Hedera notched three non-price milestones today: the Africa hackathon prize pool grew by $1 million after a new backer joined; the Linux Foundation hosted a webinar marking a year of “Hiero,” Hedera’s open-source transition; and the network confirmed its next mainnet upgrade for Sept. 24.

Africa hackathon prize pool grows

United Gulf Financial Services (UGFS North Africa) said it would add $1 million to the Hedera Africa Hackathon prize pool, expanding support for teams building on Hedera. Organizers framed the move as additional capital aimed at turning prototypes into funded startups.

The pan-African program runs through Sept. 30 with online and in-person events across more than 20 cities. It targets 10,000+ participants and draws backing from dozens of partners and universities, according to the event’s materials and prior launch notices.

Regional coverage says the extra funds lift total prize money to $2 million, with part of the contribution earmarked for investments in winning teams. Hedera-affiliated event listings still reference a $1 million pool, so the higher figure reflects new reporting rather than an official global update.

Linux Foundation marks ‘One Year of Hiero’

The Linux Foundation’s LF Decentralized Trust hosted a “One Year of Hiero” webinar with Hedera today, highlighting open governance and neutral stewardship over the codebase that powers the network. Speakers positioned Hiero as a model for collaborative development of decentralized infrastructure.

The session comes a year after Hedera contributed its entire core software—hashgraph consensus and services included—to the Linux Foundation as the Hiero project and became a founding premier member. The foundation said the move created a neutral home for long-term maintenance and broader community contribution.

Since launch, LF Decentralized Trust has bundled the Hyperledger landscape, Trust Over IP, and new code contributions under one umbrella. In that context, today’s webinar served as a status check on how Hedera’s open-source posture fits into a larger stack of enterprise-grade decentralized tech.

Network upgrade v0.65 slated for Sept. 24

Hedera’s next mainnet release, v0.65, is scheduled for Sept. 24. Community calendars tracking project announcements show the rollout timing and note that testnet upgraded earlier this month.

According to release materials, v0.65 introduces the “Virtual Mega Map” to unify entity state, enforces HIP-991 maximum custom fees on scheduled transactions, and advances the Block Stream format to standardize records and improve forward compatibility. These items aim to simplify state management and developer tooling.

Taken together, the upgrade targets scalability and operational clarity for dapp teams ahead of the hackathon’s close. If timelines hold, builders will hand off submissions as the new features reach mainnet.

Background: Wyoming’s state stablecoin taps Hedera

Earlier this month, Wyoming’s Stable Token Commission named Hedera a candidate chain for FRNT, the first U.S. state-issued stable token. Officials cited performance and compliance in their rationale.

FRNT is fully backed by dollars and short-term Treasuries with an additional 2% reserve, according to Hedera’s announcement. The program’s rollout spans multiple blockchains; purchasing access and usage details continue to evolve as agencies finalize the launch cadence.

While not a price driver by itself, the selection underscores Hedera’s push into public-sector payments and may shape developer priorities visible in hackathon entries and post-upgrade deployments.

