In an interesting development, tech giant Google selected Sui as a launch partner for its new AI-driven payments protocol this week. The announcement placed the blockchain project alongside major firms building digital payment infrastructure.

Yet, despite the development, SUI price showed little response in markets. The token held steady, mirroring recent muted activity. Traders largely shrugged off the headline, leaving the project’s fundamentals in focus while price action remained tied to broader market currents.

Google Partnership Adds Weight to Sui’s Fundamentals

The muted market response contrasted with the scale of the announcement. Google’s decision to include Sui as a launch partner for its new AI payments protocol marked a rare alignment between a major technology company and a relatively young blockchain.

The initiative, known as the Agent Payments Protocol, aimed to enable agent-led digital transactions using both traditional rails and cryptocurrencies. Sui’s participation placed it at the center of this experimental framework, signaling confidence in its infrastructure.

The partnership underscored Sui’s push to move beyond speculative trading and toward real-world adoption. By anchoring itself in an ecosystem backed by Google, the project gained a degree of validation that few newer blockchains have secured. Moreover, the connection also hinted at potential exposure to a broader network of collaborators, including payment firms and institutional players testing agent-driven models. While SUI token’s price remained flat, the longer-term significance rested in whether these integrations could translate into measurable activity on the chain.

For now, the development highlighted a growing distinction between Sui’s technical role and its market valuation. The project’s fundamentals have shifted. The challenge ahead lies in converting this partnership into sustained demand, proving that participation in a protocol of this scale could feed into ecosystem growth and eventually filter into value for the token.

Analysts Frame Technical Setup as a Breakout Candidate

While the Google partnership shifted attention toward fundamentals, analysts continued to dissect the token’s chart structure. Their views converged on the same point: SUI price was consolidating in a way that often preceded decisive moves. This aligned with the earlier discussion of muted short-term price action, showing how sentiment remained focused on what might unfold next rather than what had already occurred.

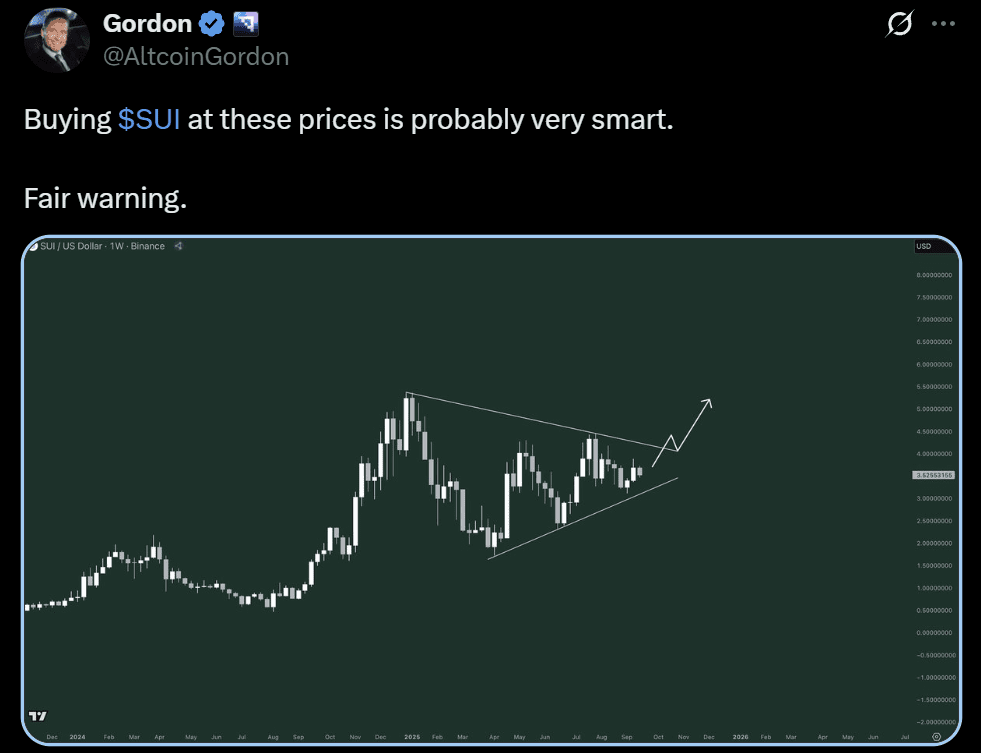

Market analyst Gordon argued that SUI traded near levels attractive for accumulation. His weekly chart highlighted a tightening triangle, with resistance compressing against rising trend support. The formation suggested that buyers had defended higher lows despite repeated sell-offs. The projection he attached pointed toward a breakout, framing current levels as an entry zone.

