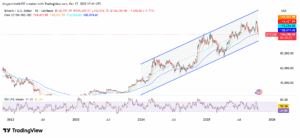

Bitcoin (BTC) hovered near $106,900 on Thursday evening, recovering from deeper intraday losses after a volatile 24-hour stretch that rattled the entire crypto market. The rebound came just as gold prices posted their sharpest two-day drop in months. So, are investors moving money out of safe assets and back into risk? Lets analyse.

Bitcoin Finds a Bid After a Brutal Week

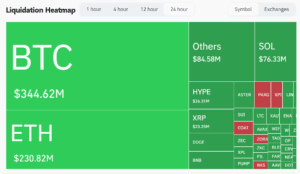

The overall crypto market is facing one of its most volatile phases of 2025. Bitcoin price recently dropped below $108,000, triggering more than $1.2 billion in liquidations across major exchanges. Altcoins such as Ethereum (ETH), XRP, and Cardano (ADA) followed the decline.

The selloff came amid a broader risk-off shift in global markets. Rising U.S.–China trade tensions, uncertainty around Federal Reserve policy, and renewed stress in regional banks have caused investors to pull capital from volatile assets. As a result, the total crypto market capitalization slipped below $3.8 trillion, its lowest level in months.

Bitcoin’s slide below its 200-day moving average further deepened bearish momentum, forcing automated sell orders and triggering another wave of leveraged liquidations. Yet after the dust settled, BTC price rebounded to around $106,900 on Oct.17 evening, suggesting that selling pressure may be easing.

Gold Loses Its Shine After Record Run

For much of 2025, gold looked unstoppable. It climbed above $4,300 per ounce last week — its highest level ever — as investors sought safety from political tension, rising tariffs, and concerns over U.S. regional banks.

That trend broke this week. Profit-taking hit the precious metal after a series of strong sessions, sending prices down by nearly 3% in two days, their steepest drop since March. The dollar strengthened slightly, Treasury yields rose, and traders began trimming gold positions that had ballooned during the flight to safety.

Gold’s rally had entered euphoria territory, with sentiment stretched and momentum peaking. Tokenized gold volumes also cooled after touching $1 billion in daily trades earlier this month, suggesting investors were beginning to unwind speculative exposure.

Is This Rotation Real or Just Reflex?

At first glance, gold’s decline and Bitcoin’s slight rebound look like the early signs of capital rotation. But a closer look at market data suggests the move is more reaction than reallocation.

Out of that $1.2 billion liquidations that took place today, about four-fifths of those losses came from long positions, meaning over-leveraged traders were flushed out as prices broke key support levels. The sell-off dragged the total crypto market capitalization below $3.8 trillion, its lowest level in months.

At the same time, U.S. spot Bitcoin ETFs recorded over $530 million in outflows on Oct. 17. This was the largest single-day withdrawal since August. That signals that institutional investors are still retreating rather than adding exposure. Combined with weak liquidity and fading volumes, it shows that money isn’t yet flowing into risk. It’s simply exiting in a more orderly fashion after the panic.

The macro backdrop also argues against a lasting rotation. Renewed U.S.–China trade tensions, uncertainty over Federal Reserve policy, and fresh concerns about regional banks have kept global investors cautious. These pressures typically drive capital toward gold and Treasury assets, not away from them. Gold’s recent pullback, therefore, looks more like profit-taking after a record rally than a wholesale shift of money into crypto.

Until fear in traditional markets fades and ETF inflows return, this episode appears to be a reflex, not a rotation. Bitcoin may stabilize after weeks of forced selling, but without fresh liquidity, the narrative of capital moving from gold to crypto remains premature.