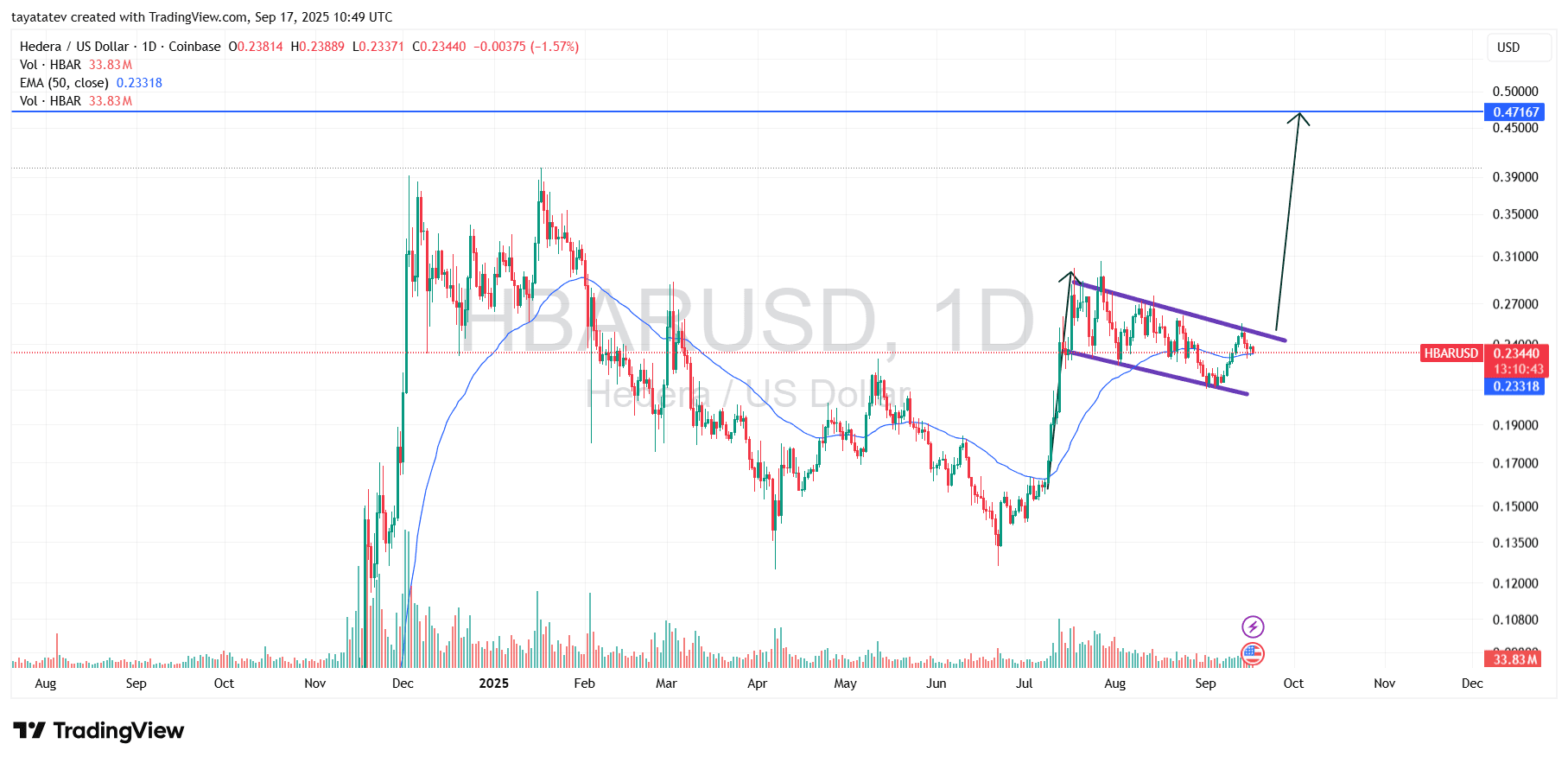

HBAR forms bullish flag; breakout could target $0.469 — Sept. 17, 2025

Hedera’s HBAR/USD printed a compact bullish flag on the daily chart on Sept. 17, 2025, with price near $0.234. A bullish flag is a brief, downward-sloping consolidation that follows a sharp rally and, when confirmed, often resumes the prior uptrend. The structure appears after July’s vertical advance and now tilts lower between parallel lines, while price hugs the 50-day Exponential Moving Average (EMA) around $0.233.

If HBAR closes above the flag’s upper boundary on expanding volume, the breakout would confirm the pattern. In that case, the measured move points roughly 100% above the current level, implying a target near $0.4688. Importantly, that objective aligns with the visible resistance band around $0.47 shown on the chart, which strengthens the case for that area as the next technical magnet.

Meanwhile, price action respects rising support from early August, and the 50-day EMA now acts as a pivot. Additionally, recent daily volume sits around 33.8 million HBAR on the displayed bar, which gives a reference for any breakout-day expansion. However, a decisive close back inside the lower channel—roughly the low-$0.22 area on this view—would weaken the flag and delay any upside projection. Therefore, traders will watch for a clean topside breach with momentum before treating $0.4688–$0.4717 as the full measured-move zone.

