Hedera Hashgraph’s HBAR saw its price register a modest rise on Sept. 16 after two days of downtrend. The token reached a daily high near $0.24 before paring some gains to the bears. Moreover, trading volume ticked up as institutional interest grew.

Underlying the price action, Hedera announced new fundamentals, such as growing interoperability via new bridges, and speculation around high-profile partnerships. The ETF narrative added fuel, though regulatory approval remains in process.

Cross-Chain Push and Speculation Drive Hedera’s Narrative

Hedera advanced its interoperability push after going live on Stargate Finance, connecting the network to over 40 blockchains.

The integration allowed users to transfer canonical wrapped Ether directly to Hedera, giving them access to an initial liquidity pool on SaucerSwap Labs. That step signaled a deeper move into cross-chain DeFi, exposing Hedera to previously out-of-reach liquidity streams. The launch also positioned Hedera alongside established networks in Stargate’s ecosystem, narrowing the gap between Hedera and larger innovative contract platforms.

The development came as community speculation intensified around possible high-profile partnerships. Attention turned to TikTok after social media chatter linked Hedera to the platform. While no confirmation emerged, the discussion underscored the market’s readiness to price in potential collaborations. The narrative aligned with Hedera’s history of positioning itself within mainstream applications, even if tangible proof remained pending.

Alongside these shifts, investors also pointed to Hedera’s presence in the broader ETF conversation. Although reports of a potential spot HBAR ETF date back to late Aug. 2025, the narrative continued contributing to market sentiment. The bridge integration, liquidity expansion, partnership speculation, and ETF optimism could become the fuel that HBAR price needs to realize the bullish predictions of market analysts.

Analysts Frame HBAR’s Technical Outlook

The recent fundamentals — from the Stargate bridge launch to speculation around mainstream partnerships and ETF discussions — shifted attention toward HBAR’s technical setup.

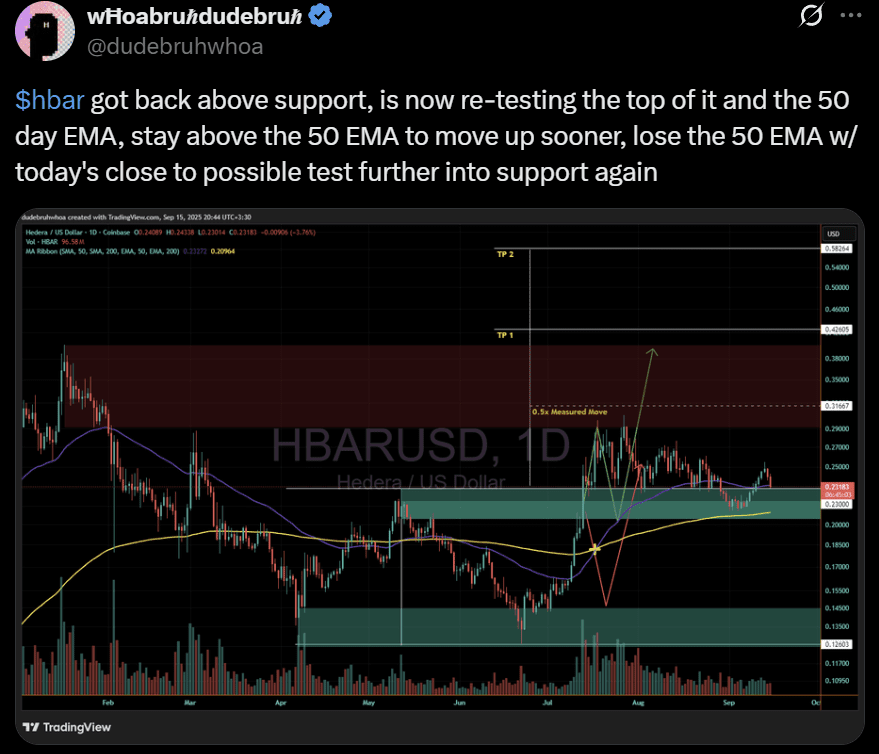

Dudebruhwhoa, an X-based analyst, noted that the token reclaimed support near $0.23 and re-tested the 50-day EMA. He stressed that holding above the EMA could accelerate momentum, while losing it on a daily close risked another move back into the $0.20 support region. The analyst also outlined resistance levels for the HBAR USD pair at $0.38 and $0.42, with a higher projection near $0.58 if strength persisted.

At the same time, independent trader and analyst Steph Is Crypto compared the present structure to the 2020–2021 rally, suggesting that HBAR might be setting up for a similar large-scale move. His projection leaned on historical comparison but reflected the optimism circulating within parts of the community. Together, the posts underscored how traders weighed fundamentals against chart signals, with the 50-day EMA acting as the immediate pivot.

Falling Wedge Structure Highlights Breakout Potential

The analyst’s projections around the 50-day EMA placed focus on HBAR’s short-term strength, but the broader structure revealed a falling wedge. This pattern, defined by two converging downward-sloping trendlines, often signals bullish continuation once resistance is broken. The setup carried weight because HBAR repeatedly respected both trendlines, consolidating in a tighter range as momentum compressed.

Technical measurements pointed to clear upside objectives. Immediate resistance was near $0.26, with the next barrier at $0.28. A breakout through these levels would confirm the wedge resolution, opening the way for the projected target.

That target was calculated by measuring the wedge’s height at its widest point and applying the distance to the breakout level, a standard method in technical analysis. The result aligned with a move toward the $0.30 zone, reinforcing the bullish bias already building across the market.

On the downside, the HBAR price has support near $0.22 and $0.196, though testing the second support level could invalidate the bullish setup. The Hedera token’s RSI remained neutral, with a score near 52.38.

Disclaimer: The technical analysis and price projections discussed above reflect the author’s views and are provided for informational purposes only. They should not be construed as financial advice. Readers are strongly encouraged to conduct their own independent research and due diligence before making any investment decisions. Neither the author nor CoinChapter will be held liable for any financial losses or damages arising directly or indirectly from reliance on the analysis presented in this article.