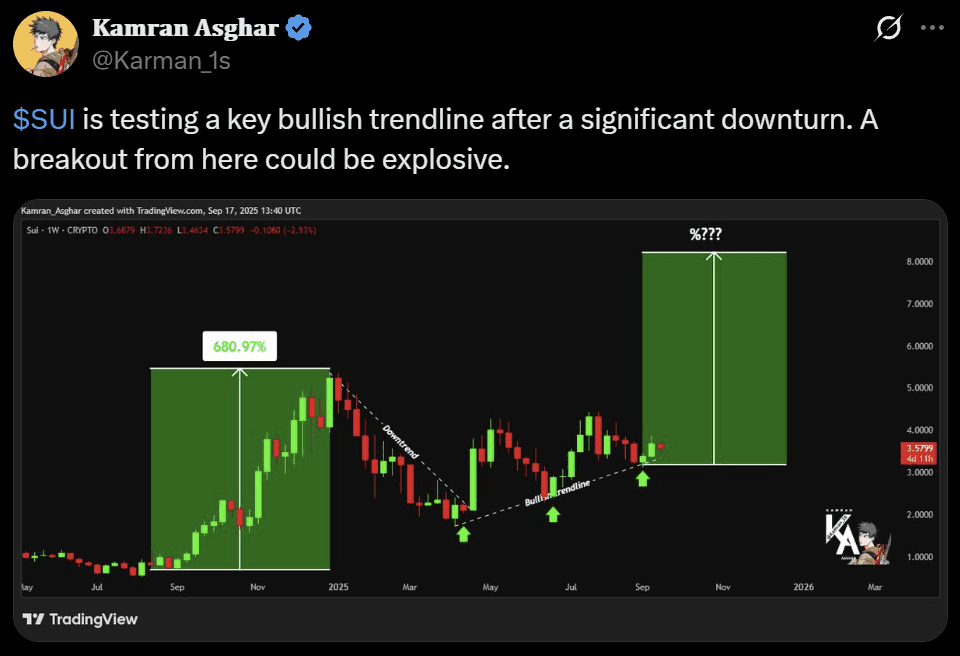

Independent analyst Kamran Asghar emphasized the same trendline but through a historical lens. He noted that SUI had previously surged nearly 680% after reclaiming similar bullish setups. Asghar’s chart connected the dots between the past recovery and the current positioning, implying that another large rally would have remained possible if support had been held.

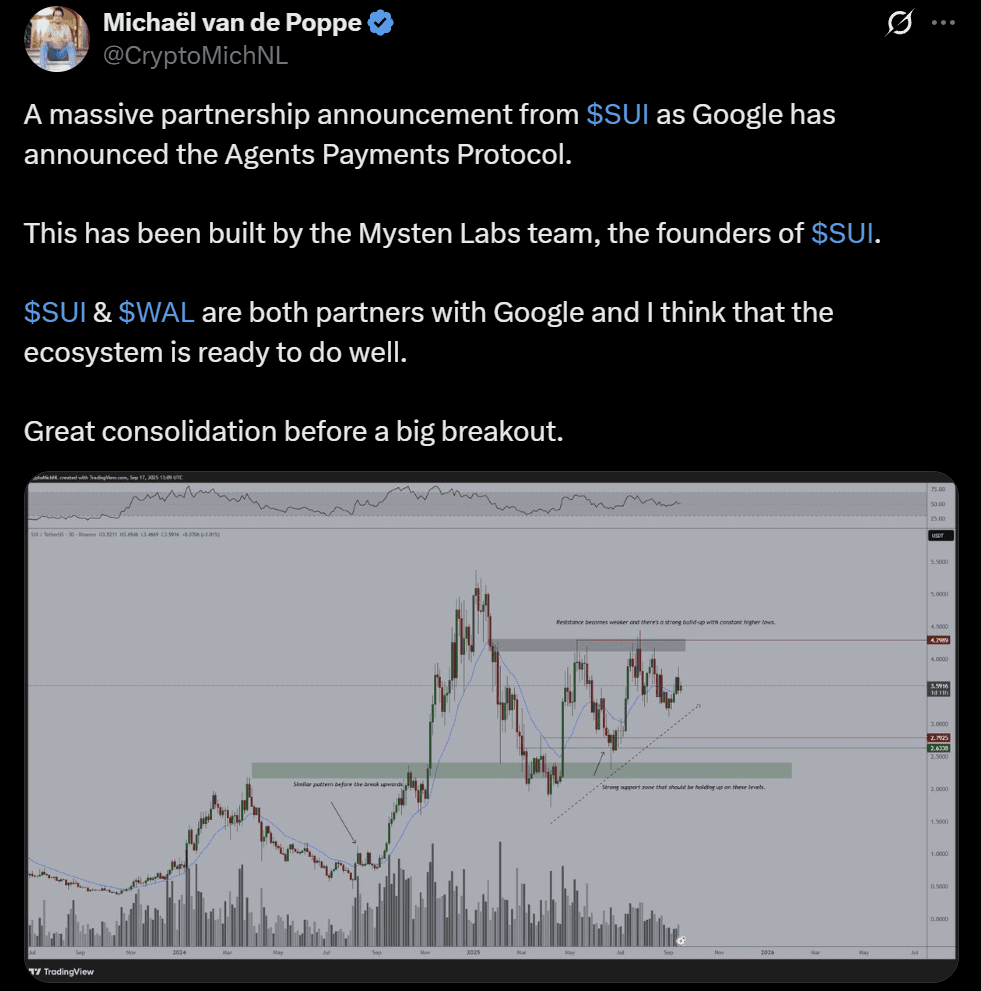

Veteran trader Michaël van de Poppe tied both angles back to fundamentals. He highlighted that the Google announcement coincided with steady consolidation. Van de Poppe pointed to support near $2.8–2.6 as the base and resistance near $4.2 as the ceiling for the SUI USD pair.

According to his view, repeated higher lows weakened resistance and strengthened the case for a breakout. Together, these perspectives kept traders focused on the same dynamic: whether SUI’s consolidation could transform into an advance.