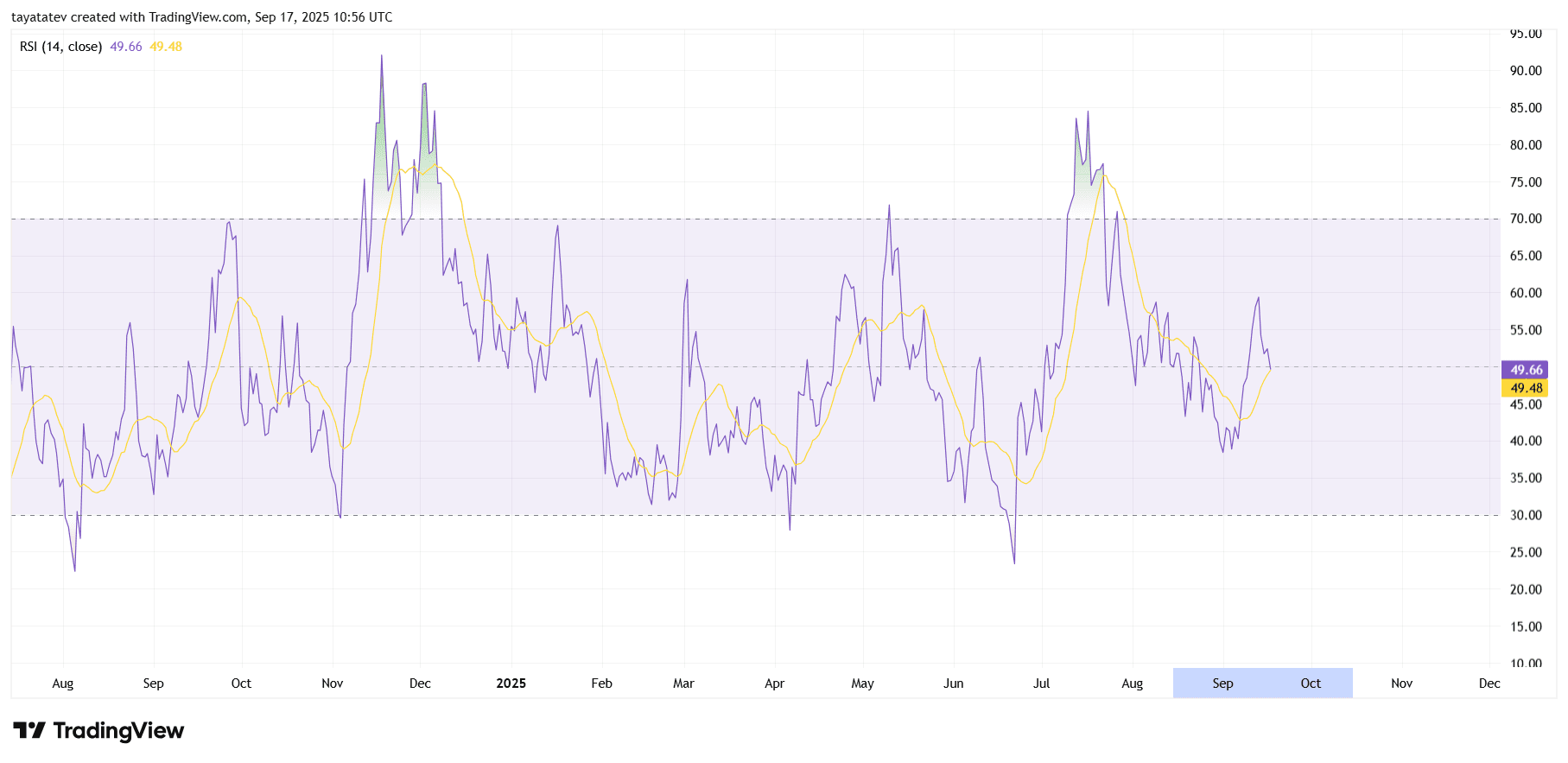

HBAR momentum sits neutral as RSI hovers near 50 — Sept. 17, 2025

Hedera’s daily Relative Strength Index (RSI 14) reads 49.66 with its signal line near 49.48. This places momentum squarely in the neutral band between 30 and 70. In simple terms, buying and selling pressures look balanced after the early-September dip. Because RSI measures the speed and magnitude of recent price changes, levels around 50 often mark transition zones rather than strong trends.

Moreover, RSI has risen from the low-40s toward 50 over the past sessions, and the RSI line now sits slightly above its own moving average on this view. That crossover hints at improving short-term momentum, yet it still lacks the follow-through that typically appears when RSI pushes through 55–60. Until that push occurs, the setup remains neutral with room to move before any overbought reading near 70.

Previously, July’s impulse saw RSI spike into the 70s and 80s before reverting. Since then, swings have stayed mostly inside the 30–70 channel, reinforcing the idea of consolidation rather than a trend. Therefore, traders will watch whether RSI can sustain closes above 55 to validate acceleration, or slip back under 45 to show momentum fading.