Grayscale Investments launched the Solana ETF with staking on NYSE Arca under the ticker GSOL. The seed capital opened near $102.7–$103 million, according to the announcement. The Solana ETF adds staking to give holders exposure to Solana (SOL) and network participation.

The Solana ETF began trading one day after the Bitwise Solana ETF went live. Therefore, Grayscale became the second Solana ETF manager in the United States. The listing on NYSE Arca places GSOL alongside other crypto-linked funds.

Inkoo Kang, Grayscale’s senior vice president of ETFs, said the Solana product is “expanding investor choice.” The Solana ETF arrives as Grayscale positions itself among large Solana ETP managers by AUM. GSOL enters a narrow field with another Solana ETF already operating.

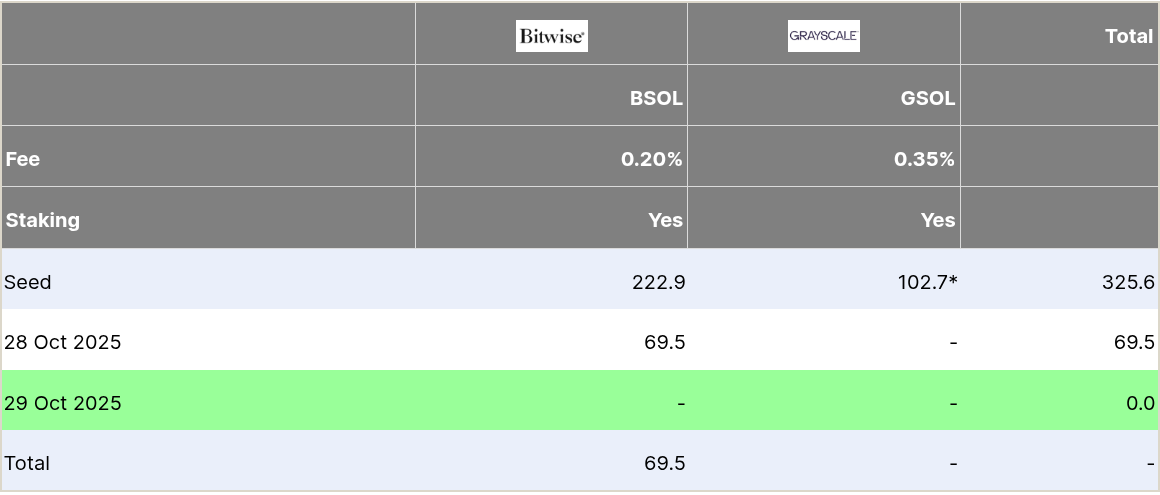

Solana ETF inflows — Bitwise vs. Grayscale data

The Bitwise Solana ETF launched on Tuesday with $222.9 million in assets under management. Farside Investors reported $69.5 million of first-day inflows for the Solana ETF from Bitwise. Those figures set the initial flow baseline for the new category.

The Grayscale GSOL Solana ETF started on Wednesday with $102.7 million in seed capital. Together, the two Solana ETFs entered the market with $325.6 million in initial capital. Farside Investors lists only two US Solana ETF products: Bitwise and Grayscale.

Price context showed SOL around $199.48 at the time referenced. However, Solana ETF flows, seed sizes, and trading venue details defined day-one comparisons. As a result, the Solana ETF market now has two points of reference for AUM and liquidity.

Solana staking rewards — how the ETFs split returns

Both the Grayscale GSOL and the Bitwise Solana ETF include staking on the Solana proof-of-stake (PoS) network. Funds delegate SOL to validators to help secure the network. In turn, staking rewards accrue to the funds and can be redistributed.

Grayscale disclosed a 77% staking rewards redistribution to Solana ETF investors. The remaining portion covers staking operations and related costs. This disclosure clarifies how GSOL treats rewards inside the Solana ETF structure.

Bitwise set a different staking rewards policy. The Bitwise Solana ETF retains 28% of rewards and distributes 72% to investors. Therefore, Solana ETF investors can compare staking rewards splits, fees, and liquidity across the two products.

Kristin Smith, president of the Solana Policy Institute, described the role of staking in these Solana ETFs. She said, “through staking in these products, investors aren’t just gaining exposure – they also have the opportunity to help secure the network, accelerate innovation for developers, and earn rewards.” The statement links Solana ETF exposure with network security.

Earlier this week, Ryan Lee, chief analyst at Bitget, discussed potential first-year capital. He said, “Solana could attract between $3–$6 billion in its first year.” The remark followed the initial Solana ETF approvals. It reflects outside analysis rather than fund guidance.

The Solana ETF venue also matters. NYSE Arca hosts GSOL, which can influence spreads and depth as trading builds. The Solana ETF category remains limited to Bitwise Solana ETF and Grayscale GSOL, per Farside Investors, enabling direct side-by-side tracking.