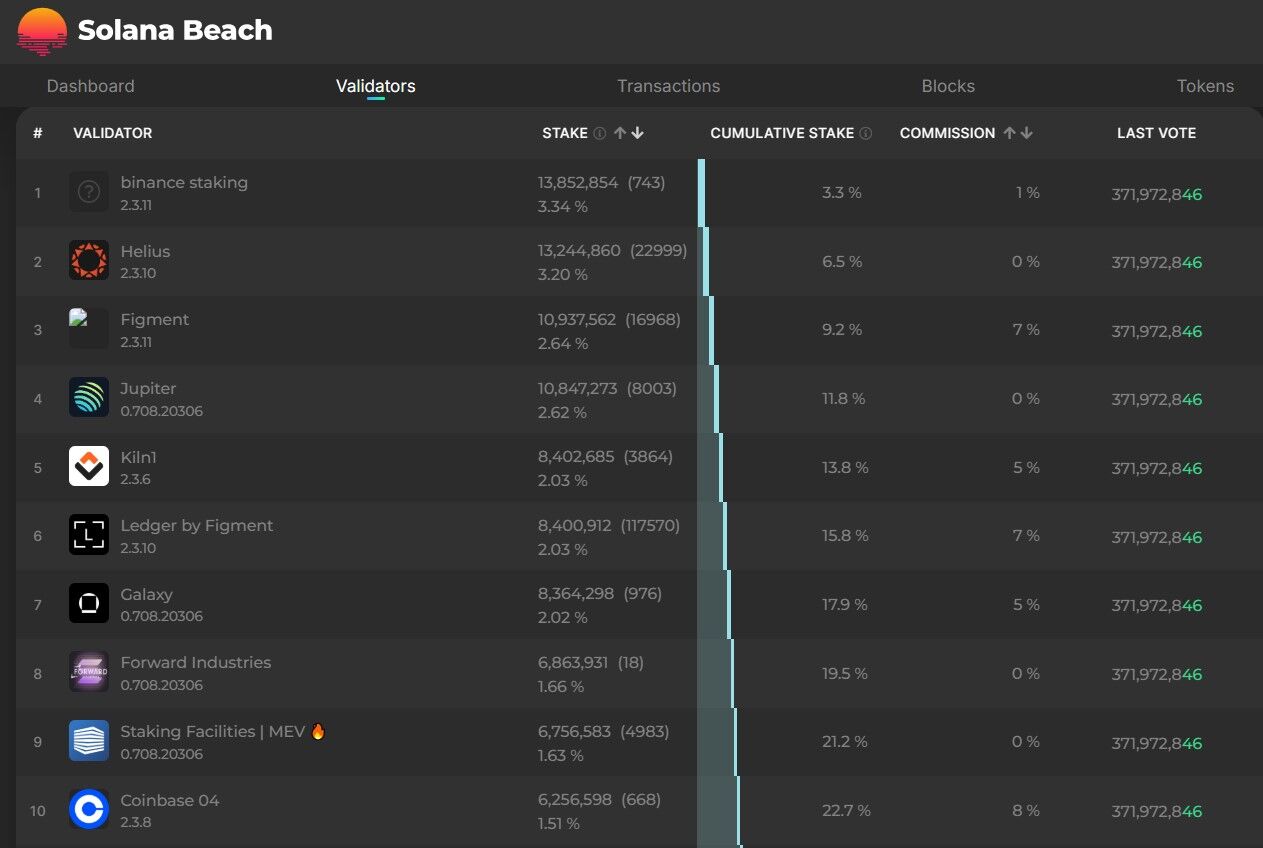

Top-10 slot on Solana validators

Solana Beach shows Forward’s entire SOL position delegated to the new validator address. The full-treasury stake placed the operator straight into the network’s top 10 by delegated tokens. That rank gives the validator meaningful participation in consensus and reward distribution.

Forward’s entry edged out long-standing operators listed just below it. Staking Facilities and Coinbase appear next with roughly 6.7 million and 6.2 million SOL, respectively. The changes reflect straightforward arithmetic: a single, concentrated stake can reorder the leaderboard quickly.

At the very top, Binance Staking, Helius, Figment, and Jupiter continue to anchor the largest pools. Each of those operators holds well above 10 million SOL in stake, according to Solana Beach. Consequently, Forward’s top-10 position is significant but not yet near the first tier.

Validator runs on DoubleZero and Firedancer

Forward said the validator runs on DoubleZero’s fiber network. That setup aims to deliver low-latency connectivity between Solana peers. In practice, fiber peering reduces propagation time for votes and blocks, which supports stable performance.

The configuration also references Jump Crypto’s Firedancer, an independent Solana validator client. Firedancer expands client diversity beyond the primary implementation. Client diversity matters because it reduces correlated failure risk across the network.

With these components, the validator targets institutional reliability. The build pairs physical network paths with software redundancy. Thus, the launch aligns with Forward’s positioning as a large, professionally run operator.

0% commission targets delegators

Forward set its commission at 0% at launch. Commission is the share a validator keeps from staking rewards before passing the rest to delegators. A 0% rate means delegators receive the full protocol reward from that validator, subject to performance.

Benchmark rates across top operators vary. Binance Staking lists about 1% commission, while providers such as Figment and Ledger by Figment show around 7%. Coinbase sits higher among top-10 peers at roughly 8%. Therefore, Forward’s opening price undercuts the field.

However, commission levels can change as validators scale. Running institutional infrastructure carries ongoing costs. Operators commonly introduce or raise fees after reaching a stable delegation base, so delegators should track the posted rate over time.

Solana tests $264 resistance as monthly chart builds higher highs

Solana trades near $222 on the monthly SOLUSDT chart (TradingView). The structure shows a series of higher highs and higher lows since 2023, while the next clear level sits at $264.40. A decisive break and acceptance above $264 would open the path toward historical supply at $421.91 and $550.00, according to the marked zones.

Momentum improved into Q4 as candles ground above the mid-$200s. However, sellers defended the $260s several times in 2022 and 2025, so the market must absorb offers there. If buyers force a monthly close through $264, the chart points to layered targets at $421.91, $550.00, $673.25, $923.37, and $1,094.59. Each band reflects prior congestion or measured levels on the monthly timeframe.

On the downside, initial support sits around the dotted area near $220, with a deeper demand band at the highlighted $165.19 line. A rejection from $264 would likely revisit those zones to test trend strength. Conversely, a breakout followed by a shallow retest and hold above $264 would confirm continuation and keep the larger “road to $1K” narrative in play.